Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Unlike its blockchain counterparts, IOTA uses a standout feature called DAG (Direct Acyclic Graph) – enabling transactions to be added in parallel to one another.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioIf you like the idea of learning how to buy IOTA from home, then look no further!

Today, we not only do we discuss how to buy this highly speculative currency, but also what investment strategies you can incorporate into your master plan. Additionally, we have saved you some time by reviewing the best brokers that allow you to buy IOTA safely and in a cost-effective manner.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

How to Buy IOTA in 10 Minutes – Quickfire Guide

If you are pushed for time, you probably want to invest in IOTA right now. If so, the first thing you need to do is join a reliable cryptocurrency broker.

See below a quickfire guide of how to buy IOTA in less than 10 minutes without paying any commission.

- Step 1: Sign up with an online broker that can provide you with access to IOTA – Capital.com will allow you to buy IOTA with zero commission payable and no ongoing account fees

- Step 2: Fill in your details such as full name, email, and residential address

- Step 3: To complete your profile you need to send the broker a clear copy of your ID, such as a passport. Another requirement is to send proof of address, such as a utility bill

- Step 4: Now you can deposit some funds with a debit/credit card, bank transfer, or e-wallet

- Step 5: Look for IOTA via the search facility and place an order – Capital.com supports investments from just $25

If you like the sound of Capital.com, you will find a full review of this top-rated broker below, as well as some great alternatives.

Select a Trusted IOTA Broker

As we alluded to, the best way to buy IOTA is by signing up with a trusted broker. With that in mind, this section will review the best platforms for the job.

A hallmark of all three of the below providers is that you can apply leverage when trading IOTA. For those in the dark about leverage, we offer an example later when discussing CFDs.

1. AvaTrade – Huge Variety of Trading Tools for IOTA CFD Trading

AvaTrade is another platform that will facilitate IOTA CFD trades, enabling you to apply leverage - if permitted in your jurisdiction. This brokerage charges a 0% commission on cryptocurrencies and all other financial instruments. When trading IOTA CFDs via this platform you can expect to pay a spread of around 2% over-the-market spot price.

This platform accepts multiple payment types, including Skrill, Neteller, Bitcoin, debit/credit cards, and wire transfers. The minimum deposit to trade IOTA is $100, which is accessible for most. If you wish to access a multitude of advanced trading tools like pricing charts, educational content, automated bots, and indicators - this CFD broker works smoothly with MT4 and MT5.

With that said, this broker has its fair share of proprietary apps, resources, and features. For instance, there is the AvaTradeGO mobile app, which allows you to trade on the move with ease and offers live news feeds and pricing trends. Another helpful addition to your trading arsenal might be the risk management offering called AvaProtect, which in itself is packed with handy tools.

For the more sociable of you out there, AvaTrade also enables you to hook your account up to the AvaSocial app. This allows you to copy other pro investors, automate your IOTA trades, and create your own networks by following and 'liking' like-minded crypto-traders. Moreover, the platform gives all clients a free trading account with $100k in practice money.

Finally, this online broker operates under the watchful eye of six financial authorities. Tier-1 and Tier-2 regulation come from well-known organizations such as ASIC, FSCA, FSA, MiFID, BVI, and ADGM. This protects you and your fellow traders against financial crime. You can also be sure that this regulated trading platform is operating legitimately and within the law.

- Trade IOTA CFDs with a minimum deposit of $100

- Regulated by multiple jurisdiction's

- 0% commission on CFDs

- Admin fee payable after a year of inactivity

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Buy IOTA or Trade CFDs

When considering how to access IOTA, you have likely already thought about whether you want to buy or trade CFDs.

For those who are undecided, see below the 2 most commonly adopted ways to access this market.

Buy and Hold IOTA

If you like the idea of sitting on your investment and not worrying about day-to-day price shifts – you might consider the ‘buy and hold’ method. This entails making one or more IOTA purchases and then selling the coins later on for a higher price. Depending on the market sentiment, you might hold on for years.

