EUR/CHF Market Analysis—February 10

As we move through the first quarter of 2026, the EUR/CHF continues to navigate a landscape defined by deep structural divergence and a persistent “risk-off” sentiment that favors the Swiss Franc. While the pair has managed to find a temporary floor at the 0.9100 psychological level, the fundamental backdrop offers little fuel for a meaningful recovery toward 0.9300. This lethargy is primarily driven by a widening gap in monetary realities: the European Central Bank (ECB) remains cautious amid a cooling Eurozone economy—where inflation has recently dipped toward 1.7%—while the Swiss National Bank (SNB) oversees an economy with near-zero inflation (projected at just 0.6% for 2026). This disparity, compounded by fresh geopolitical uncertainties and global trade anxieties, has solidified the Franc’s status as the ultimate safe haven. Without a hawkish pivot from Frankfurt or a significant rotation out of defensive assets, the Euro’s attempt at a bullish reversal remains fundamentally “capped,” leaving the pair in a state of bearish consolidation.

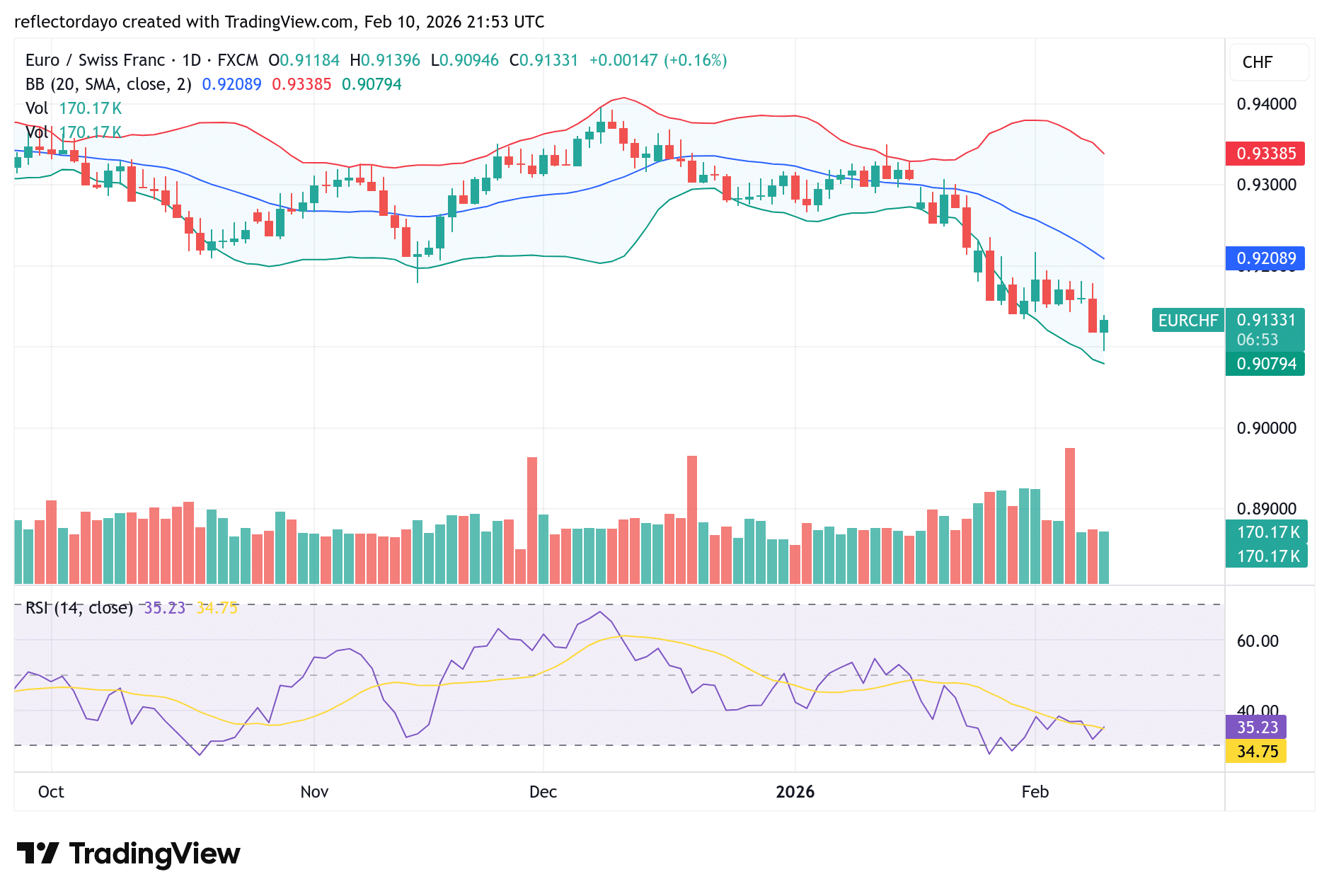

EUR/CHF Key Levels

Supply Levels: 0.9300, 0.94000, 0.95000

Demand Levels: 0.91000, 0.9000, 0.89000

EUR/CHF Technical Outlook

We have observed a classic dead cat bounce, or a low-momentum consolidation phase, in the EUR/CHF market. In recent trading sessions, the market has been consolidating; however, in more recent sessions, bears have gained the upper hand, causing price action to slide from around the 0.9300 level.

After finding support near 0.9100, price rebounded as traders quickly bought the dip. However, the rebound has lacked sufficient strength to extend a meaningful bullish recovery. Instead, the bounce appears weak, with bulls merely attempting to defend the newly formed support at 0.9100.

Their grip on this level remains fragile, and the market still carries the possibility of breaking lower into fresh lows.

Short-Term Trend:

The bullish recovery phase was short-lived, as price action faced an early test around the 0.9130 level shortly after bouncing from the 0.9100 threshold. This early rejection suggests that bears may still be in control of the market.

However, despite this pressure, the emergence of support at the 0.9100 level could allow price action to consolidate above this zone. From a broader perspective, the EUR/CHF market still appears to be gradually trending lower, reflecting a prevailing bearish structure.

Make money without lifting your fingers: Start using a world-class auto trading solution.

Related Resources

- Forex Signals — live EUR/USD, GBP/USD and more

- What Are Trading Signals? — beginner’s guide to signal services

- VIP Trading Signals — join 40,000+ traders getting early signals

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.