Market Analysis – January 28

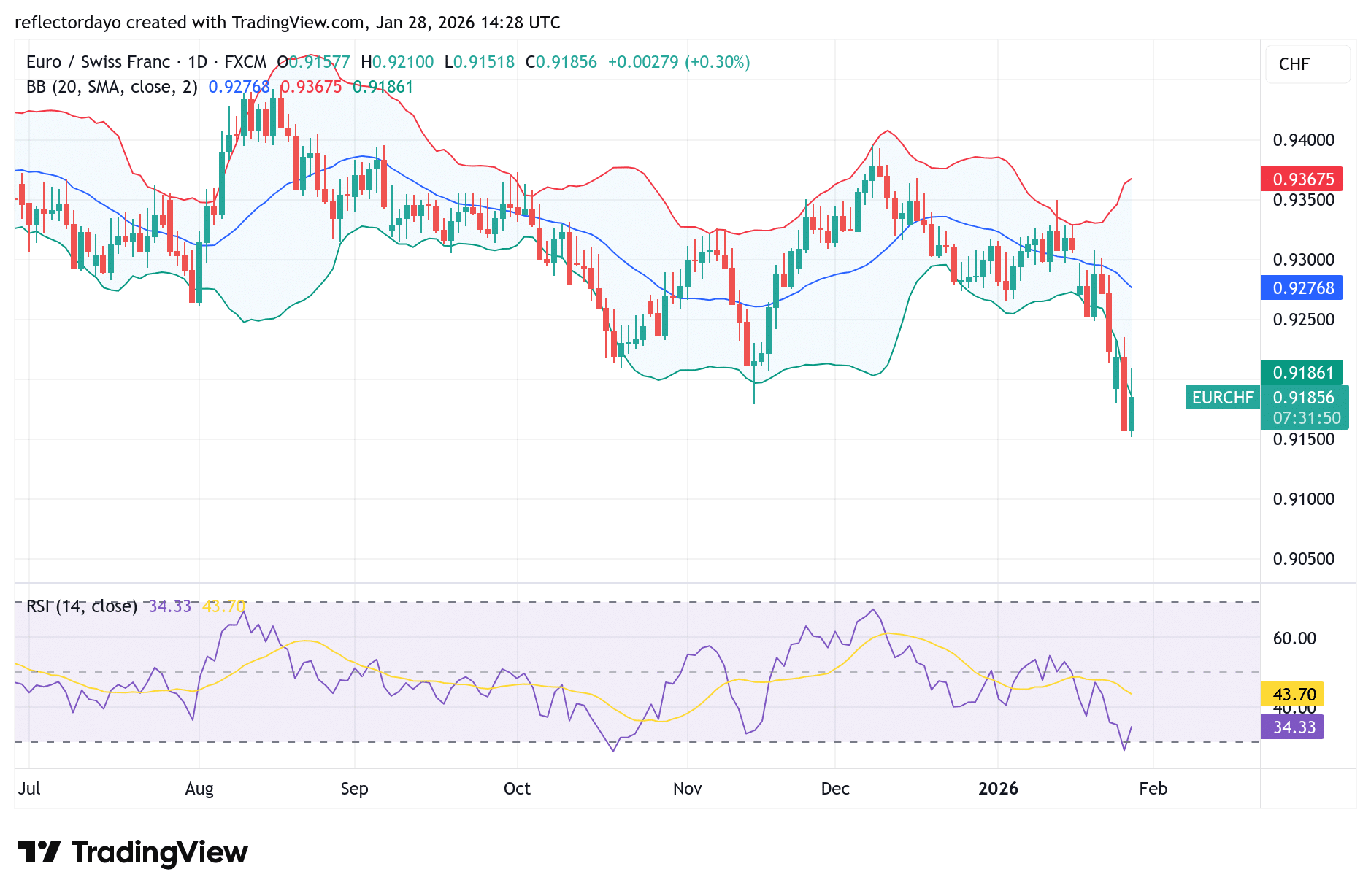

The EUR/CHF pair remains under pressure as strong safe-haven demand for the Swiss franc continues to cap upside attempts in the euro. Amid persistent global economic and geopolitical uncertainty, investors have increasingly turned to the franc as a stability anchor, limiting EUR/CHF rallies and reinforcing downside bias. Structurally lower inflation in Switzerland—hovering around 1.2% compared to the Eurozone’s roughly 2.3%—also supports franc strength, as the currency naturally appreciates to preserve purchasing power parity.

At the same time, the euro faces headwinds from weak growth sentiment across the bloc, with soft retail sales and sluggish manufacturing activity, particularly in Germany, undermining confidence in a near-term recovery. This fundamental weakness is reflected in price action, as the pair continues to struggle below the critical 0.9200–0.9300 resistance zone, a level that has repeatedly rejected bullish advances.