To make things clearer, see an example of a buy and hold strategy below:

- You see that IOTA has fallen in price – but believe this is a short-term trend

- Consequently, you create a $150 buy order at your chosen brokerage

- 12 months later, IOTA has risen in value by 21% – meaning your speculation was correct

- To cash out your gains you place a sell order

- From your original buy order of $150, you made a profit of $31.50 ($150 x 21%)

In this example, you held onto your IOTA investment for 12 months. Although cryptocurrencies are digital, they still need storing. You may look at downloading a crypto-wallet, however, this can make things more complicated for newbies as you also need to consider securing your purchase from hackers.

This guide found that in all cases, the easiest way to store your IOTA is via a regulated broker. This way, you can access your own investment when you wish, but don’t need to encrypt and protect it yourself. Regulated brokerage eToro facilitates commission-free IOTA investments from $25 and will store your coins on your behalf.

Trade IOTA

If you have been researching how to buy IOTA, the chances are you have heard of CFDs. We touched on this subject in our broker reviews, however, for newbies let’s offer some insight. CFDs (Contracts for Differences) offer a way to trade cryptocurrencies like IOTA without taking ownership.

The CFD will instead monitor and price match the underlying asset (IOTA in this scenario) – so your role is to speculate correctly on its future direction. People who trade IOTA often do so in pairs so you will see crypto-crypto and crypto-fiat offerings at most CFD trading platforms.

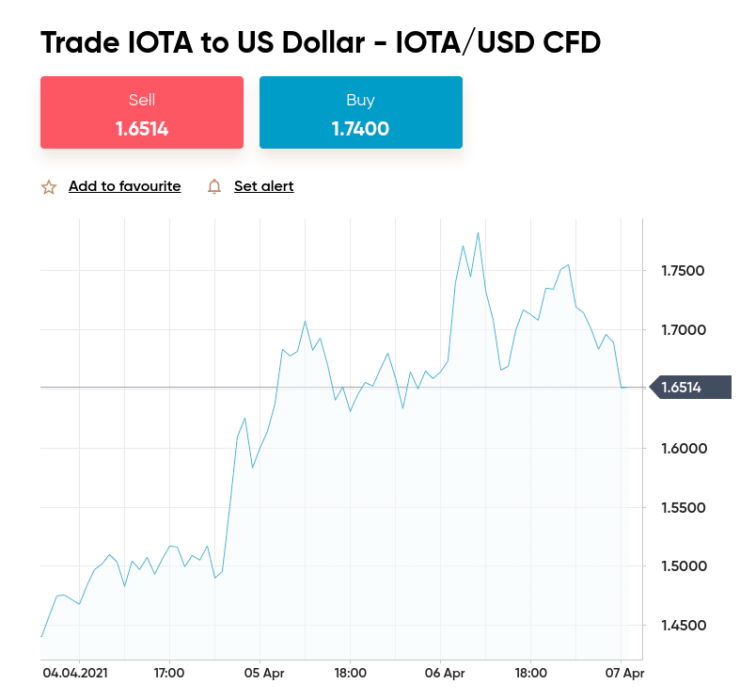

The most popular pair to trade from each category is IOTA to Bitcoin (IOTA/BTC) and IOTA to US dollars (IOTA/USD).

Please see an example of IOTA CFDs to clear any confusion:

- Let’s say you are trading IOTA against US dollars via a CFD

- The CFD naturally mirrors the price of IOTA/USD, which is currently $1.60

- You think the markets have overvalued the pair and IOTA/USD will soon see a price drop

- This is when you create a $300 sell order to go short on the pair

- Sure enough, 4 hours later IOTA/USD is valued at $1.32, showing a 17% drop

- Satisfied with your 17% gains from this trade, you place a buy order to close your position

- You made a profit of $51 from this CFD trade ($300 x 17%)

Another important CFD characteristic you should know about is leverage, which acts as a loan to allow you to open a higher value position. Leveraged crypto CFDs are prohibited in some jurisdictions – including the UK, Hong Kong, and the US.

