In a lightning-fast regulatory crackdown, the US Securities and Exchange Commission (SEC) has cast its regulatory net over two of the world’s most prominent cryptocurrency exchanges, Coinbase and Binance.

The SEC wasted no time, filing charges against Coinbase for allegedly functioning as an unregistered broker while designating Cardano (ADA) and other assets as securities. Surprisingly, Chairman Gary Gensler’s previous comments about crypto assets using the Proof-of-Stake (PoS) consensus mechanism were absent from the SEC’s mention.

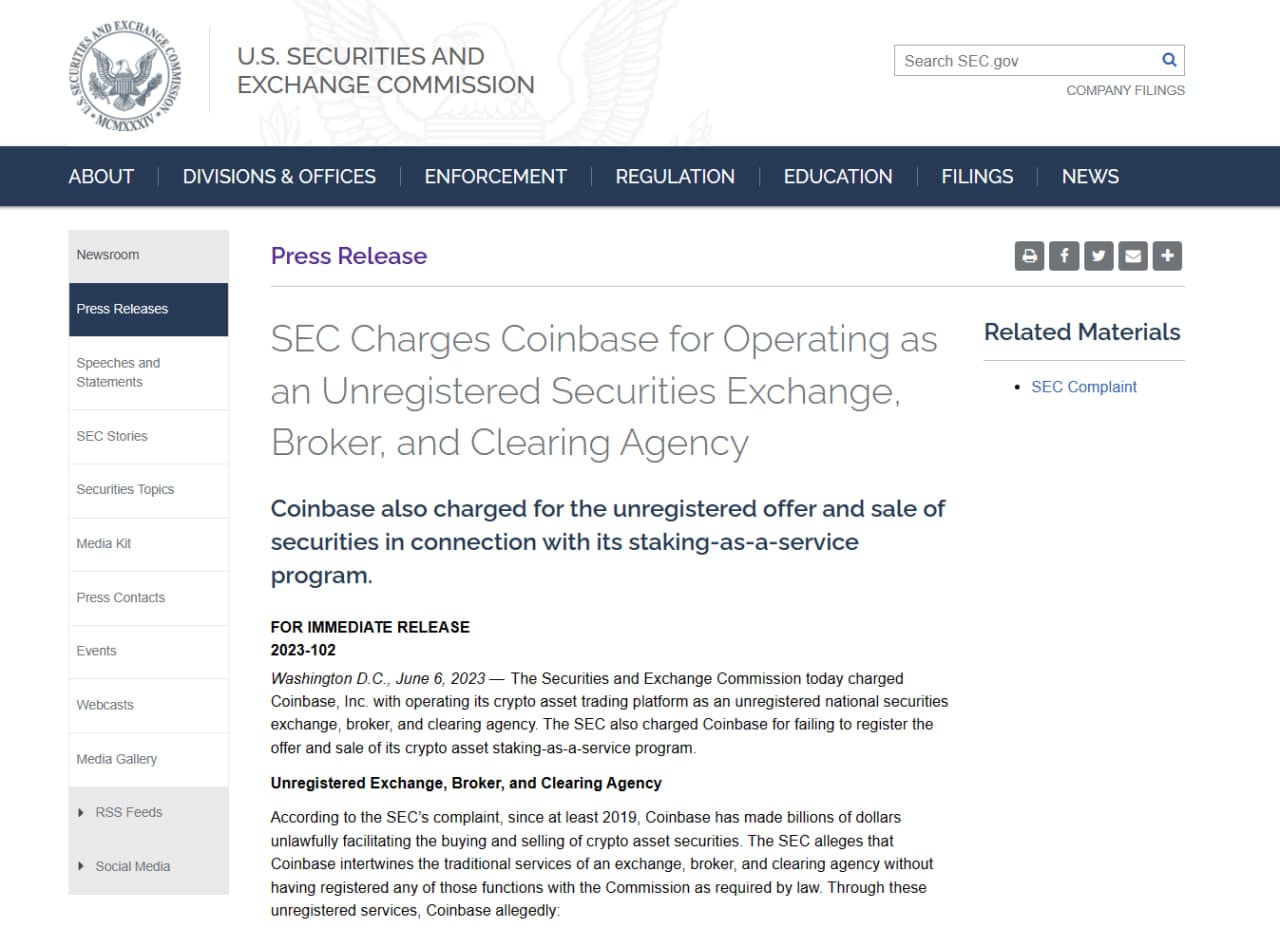

Coinbase Comes Under the SEC’s Radar… Again

Coinbase, the heavyweight among cryptocurrency exchanges, found itself in the crosshairs of the SEC as the watchdog asserted that the platform had been operating as an unregistered broker since 2019. These charges, brought to light recently, have drawn attention to the SEC’s claim that Coinbase neglected to provide the essential disclosures customary in traditional security markets due to its failure to register. Consequently, the agency argues that investors have been left in the dark without the necessary disclosures and protective measures they rightfully deserve.

One particular aspect that triggered the SEC’s scrutiny was Coinbase’s staking program, which the agency boldly classifies as a security. Despite the SEC’s recent crackdown on staking services, Coinbase’s Chief Legal Officer, Paul Grewal, boldly announced that the exchange would continue to offer its staking service, distinguishing itself from its counterparts like Kraken.

SEC Accuses Coinbase of Offering Four Unregistered Crypto Assets, Including Cardano

In addition to these charges, the Commission further accused Coinbase of facilitating trading in unregistered securities, including FLOW, VGX, MATIC, and ADA. Interestingly, many of these assets, including the controversial Cardano, were also classified as securities in the SEC’s charges against Binance.

The SEC’s insistence on reiterating the classification of these assets as securities highlights the agency’s unwavering commitment to its stance. However, the conspicuous absence of any mention of Ether (ETH) in the charges raises eyebrows.

In previous remarks, Chairman Gary Gensler indicated that all crypto assets using the PoS consensus mechanism could potentially be considered securities. This omission adds a twist of intrigue to the SEC’s approach to classification.

You can purchase Lucky Block here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.