Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Solana has experienced rampant growth since the turn of 2021. With that said, this industry is renowned for its volatility, so the best way to access SOL tokens is via a regulated and trustworthy broker.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioToday, we take you through the process of how to buy Solana in under 10 minutes, alongside a quick overview of the best brokers for the job.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

How to Buy Solana in 10 Minutes or Less – Fast Track Guide

The best cryptocurrency brokers for beginners will enable you to sign up and buy Solana in an efficient and safe manner. See a fast-track run-through below, which covers how to create a brokerage account to access the Solana market in under 10 minutes.

- Step 1: Create an Account With a Trustworthy Cryptocurrency Broker – Look for a platform holding a license from a tier-1 regulatory body. Next, look for the sign-up button and enter all details needed to create an account. This will entail identifying yourself to the broker – by entering your name, nationality, address, and date of birth. Fill in your desired account password and username and move on to step 2 by confirming everything you’ve entered so far.

- Step 2: Complete the KYC Process – To create an account for you, regulated brokers are required to validate the information you’ve already given. This shouldn’t take long. Take a photograph or scan of your passport/driver’s license and a recent utility bill. Attach the documents when prompted.

- Step 3: Make a Deposit – Choose a payment type from what is supported and enter all details required. The best broker to buy Solana will be compatible with e-wallets, major credit and debit cards, and bank transfers.

- Step 4: Buy Solana – Use the broker’s search bar to find SOL tokens and select to place an order. Now you can buy Solana, by entering the amount you want to allocate, and confirming. The broker will credit your portfolio with the tokens accordingly, at the current market value.

That’s it. In 4 simple steps, you can buy Solana online. As we said, you also need to handpick a legitimate broker, from the many available.

Best Broker to Buy Solana

The best broker to buy Solana will be a multifaceted provider with the approval of financial regulators. Without this, you could be dealing with a shady company that doesn’t take care of your funds.

In your quest for the best place to buy Solana, there are a handful of other considerations to think about:

- Is the broker regulated by the FCA or SEC, or another well-known body like ASIC?

- Is the broker economical, in terms of fees?

- Can the platform provide you with access to SOL tokens, as well as other markets?

- Is the website easy-to-use, yet functional and well-designed?

- What forms of payment will you be able to use to buy Solana?

Bearing all these key points in mind, next you will see our full evaluation of Capital.com. This is the best trading platform to access Solana, importantly, in a legitimate and cost-effective way.

VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

How to Buy Solana – Step-by-Step Walkthrough

When you are learning how to buy Solana, you’ll probably be hoping for low fees and the ability to access the market in a heartbeat.

Once you’ve found a suitable broker, it’s then just a case of creating an account and making a deposit. We are using Capital.com for this walkthrough, but, of course, you can opt for any platform of your choosing.

See why we chose Capital.com:

- Capital.com lists SOL/USD and plenty of alternative crypto markets (200+)

- The FCA, CySEC, ASIC, and NBRB regulate this broker

- Capital.com offers 0% commissions on all markets

- The website is really simple to navigate and is jargon-free, making it appropriate for newbies

- Signing up is timely and stress-free

Below you will see the 5 step process of how to trade Solana via Capital.com.

Step 1: Open a Crypto Broker Account

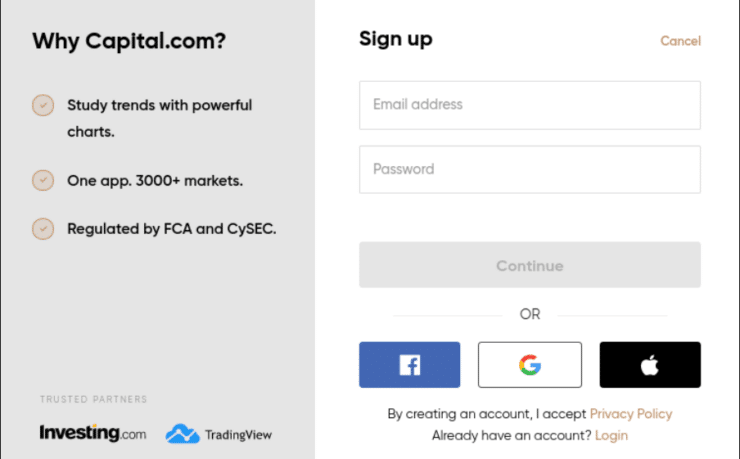

Signing up with a broker should be stress-free. At Capital.com, you will see the sign-up button on the main platform. Click this to be presented with the following registration box.

