Market Analysis – January 6

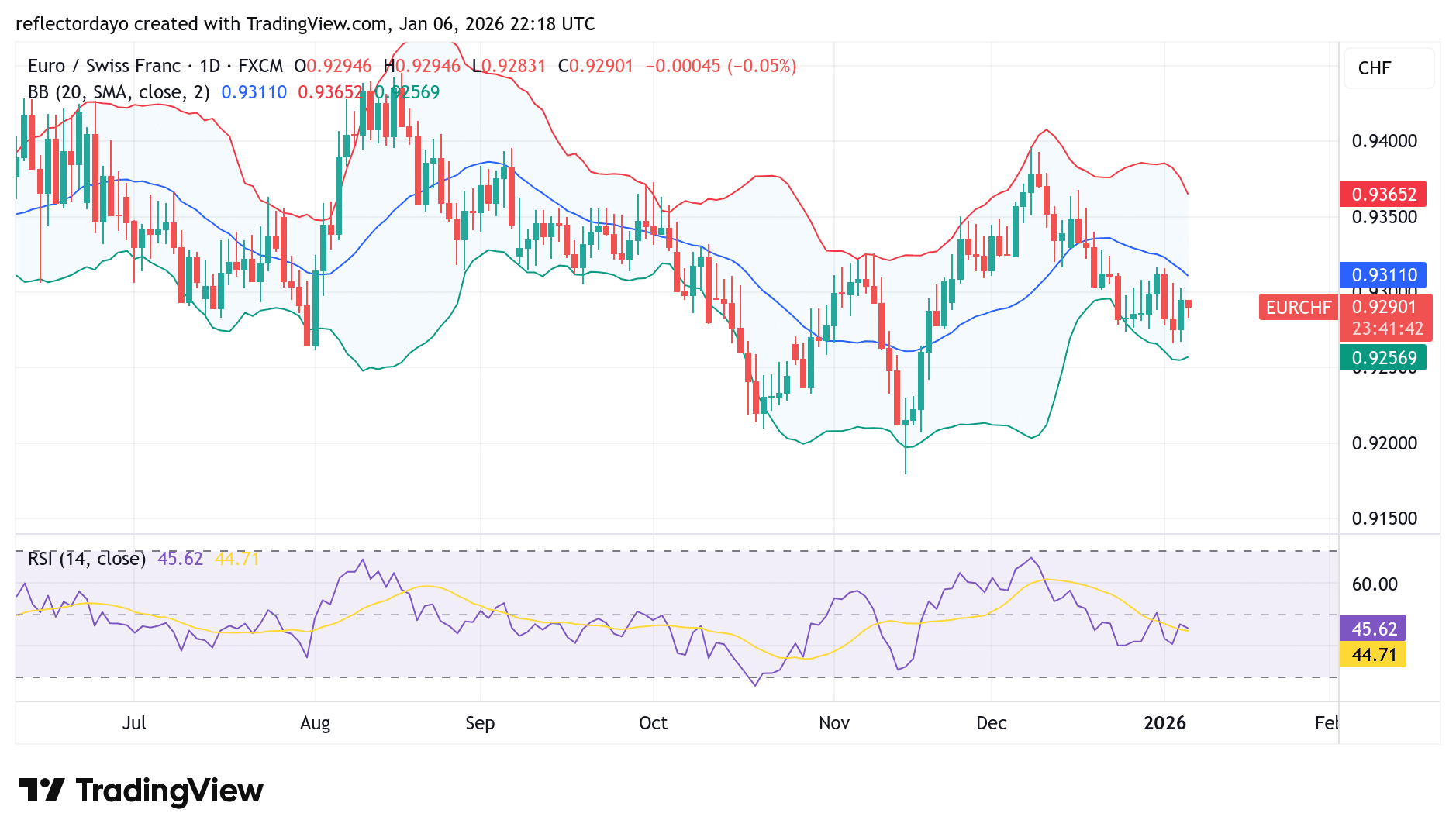

Following the bearish performance that rounded off trading last week and the close of last year—when price broke below the 0.9300 level—the market has staged only a modest recovery. This rebound has since stalled, with price pulling back as it retests the 0.9300 zone, highlighting growing trader caution around this critical level. The key pivotal support for any potential bullish recovery remains near the 0.9260 level.

EUR/CHF Key Levels

Demand Levels: 0.92500, 0.92000, 0.91500

Supply Levels: 0.93000, 0.94000, 0.95000

EUR/CHF Hovers Around the 0.9300 Level

Economic conditions in both the Eurozone and Switzerland help explain why EUR/CHF continues to consolidate around the 0.9300 level. Despite a recent bullish recovery attempt, the 0.9300 zone remains a critical resistance, with traders already showing caution as sell orders around this level have been triggered, prompting a pullback toward key support areas. Nevertheless, during this corrective move, bulls have maintained a presence. This is reflected in the latest candlestick formation, which displays a lower shadow, signaling renewed buying interest in the market.

