$COIN (NASDAQ: COIN) Forecast: February 2

The Coinbase Global (NASDAQ: COIN) market anticipates a pullback from the current low of $190.96, as selling pressure may soon end, and the stock price could be poised for an upward surge. The share bullish pattern may begin at the oversold region. The price may therefore reverse to a bullish pattern, aiming to break the $392.16 barrier and extend to a higher resistance level of $405.88, creating a solid accumulation zone for buyers, should the bulls intensify their buying momentum.

Key Levels:

Resistance Levels: $361.00, $362.00, $363.00

Support Levels: $231.00, $230.00, $229.00

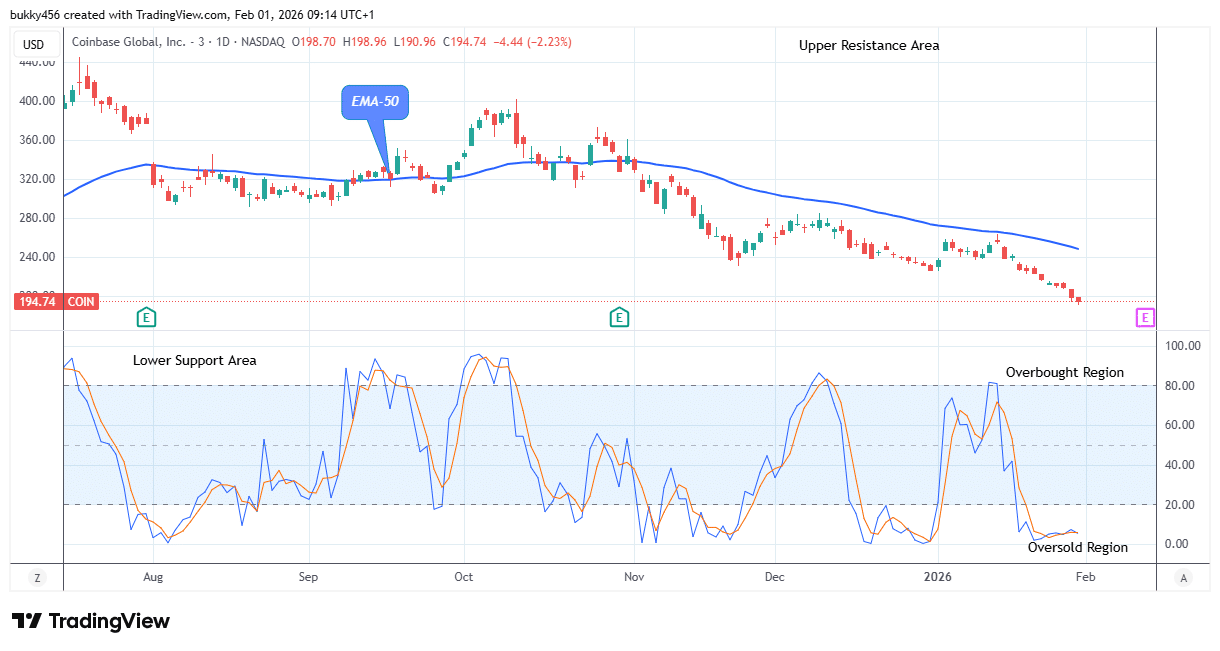

COIN Long-term Trend: Bearish (Daily Chart)

The long-term market of $COIN is bearish. The stock price is below the moving average, confirming its bearishness.

As the daily chart begins today, bearish actions sent the NASDAQ:COIN price lower, reaching the $190.96 support level below the EMA-50.

Hence, if the bulls change their orientation and increase buying pressure, the bullish momentum may emerge and pull back the current low to break the previous high of $392.16.

Additionally, the NASDAQ stock market is in the oversold region of the daily stochastic. Thus, more buyers’ participation is a prerequisite at the moment.

As a result, the next target may reach the upper resistance value of $405.88 in the coming days in its higher time frame as buyers await a bullish opportunity.

COIN Medium-term Trend: Bearish (4H Chart)

The $COIN market is in a bearish trend and awaits a bullish opportunity in the medium-term outlook. The stock price is below the resistance level, indicating a bearish trend.

$Coin Pullback Is Imminent

The good news is that, we have reached the channel bottom. The NASDAQ:COIN futures overnight are dumping hard, and a pullback is imminent.

🚨The NASDAQ $QQQ $NQ Futures Overnight Are Dumping HARD, but the good news is that we’ve come down to the channel bottom like I mentioned in my last video.

— Swing Trading and Coffee (@swingtrader52) February 2, 2026

Expect red tomorrow but the question is if we get bought up.

Also $GLD and $SLV Likely at support but we will see… pic.twitter.com/nOmRD3I0j3

Having completed its selling moves, the bulls successfully rebounded to a $197.22 high mark below the EMA-50 as the 4-hourly session opened today, suggesting the return of buy traders to stage a play.

Thus, closing the 4-hourly session above the $361.41 supply level will increase investors’ confidence in the asset and put the trade more on the buying side.

Meanwhile, further increases are likely as the price signal remains in an uptrend at the oversold region, implying the emergence of more buyers, and may likely break the previous peak barrier to reach the upper resistance level of $400.00 soon in the medium-term time frame.

Trade your favorite stocks using a premium broker. Open an account here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.