Enter the required information, including a username and password of your choosing. The broker will also ask for your name and home address. Then, add contact information, like a mobile number and email address.

After completing your date of birth, nationality, and a few other snippets of information, you can move forward to step 2 of buying Solana.

78.77% of retail investor accounts lose money when trading CFDs at this provider

Step 2: Complete KYC

From start to finish, the KYC process shouldn’t take more than 1-2 minutes at Capital.com. This is a key component of signing up with a regulated brokerage to buy Solana.

- Attach a copy of your photo ID. For this, you may use a driver’s license or a passport. Make sure your name, photograph, and date of birth are visible

- Upload a document that includes your address, full name, and an issue date from the last 3 months. This must be an official letter, such as a bank statement or a utility bill

Capital.com is usually able to verify new accounts quickly. When you receive confirmation, you can move on to step 3.

Step 3: Deposit Funds

To buy Solana, you will need a funded account. Capital.com accepts payment types like credit and debit cards. You can also select one of many e-wallets, including PayPal, Skrill, and iDeal.

If you would rather use a wire transfer, please note that you will not be able to trade Solana for 2-3 business days. Capital.com does not charge deposit fees irrespective of the payment method being used.

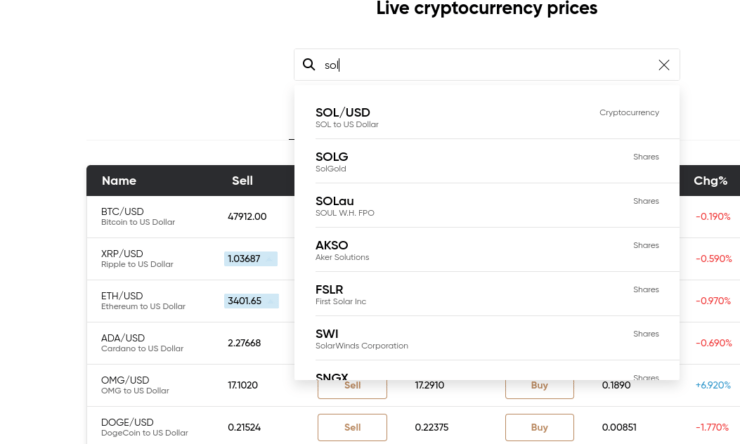

Step 4: Search for Solana

Look for Solana by using the search bar. When you see it, select it.

Capital.com will redirect you to a new page to place your order.

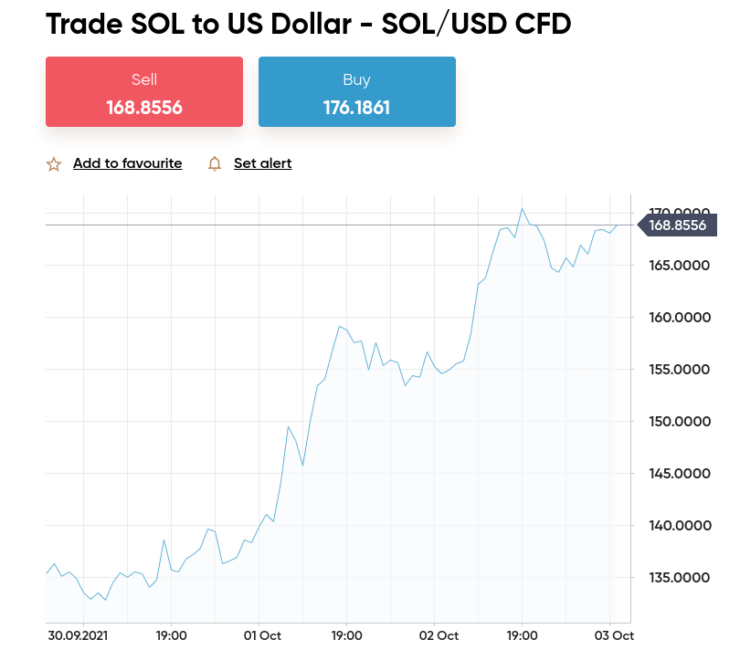

Step 5: Place Buy Order

First, make sure the page it has redirected you to is for Solana. Next, click ‘buy’ to place an order.

