Market Analysis – January 13

The EUR/CHF market is currently consolidating, reflecting a balance of capital flows and widespread market indecision. This sideways behavior is largely driven by the lack of meaningful policy divergence between the European Central Bank and the Swiss National Bank, as both continue to signal cautious and broadly aligned monetary stances, limiting interest rate differentials as a directional driver. Mixed economic data from the Eurozone, combined with Switzerland’s stable but low inflation environment, adds to the uncertainty, while the Swiss franc’s safe-haven status creates a constant push-and-pull between risk-on and risk-off flows. Together, these factors have kept EUR/CHF confined within a narrow range, with the market likely to remain in this holding pattern until a significant economic surprise or an unexpected policy shift provides the momentum needed for a breakout.

EUR/CHF Key Levels

Demand Levels: 0.92500, 0.92000, 0.91500

Supply Levels: 0.93000, 0.94000, 0.95000

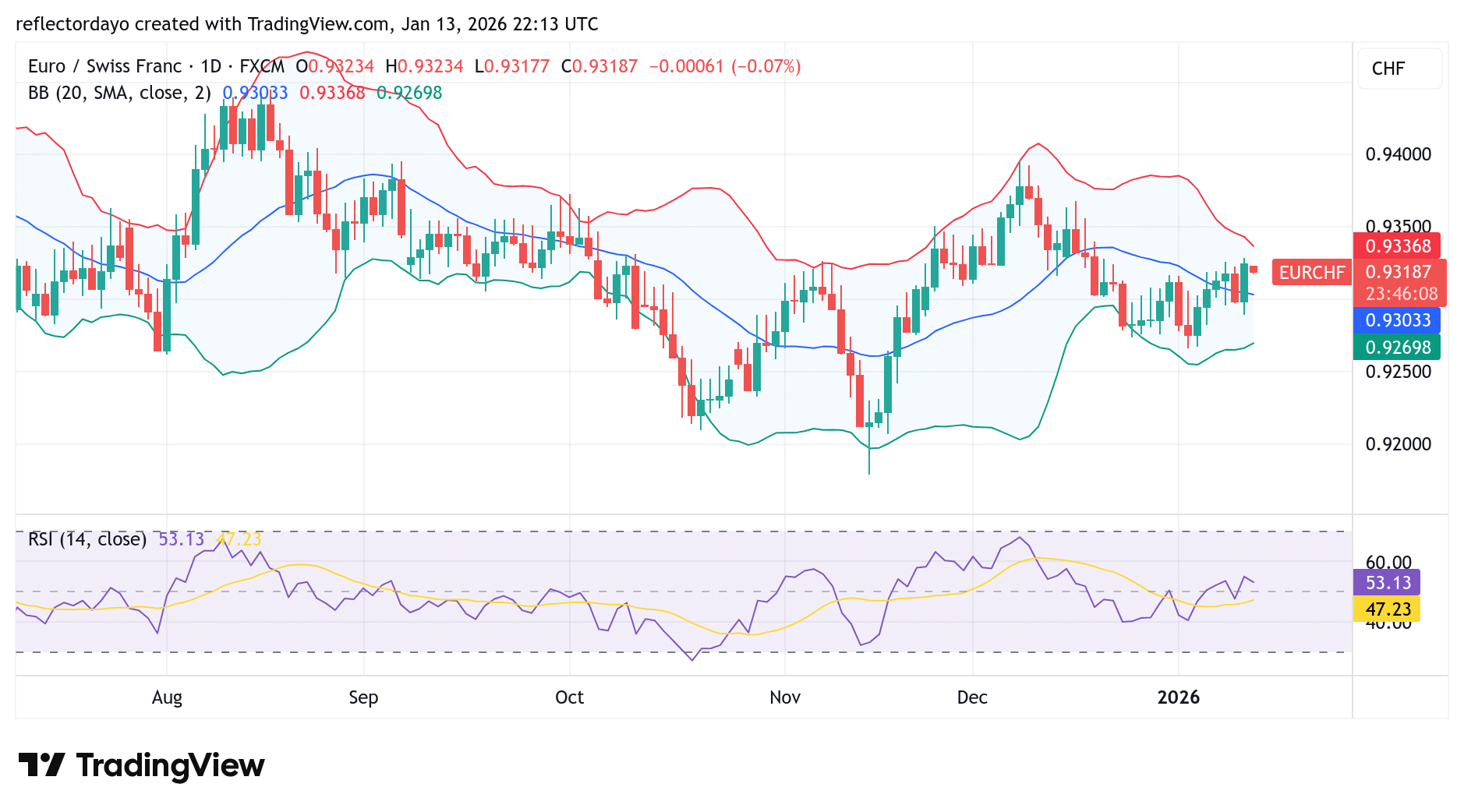

EUR/CHF Consolidates Above 0.93000

The EUR/CHF market began a bullish recovery last week. Although the advance was gradual, price eventually broke above the 0.93000 resistance level and managed to sustain trading above it. However, strong resistance around 0.93281 halted further upside progress, causing the bullish momentum to fade.