EUR/CHF Key Levels

Supply Levels: 0.9300, 0.9400, 0.9500

Demand Levels: 0.91500, 0.9100, 0.9000

EUR/CHF Faces Resistance at 0.92000

From an indicator perspective, the recent bearish move has triggered a noticeable increase in market volatility, as reflected by the widening Bollinger Bands. At the same time, the RSI is signaling weak momentum, confirming that sellers currently have the upper hand. However, the key support level at 0.92000 is holding firm and continues to sustain a modest bullish recovery.

Interestingly, resistance is also emerging around the same 0.92000 area, creating a tight zone of conflict between buyers and sellers. With both support and resistance converging at this level, the pair may enter a phase of consolidation within a narrow price channel until a clear directional breakout occurs.

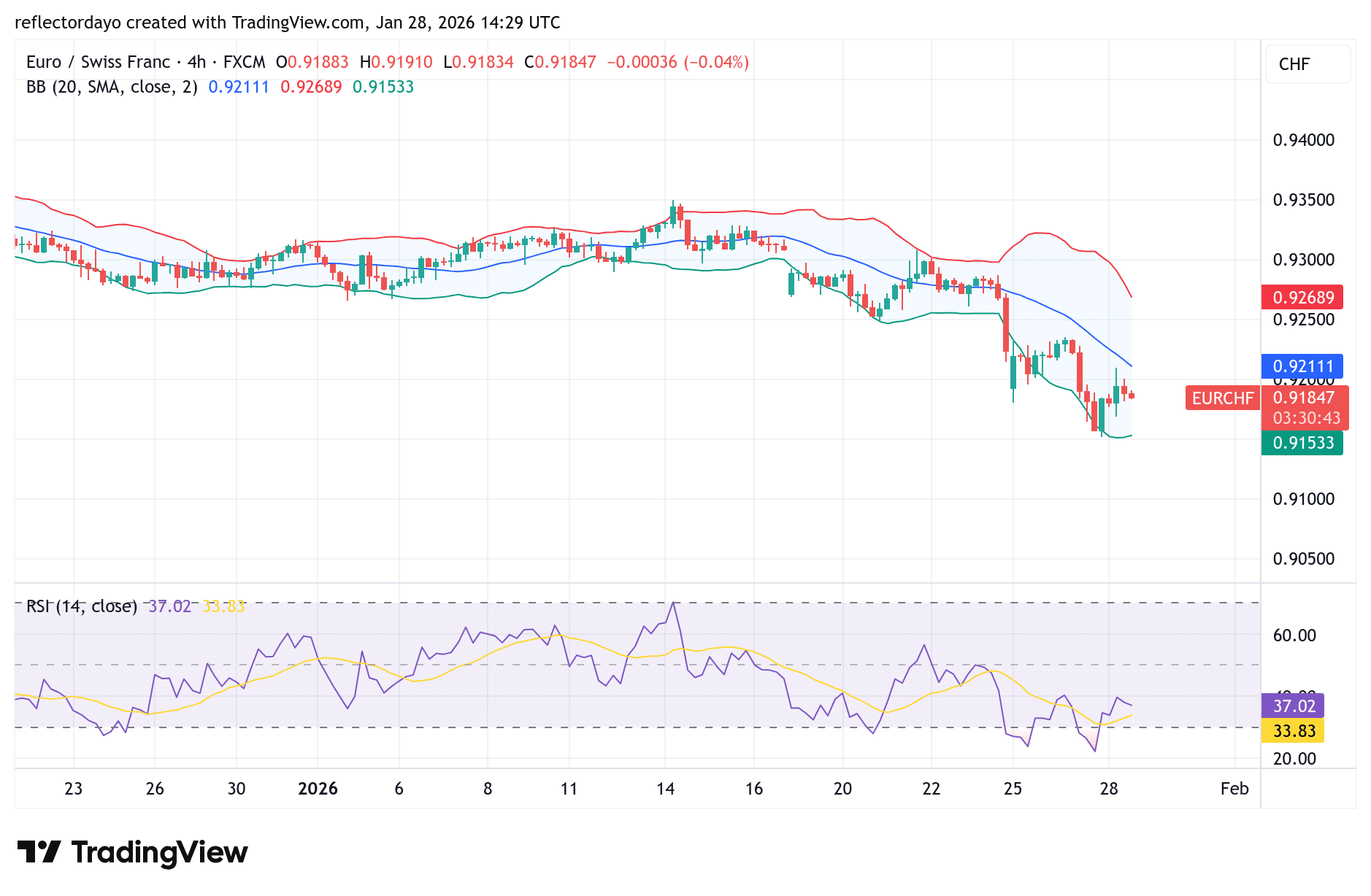

EUR/CHF Short-Term Trend:

Following the pivotal bounce from the 0.91500 price level, EUR/CHF has pushed higher despite persistent selling pressure in the market. While a bearish bias still lingers, the strong downward move invited bullish interest around 0.91500, triggering a recovery in price action. However, this bullish rebound is now struggling to break above the 0.92000 level, where selling pressure remains strong. With demand and supply currently balancing around this zone, the pair may consolidate near 0.92000 for a period before committing to its next directional move.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.