To buy Solana via CFDs, enter the amount you wish to allocate and confirm all. Capital.com will add SOL/USD to your account.

Step 6: How to Sell Solana

When you learn how to trade crypto, you will probably be doing so to make a profit later on.

See below how you might buy Solana and make gains at a later date:

- After signing up with a regulated brokerage, in 2021, you allocated $1,000 to buy Solana

- Later, SOL tokens rise in value by 56% so you want to cash out

- To do this, you sign in to your broker account and locate SOL, from within your purchased assets

- Next, you create a sell order. The broker is now buying the SOL tokens back from you, at the current value

- Once complete, the proceeds appear in your brokerage account as an available trading balance

As you can see, when using the right online broker, selling Solana has never been easier.

Best Solana Wallets

The best Solana wallets offer a safe place to store SOL tokens, whilst being appropriate for your level of experience.

You will see the two most common options below.

Trust Wallet – Overall Best Solana Wallet

The Trust Wallet is a highly regarded crypto wallet, for people who buy Solana. This storage option comes in the shape of a mobile application and is a ‘software wallet’.

- To interact with the Solana network, you can download Trust Wallet from Google Play or the App Store

- All assets and private keys are encrypted. This produces a master private key

- You will need to take good care of your seed phrase to prevent anyone else from accessing your SOL tokens

- Trust Wallet facilitates the buying, selling, and swapping of cryptocurrencies

Whilst the Trust Wallet is considered a safe option, the most secure is a hardware wallet – which we cover below.

Ledger Nano – Best Solana Wallet for Security

When examining how to buy Solana, as well as how to store it, you may come across the Ledger Nano. This is a ‘hardware wallet’ and it is one of the most secure ways to store digital assets.

- Once you have unlocked and fully connected your ledger device, you can head to the app catalog

- Look for the Solana app and add it to your hardware wallet

- You can now access and store SOL tokens from the hardware wallet

The Ledger Nano can cost in the region of $100-$199. Of course, if you decide to buy Solana at an online broker that stores assets within your portfolio, you will not need a wallet.

What is Solana?

The Solana blockchain platform was initially founded in 2019 by Anatoly Yakovenko, a Qualcomm engineer.

- SOL tokens were released to the public in 2020.

- This cryptocurrency has made quite a name for itself since the turn of 2021, with the value of SOL tokens exceeding many market commentators’ expectations.

- Solana aims to create a decentralized finance platform that’s accessible to everyone.

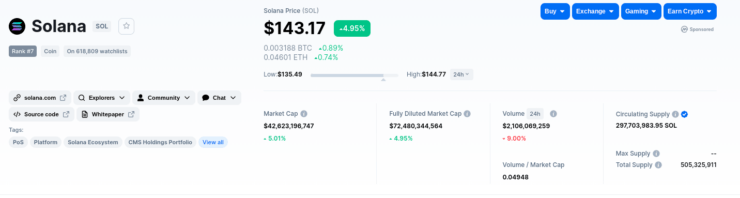

In the one year since its release, the all-time low of SOL tokens stands at $0.50, whilst its all-time high amounts to $191.68.

Reasons to Buy Solana

In addition to this cryptocurrency’s highly functional nature, there are other reasons to buy Solana. See some of these core factors below, including the explosive growth of the digital asset, its energy efficiency, and lightning speed transactions.

Solana Growth

Solana has skyrocketed in 2021. In fact, this open-source project has overtaken the so-called people’s crypto – Dogecoin. With this in mind, let’s take a look at some stand-out moments in the price history of Solana.

- On April 11th, one SOL token would have cost $0.77

- 3 months later, on July 26th, the cryptocurrency had doubled, priced at $1.56

- Fast forward to January 25th, 2021, and Solana was valued at $3.70

- By February 19th, it was at $11.47 per unit. That’s a growth of 210% in 25 days

- On May 18th, 2021, one SOL token would cost $55.91.

- Within the same month, on May 23rd, you could buy Solana for a fraction of the cost, with a full unit valued at $24.69

- A mere 4 months later, on September 8th, 2021, Solana had skyrocketed to $191.04

- At the time of writing, SOL tokens are priced at $143 – which is subject to change on a second-by-second basis

Now, let’s hypothesize that you researched how to buy Solana back on January 1st, 2021. At this time, it was priced at $1.84. Let’s say you later cashed out your investment, specifically, on September 8th, 2021. At this time, the market valued SOL tokens at $191.04 each. Your gains from cashing out would be an impressive 10,282.60%

This could present an opportunity to buy Solana now, in the hope it continues to climb. Thus, meaning you can make a profit later. There certainly seems to be potential there, but it is an absolute necessity for you to decide for yourself.

