Market Analysis – February 4

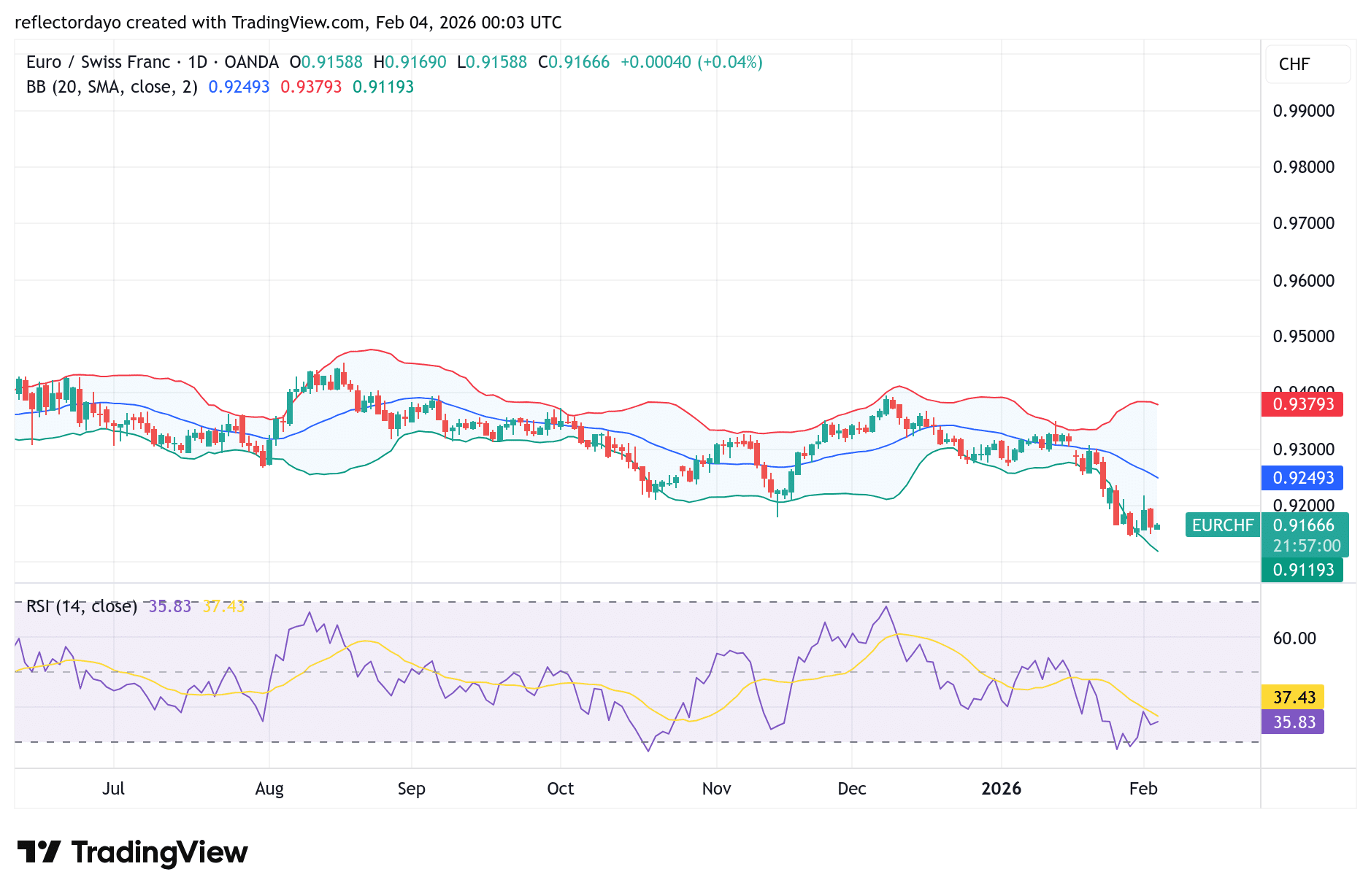

The EUR/CHF pair remains under pressure as strong safe-haven demand for the Swiss franc continues to cap upside attempts in the euro. Amid persistent global economic and geopolitical uncertainty, investors have increasingly turned to the franc as a stability anchor, limiting EUR/CHF rallies and reinforcing downside bias. Structurally lower inflation in Switzerland—hovering around 1.2% compared to the Eurozone’s roughly 2.3%—also supports franc strength, as the currency naturally appreciates to preserve purchasing power parity.

At the same time, the euro faces headwinds from weak growth sentiment across the bloc, with soft retail sales and sluggish manufacturing activity, particularly in Germany, undermining confidence in a near-term recovery. This fundamental weakness is reflected in price action, as the pair continues to struggle below the critical 0.9200–0.9300 resistance zone, a level that has repeatedly rejected bullish advances.

