$COIN (NASDAQ: COIN) Forecast: February 9

Today, the Coinbase Global (NASDAQ: COIN) market value signals a potential pump as it begins to gather momentum for an upward race, with emerging reversal patterns. The share price is trending towards the resistance trend level, signaling a possible bullish breakout. The $COIN is rising after signaling a pump at the low level of $145.16. Therefore, if the stock price experiences a significant rally from its current price of $165.52, it will enter a bullish trend. Thus, buyers may see immediate gains if this push continues to the $392.16 resistance area.

Key Levels:

Resistance Levels: $298.00, $299.00, $300.00

Support Levels: $147.00, $146.00, $145.00

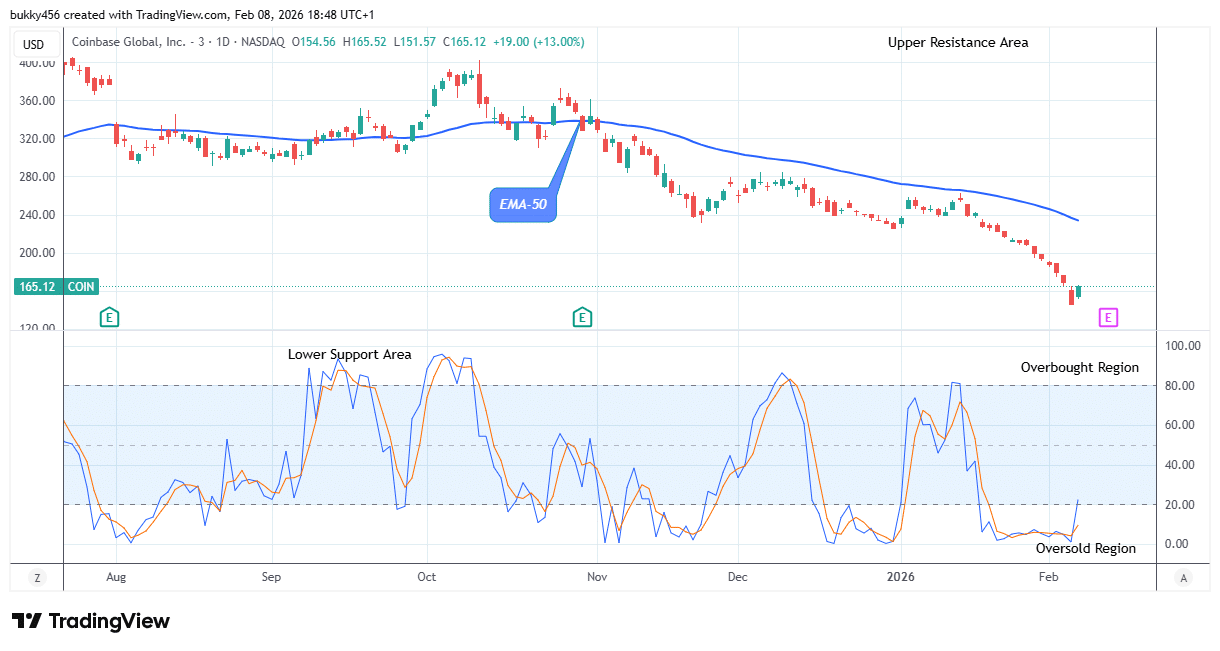

COIN Long-term Trend: Bearish (Daily Chart)

The NASDAQ: COIN market has a significant correction today, signaling a pump on the higher time frame.

The sustained bearish pressure at the $145.16 support in the last session has enabled the stock price drop below the supply levels and increase in its recent correction.

At the time of writing, the $COIN price signaled a potential pump as it reversed and increased to $165.52 below the resistance level on the daily chart, demonstrating remarkable resilience in a correcting market.

Meanwhile, a breakout from the current supply to hit the previous barrier level of $256.88 could attract momentum buyers to potentially move the share price towards the upper range, indicating a strong possibility for a bullish correction.

Notably, the daily stochastic indicates an uptrend, suggesting that the selling pressure has ended and the new bullish correction may continue.

Given this, the expected upside in the NASDAQ stock price could be high at the $392.16 upper resistance value in the coming days, according to the long-term outlook.