Solana Uses Energy Efficient PoH

This blockchain uses Proof of History (PoH), rather than Proof of Works (PoW). The latter is renowned for consuming tons of electricity and warming the planet by emitting carbon dioxide emissions.

For those unaware, there are a few categories that blockchain projects fall into; Proof of Work (PoW), Proof of Stake (PoS), and Proof of History (PoH). You may be more familiar with PoW, as well-known token cryptocurrency Bitcoin uses it.

See the difference between the aforementioned transaction validations in more detail below:

- PoW: The PoW crypto mining mechanism aims to diminish spam. All project miners are tasked with solving difficult mathematical sums using sophisticated equipment. Each miner races to adjust the ledger so they can produce a new block – which is known as hashing. The problem is that PoW assets like Bitcoin use a huge amount of energy.

- PoS: Instead of using equipment to generate the relevant hash, PoS has been modified to utilize an algorithm. This selects a token holder to submit the next block and is much faster than PoW. The node must then sign and verify it and present it to the network for authentication. Again, this consensus mechanism isn’t very energy efficient. Specially designed hardware called GPUs uses tons of resources, including the internet.

- PoH: In stark contrast, the algorithm used by Solana is comparable to a synchronized clock. The goal of Anatoly Yakovenko was to speed up the decision-making process on blockchains. In addition to making Solana less energy-intensive than the likes of Bitcoin.

Essentially, with Solana, bots and miners no longer have a say in which order transactions are added to the blockchain. This is supposed to create a faster and more secure environment that resists censorship.

Transaction Speed and Efficiency

Generally speaking, blockchain networks communicate with each other to validate time passed between transactions, and so forth. As we touched on, Solana validators keep their own clocks, making a highly efficient network.

This is achieved by an encoding stream of time, using a cryptographic hash algorithm with Secure Hash Algorithm 256-bit (SHA-256).

Another reason that both newbies and experienced crypto traders are looking to buy Solana is how fast the blockchain is.

- Solana supports transaction speeds of over 65,000 per second – Bitcoin only manages 7

- The transaction cost for Solana is only $0.00025 – whereas Bitcoin recently hit highs of $159.65!

In a nutshell, PoH prevents block producers from contending against others for a place on the network. Instead, each node has a block of its own.

This allows the network to keep track of the order of transactions in a less complicated way. Thus, rendering it faster and more efficient than most current cryptocurrency platforms.

Solana Investment Risk

It’s important that you carry out meticulous research on how to buy Solana, and educate yourself on the potential hazards of the crypto markets. As you likely know, digital currencies experience sharp fluctuations in value.

- It’s important to try to keep your cool, whilst being a realist. Think about the risks involved – namely, you could lose money

- As well as electing to buy Solana, you could also mitigate some risk by adding some smaller crypto assets to your portfolio.

- For example, you could buy IOTA. This is around $1 at the time of writing

- Another alternative is Shiba Inu coin, which is currently valued at less than $0.01

- As with any digital asset, there is a chance of a rise or fall in price. This will hopefully bring you a profit, rather than a loss, upon cashing out later

Some newbies might prefer to diversify by purchasing a better-known cryptocurrency, such as Ethereum. Either way, research the markets thoroughly. This should be done before allocating any funds to such a potentially volatile digital token.

If you would rather not risk the price of a full token, Capital.com supports fractional stakes and only requires $20 to get started, if you opt for a debit/credit card or e-wallet.

How to Buy Solana – Conclusion

When you are learning how to buy Solana, it’s crucial you grasp the importance of using a reputable brokerage site. This promises a much safer environment than an unregulated provider, as the broker will have to follow strict rules to keep your capital safe.

We evaluated the best places to buy Solana. andCapital.com passed a range of tests. The FCA, ASIC, CySEC, and NBRB regulate and license the platform. You can add funds to your account using a range of e-wallets or debit/credit cards from just $20, and can then buy Solana CFDs with 0% commission.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

FAQs

How do you buy Solana with PayPal?

How do you buy Solana with a credit card?

Can you buy Solana on Coinbase?

How do you buy Solana with a bank transfer?

How do you sell Solana?