EUR/CHF Key Levels

- Supply Levels: 0.93000, 0.94000, 0.95000

- Demand Levels: 0.91500, 0.91000, 0.90000

EUR/CHF Still Facing Resistance at 0.92000

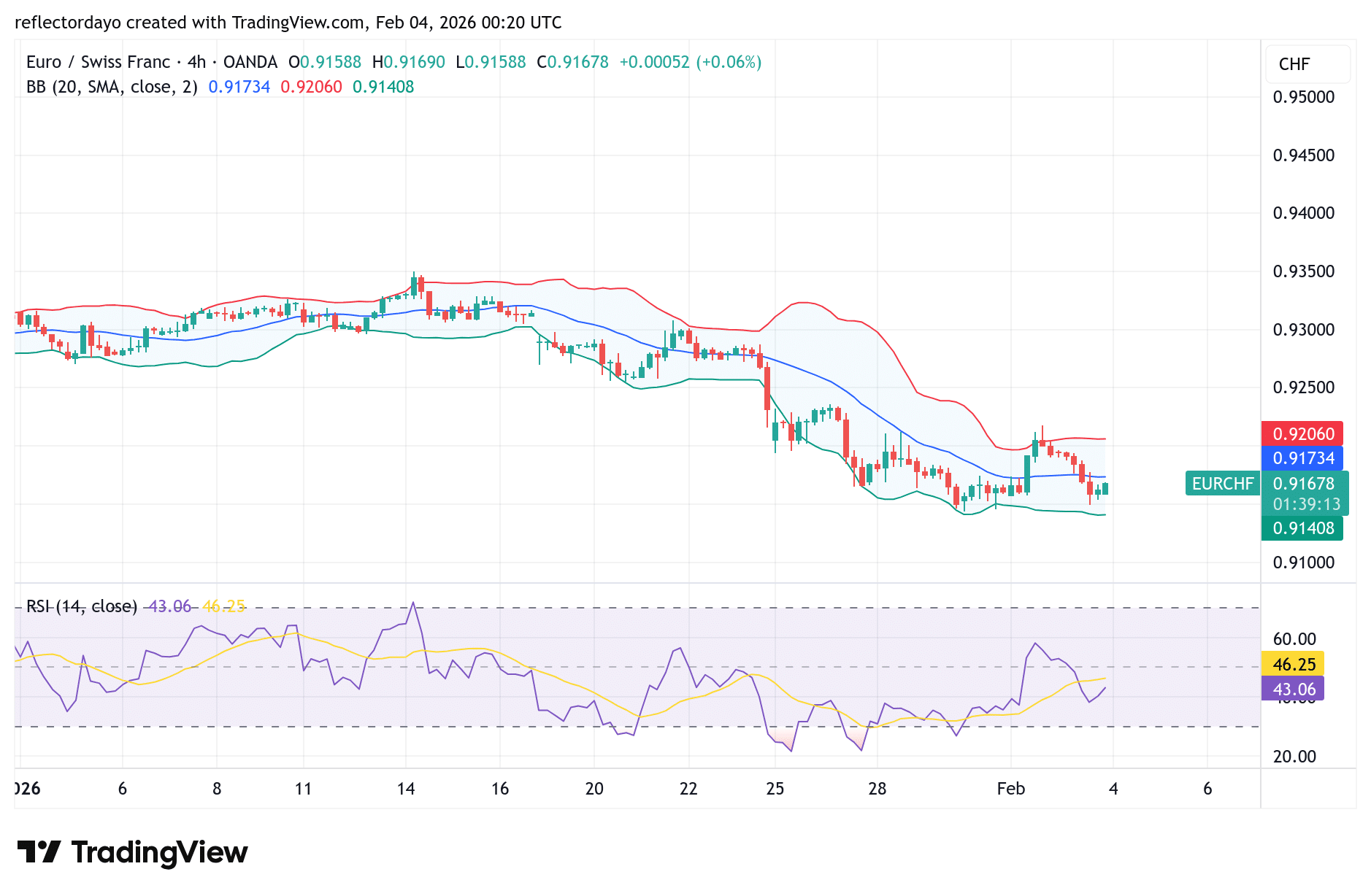

The 0.92000 price level has long served as a multi-year support zone, holding firm through the October and November trading periods. However, EUR/CHF has recently failed to maintain this level, allowing bearish pressure to regain control. Since that breakdown, the 0.92000 area has transitioned into a key resistance level, with price continuing to struggle below it and failing to establish a sustained rebound.

Over the past three daily trading sessions, multiple bullish attempts to reclaim this level have been rejected, reinforcing its significance as a near-term barrier and highlighting the prevailing bearish influence.

Short-Term Trend:

Zooming into the 4-hour chart, the market appears to be slightly under bearish control, as price continues to trade below the 20-period moving average. This positioning suggests that short-term momentum still favors sellers. Traders are, to a limited extent, maintaining a preference for the safe-haven Swiss franc, even though the euro has shown a modest rebound in recent sessions.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.