Market Analysis – February 1

NZD/USD has retreated from a six-month high as renewed US Dollar demand offsets strength in New Zealand fundamentals. The Kiwi had been supported by a surge in consumer confidence to its highest level since 2021, reinforcing expectations that the Reserve Bank of New Zealand may maintain a tightening bias. However, the US Dollar has regained traction following firm producer inflation data, which points to persistent upstream price pressures and has tempered expectations for aggressive Federal Reserve rate cuts, while a partial easing of US political risks has further supported the Greenback. As a result, the pair is undergoing a corrective phase, reflecting a short-term shift in focus from domestic optimism in New Zealand to strengthening US-side drivers.

NZD/USD Key Levels

Supply Levels: 0.61000, 0.62000, 0.63000

Demand Levels: 0.58000, 0.5700, 0.56500

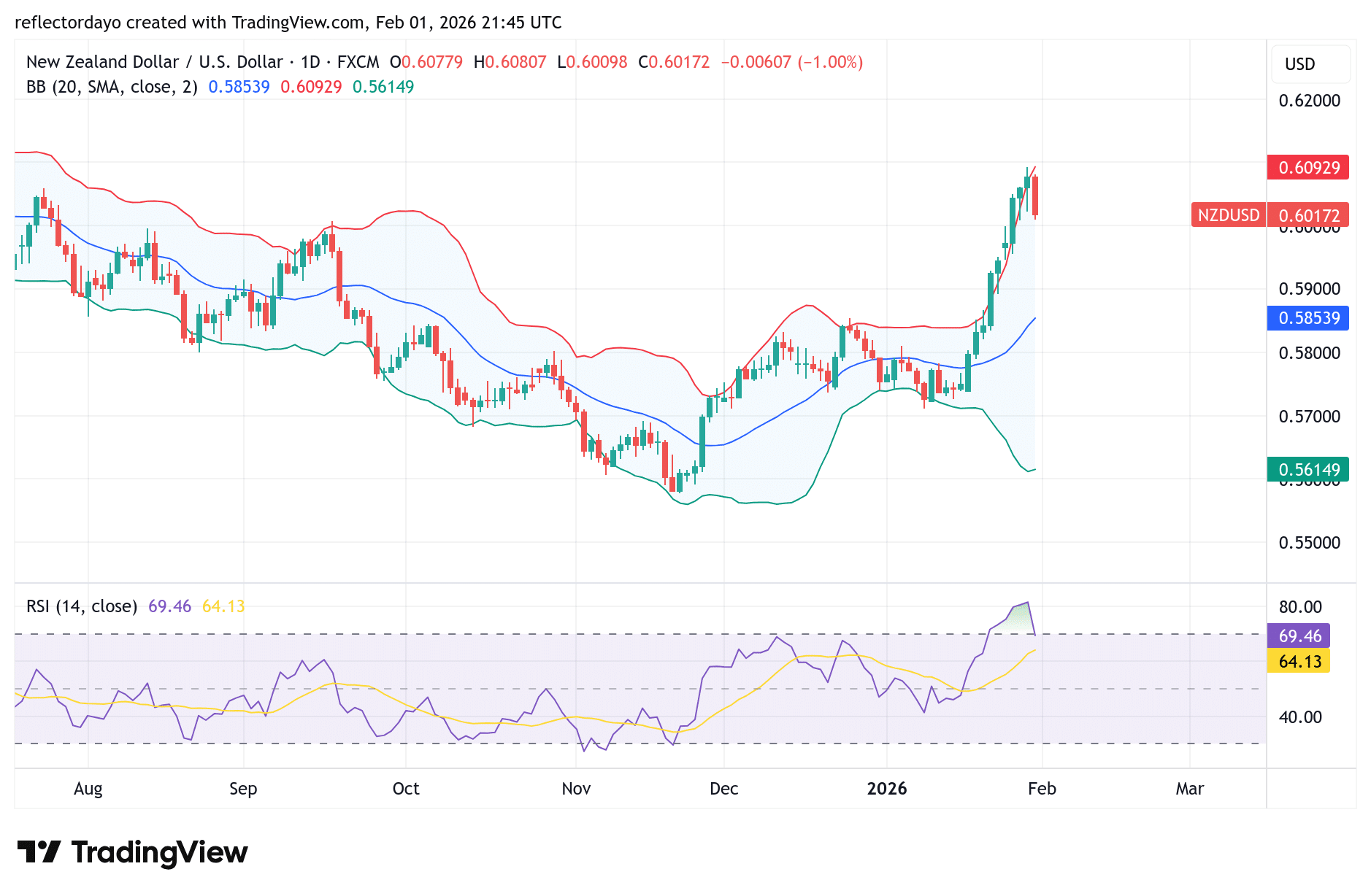

NZD/USD Daily Outlook

The US Dollar rebounded strongly after its weak performance over the previous few days. Last week, NZD/USD gained upward momentum and advanced toward the 0.6000 level, a key psychological resistance. The pair eventually broke above this barrier, attracting stronger bullish sentiment and driving price action toward the 0.6100 region. However, from this threshold, the market has pulled back. Notably, the Bollinger Bands indicator—particularly the widening of the bands—signals rising volatility, suggesting that bears may be becoming more aggressive around major resistance levels, which appears to be unfolding in the current price action.

