Market Analysis – January 26

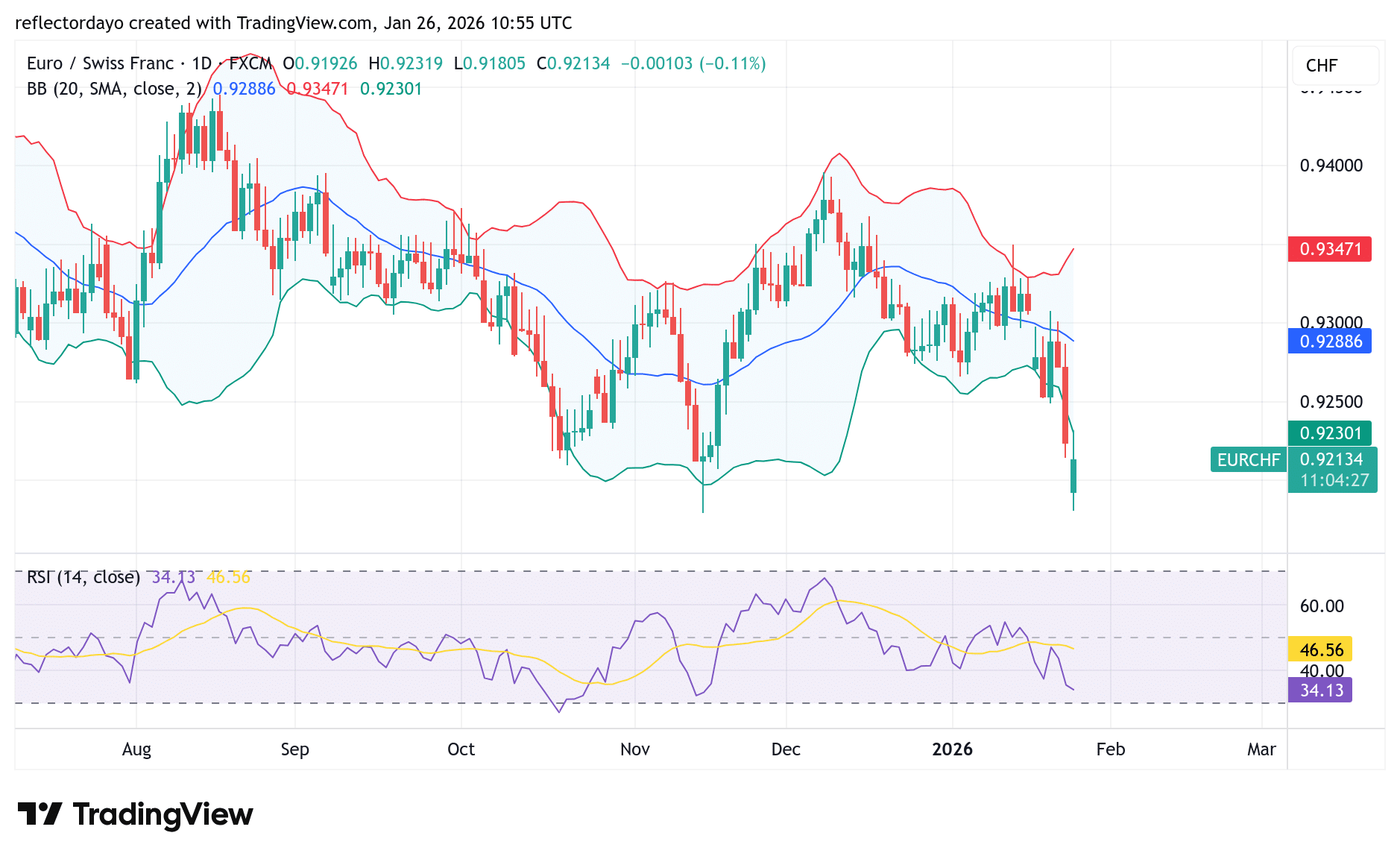

The EURCHF cross is currently navigating a period of intense bearish pressure, as a perfect storm of geopolitical friction and macroeconomic divergence weighs on the Euro. The primary catalyst for this downward trajectory is the escalating trade dispute between the United States and the European Union over Greenland, which has reignited “Sell America” sentiment and triggered a massive flight to safety. As markets brace for potential 25% tariffs on European exports, the Swiss Franc (CHF) has reasserted its status as the preeminent regional hedge, drawing significant capital inflows away from a vulnerable Eurozone. This risk-off mood is further compounded by a widening policy gap; while the European Central Bank (ECB) remains tethered to a stagnant growth outlook, the Swiss National Bank (SNB) has signaled a higher tolerance for Franc appreciation to anchor domestic stability. Consequently, EURCHF is testing multi-week lows, transforming what was once a steady range into a volatile descent driven by fear and fundamental repositioning.