As a result, the market has shifted into a consolidation phase below this critical resistance. With buyers and sellers locked in a tight contest, price action is now stabilizing around an equilibrium level just above 0.93000. This emerging balance is reflected in the convergence of the Bollinger Bands, signaling improving stability and declining volatility. Such conditions often precede a decisive directional move, suggesting that a clearer trend may soon emerge from the current consolidation.

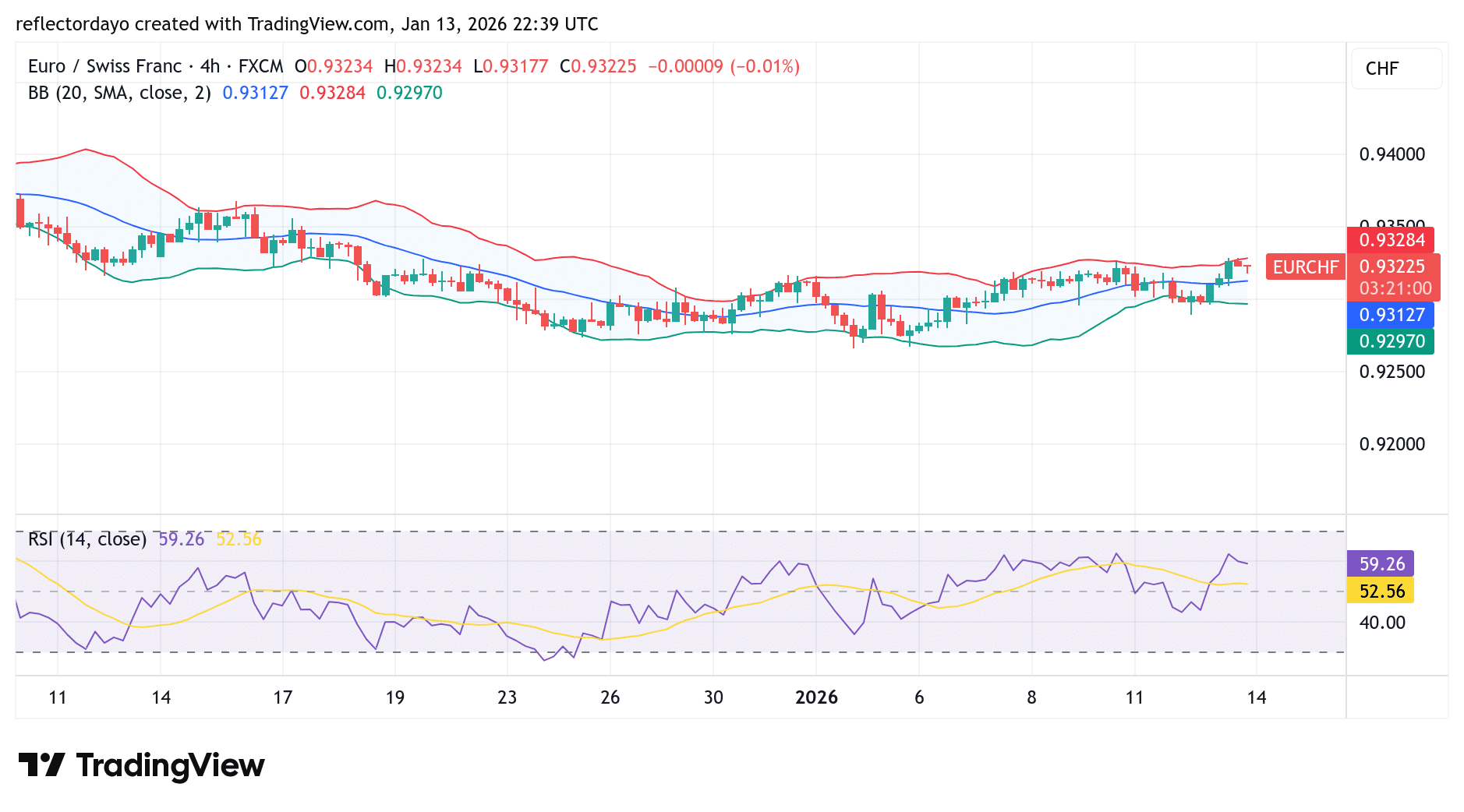

EUR/CHF Short-Term Trend: Indecision

On the lower time frame, particularly the 4-hour chart, the EUR/CHF market continues to reflect a consolidation-driven structure. Despite this sideways movement, bulls currently hold a slight advantage, as price action remains above the horizontally trending 20-period moving average. This positioning suggests that while the market is still range-bound, the short-term bias within the consolidation is tilted to the upside.

If price manages to break decisively above the key 0.93281 resistance level, it could trigger renewed buying interest and potentially propel the market higher in the near term.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.