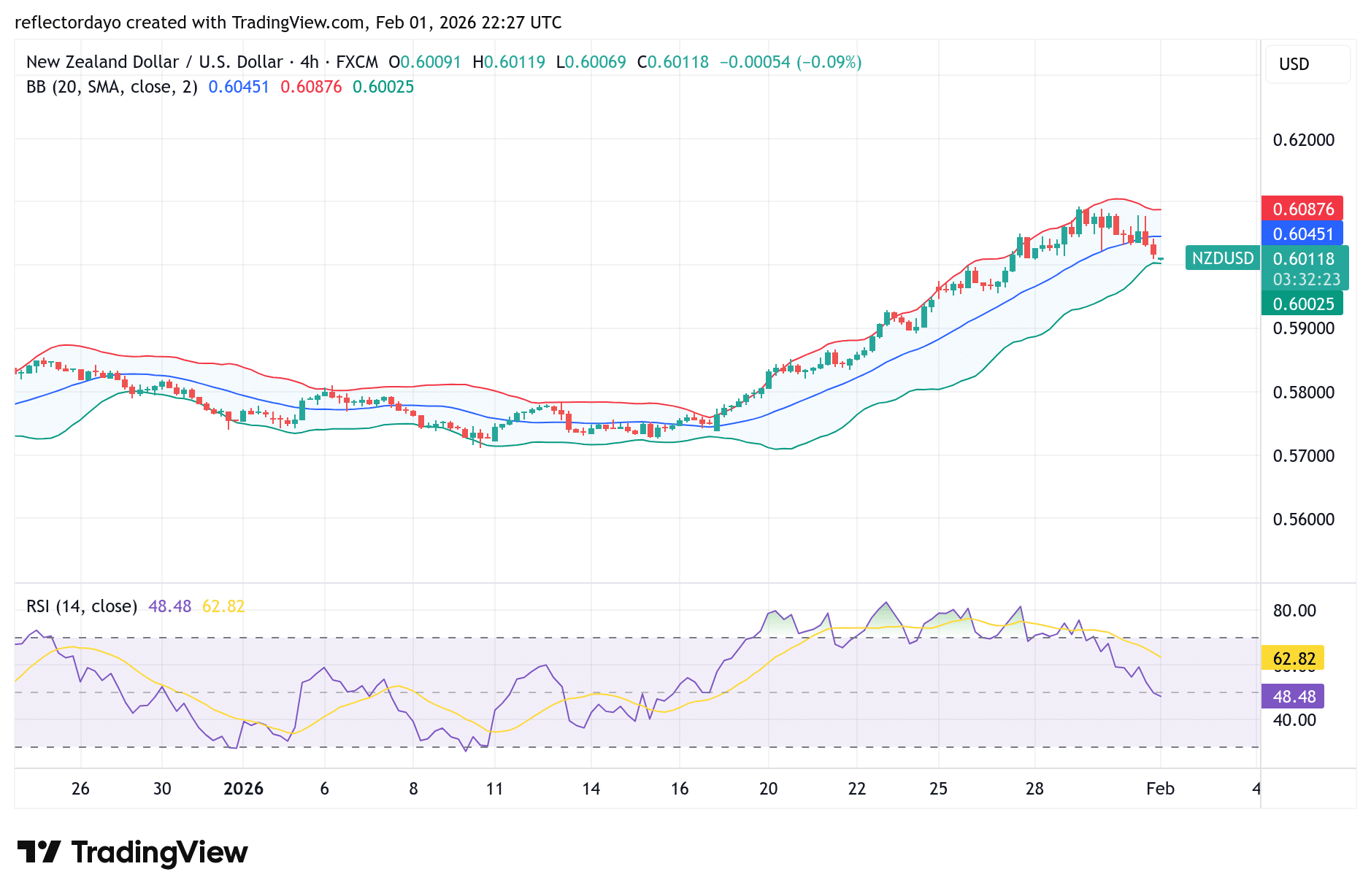

Short-Term Trend

When viewed on a lower timeframe such as the 4-hour chart, the aggressive bearish move begins to lose momentum as price approaches the 0.6000 threshold. This slowdown suggests a potential rebound around the level. However, if US Dollar strength persists and bulls continue to defend the 0.6000 zone, price action may instead enter a consolidation phase around this key support level.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.