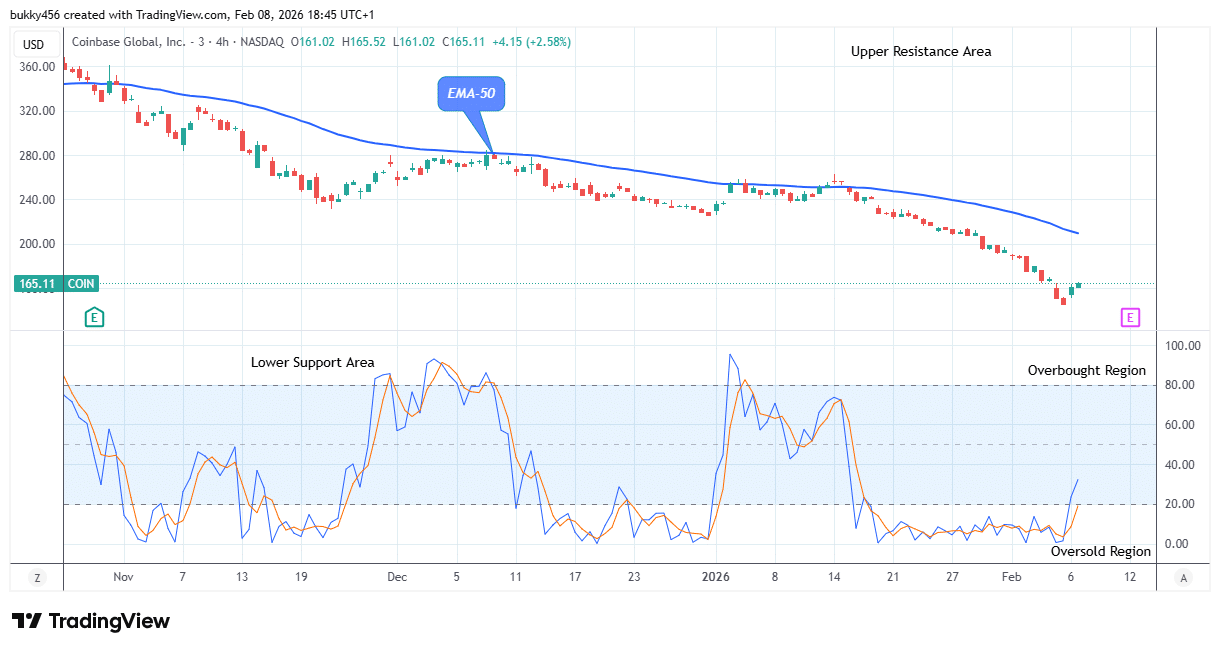

COIN Medium-term Trend: Bearish (4H Chart)

The $COIN buying pressure has just begun on the medium-term chart and could reach the resistance channel as it continues its rising pattern.

The share price is below the moving averages, suggesting a bearish trend.

$COIN Signals a Pump

On the NASDAQ, a potential sell setup is formed. Meanwhile, if momentum surges, a pump is imminent as it holds position at the $165.52 high levels.

A potential sell setup is forming on NASDAQ. Consider early entries and hold positions toward the 23,800 and 22,600 levels if momentum supports the move. pic.twitter.com/fWd0rYaflF

— PipSensei 🥷 (@Mkjackson56) February 9, 2026

Actions from short traders at a $145.17 in the last session have dropped the price beneath the supply levels lately.

On the 4-hour chart today, there is a broader recovery in the stock prices. The NASDAQ: COIN price signals a potential pump at $165.52 below the moving average and may surge toward the $361.41 resistance if the bulls add more strength to their buying forces.

Therefore, closing the 4-hourly session above the prior peak level will increase investors’ confidence in the asset and put the trade more on the buying side.

As a result, the stock price could rise again if market sentiment doesn’t witness any unfavorable situation.

With this new phase, the price may surge to reach a $392.16 upper high level in the days ahead as the share buyers await a bullish opportunity.

Trade your favorite stocks using a premium broker. Open an account here

Related Resources

- Crypto Trading Signals — real-time alerts for BTC, ETH, SOL and XRP

- Best Crypto Signals — top-rated providers reviewed for UK traders

- VIP Trading Signals — join 40,000+ traders getting early signals

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.