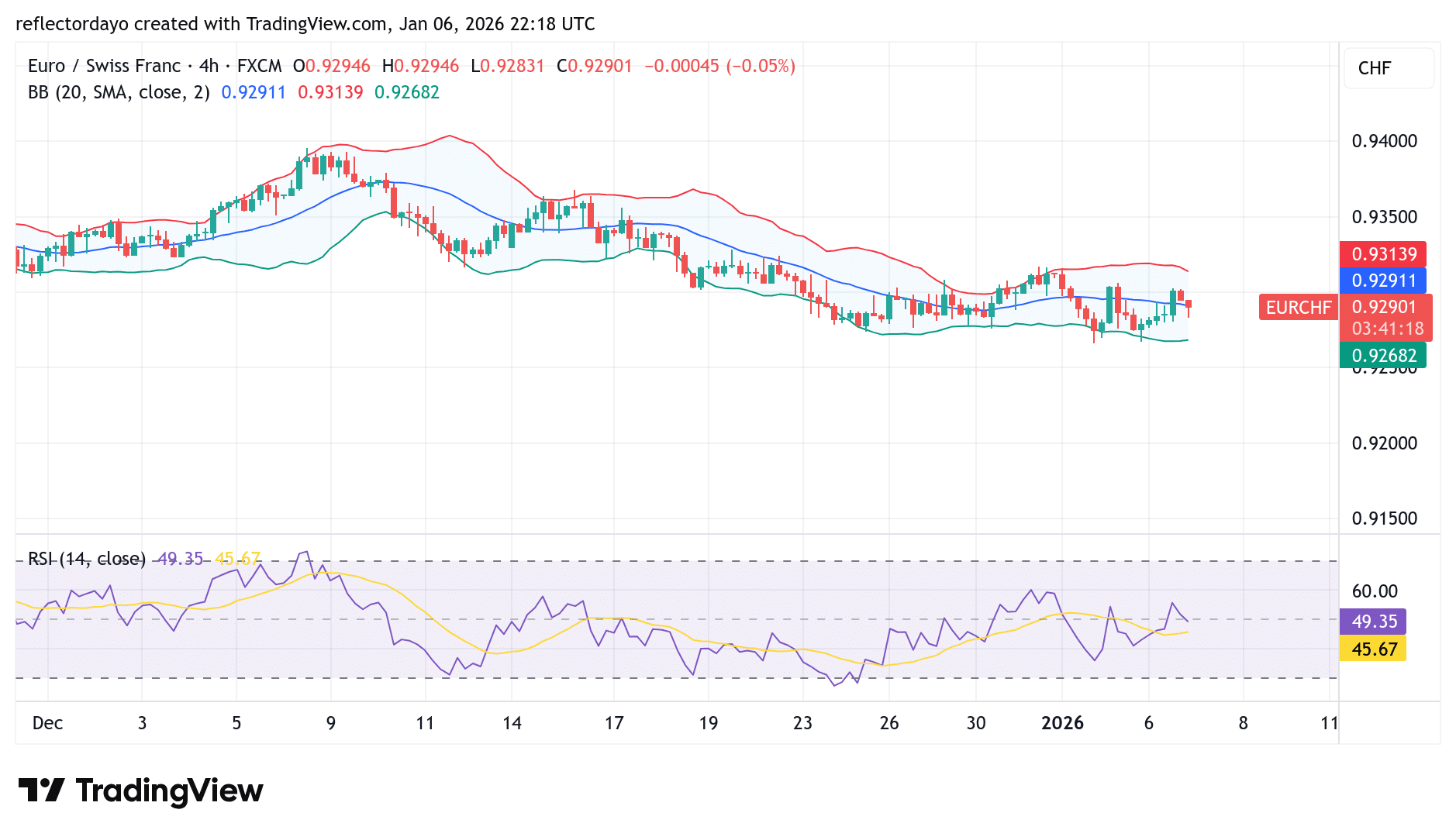

EUR/CHF Short-Term Trend: Indecision

On the lower timeframes, price action clearly reflects a consolidation phase. The Relative Strength Index (RSI) is positioned precisely at the midpoint of the indicator, around the 50 level, signaling balanced market momentum and indecision between buyers and sellers. This technical neutrality aligns with the broader fundamental backdrop.

Overall, EUR/CHF remains confined to a range, shaped by competing fundamental forces. Neutral global risk sentiment, closely aligned monetary policy expectations between the ECB and the SNB, and the Swiss National Bank’s preference for currency stability continue to limit directional movement. Meanwhile, persistent growth concerns within the Eurozone cap euro strength and prevent a sustained upside move. Until a clear catalyst emerges—such as a shift in risk appetite or a change in central bank guidance—EUR/CHF is likely to remain stable, with price action favoring consolidation rather than a decisive trend.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.