EUR/CHF Key Levels

Supply Levels: 0.9300, 0.94000, 0.9500

Demand Levels: 0.91500, 0.91000, 0.90000

EUR/CHF Sinks Below 0.92000

EUR/CHF has recorded a strong bearish move, evident in the sharp price decline and the widening of the Bollinger Bands. This divergence signals a notable increase in market volatility, which may make price behavior in upcoming sessions more difficult to predict. The 0.92000 level, previously a major support zone, failed to withstand the intense selling pressure from bears. Despite the breakdown, some buying interest appears to be emerging around this level; however, it remains relatively weak compared to the dominant selling activity.

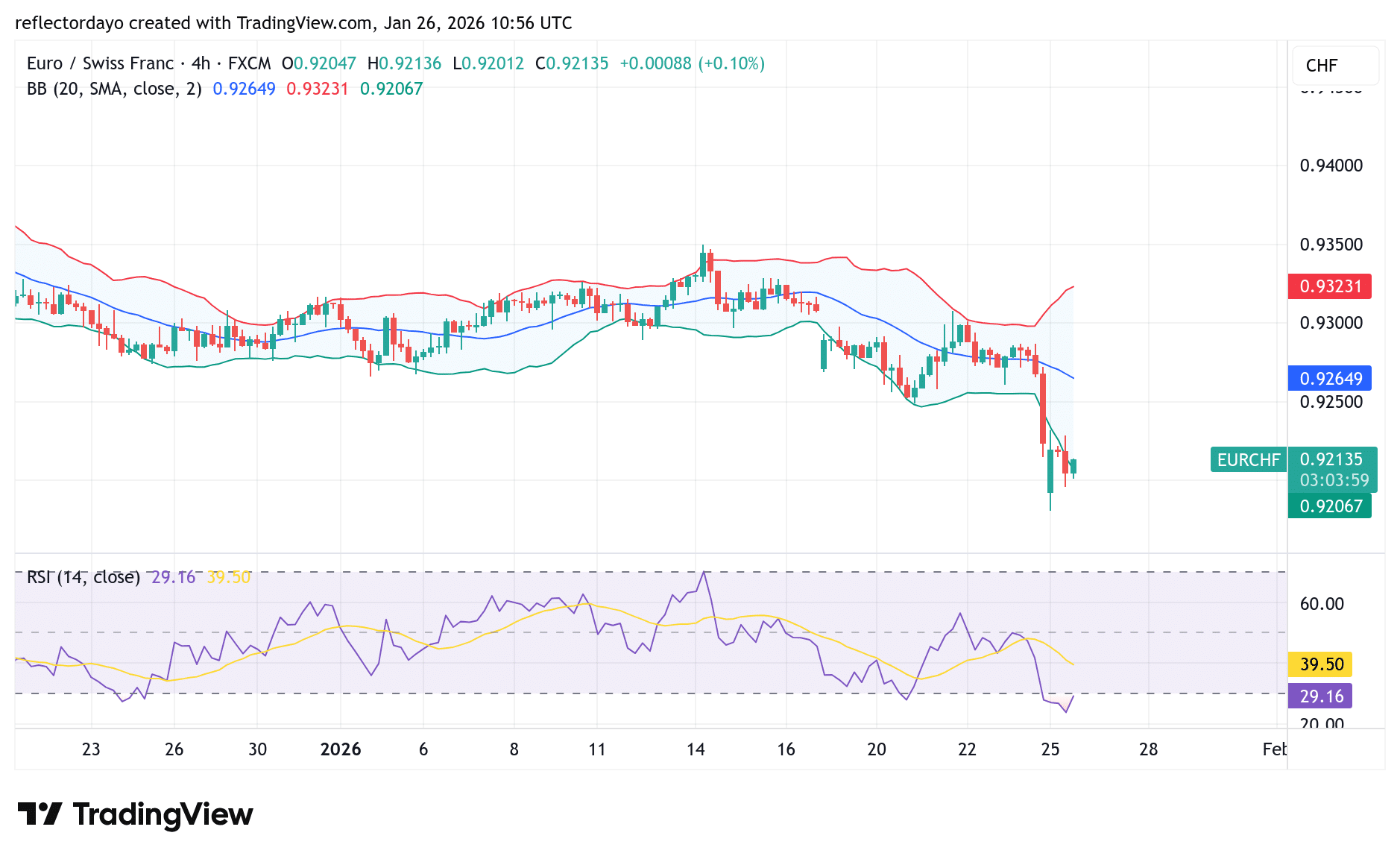

EUR/CHF Short-Term Trend:

As we narrow this analysis to a lower timeframe, we gain a clearer view of recent market behavior. Price action has rebounded above the 0.92000 level, indicating the presence of bullish interest around this area. However, this buying pressure does not yet appear strong enough, as a nearby resistance seems to be forming around the 0.92200 level. This suggests that while bulls are attempting to take control, their dominance remains limited for now.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.