You will see below a simple example of how leverage would have impacted the previous IOTA CFD trade that we discussed above.

- When placing your $300 sell order on IOTA/USD, the broker offers you leverage of X2

- Your order is now worth $600

- Without leverage, you made gains of $51 on the trade (17% of $300)

- However, as you applied leverage of 1:2 – your gains are boosted to $102.

Where to Buy IOTA

The chances are, you are now feeling prepared to conquer the IOTA markets. First, we must disclose where you can buy this digital asset.

Buy IOTA Debit Card

No two brokers are the same, so it’s important to see which payment methods are accepted before signing up with a new trading platform. Many IOTA trading platforms are compatible with debit cards – albeit, you need to check what fees apply.

Buy IOTA Credit Card

Credit cards are a fast and convenient way to buy IOTA. However, it’s crucial you are aware of any additional fees this payment type often comes with – such as the ‘cash advance’ This can be around the 3-5% mark. This is sometimes charged by credit card companies when depositing funds at an online brokerage.

Some platforms charge their own fees for this method or may even stipulate a higher investment amount. In contrast, eToro charges no extra fees for processing a credit card purchase – plus you will only pay the previously mentioned 0.5% conversion fee if USD isn’t your native currency.

Buy IOTA Paypal

We often associate PayPal with safe online purchases, so it will come as no surprise that you can use it to buy IOTA. Of course, this will depend on the broker in question, as some platforms don’t accept this e-wallet.

eToro enables you to deposit funds into your account and buy IOTA using PayPal and will still only charge you the 0.5% exchange fee for non-US deposits.

IOTA Strategies

Strategies help us stay on track when buying cryptocurrencies, so why not think about this before placing your first order? Your entry into the world of cryptocurrency investing will run much more smoothly with a plan behind you.

If you don’t know where to start, not to worry – you will see below some of the simplest and most effective strategies used today when investing in IOTA.

Dollar-Cost Averaging

Dollar-cost averaging is one of the easiest systems to incorporate into your own strategy. Think about how much money you would like to allocate to IOTA, divide it up, and spread it across multiple investments.

Let’s say, for example, you wanted to dedicate $500 per month to IOTA. This might see you making purchases of $125 per week, each time getting a different cost price. Dollar-cost averaging is a well-known way to hedge against the volatility that makes digital currencies so attractive, yet risky.

Buy the Dip

To ‘buy the dip’ is not too dissimilar to getting a discount on an undervalued product. You will wait until IOTA has fallen in price (usually by a sizeable amount) and buy whilst it’s below its market value. This of course means that you can buy low and hopefully sell high further down the line.

Let’s look at a simple example:

- Within days, the price of IOTA has fallen by 26%

- After analyzing data on the cryptocurrency, you consider this to be a temporary decrease in value

- This leads you to buy IOTA whilst it’s at a cheap price

As you can see, this is what it means to buy the dip. If you are correct and the price of IOTA increases again, you will make a profit from cashing out your investment later on.

Diversify

If you want to buy IOTA in a more conservative way, consider adding some diversity to your portfolio. By investing in more than one asset class, you will better protect yourself against the volatility of a singular market.

Diversifying is a great survival technique for investors and traders from all walks of life. To give you an indication of where to start, you might decide to add some gold or perhaps stocks to your portfolio. If IOTA isn’t performing so well, the chances are this will balance out nicely.

IOTA Trading Signals

IOTA trading signals are nothing new, however, if you haven’t heard of them let us explain. When signing up for a crypto signals service, you will receive a number of trading ‘tips’ per week, depending on the provider. This saves you from performing in-depth technical analysis on IOTA or your chosen pair.

For instance, here at Learn 2 Trade, we have a team of cryptocurrency experts who scour the markets for money-making opportunities. They then send the information discovered to our Telegram group as a signal. Importantly, we always include every aspect of your order as standard, to cut out the guesswork. This includes those all-important stop-loss and take-profit order prices.

How to Buy IOTA Online – Full Walkthrough

Capital.com came out on top of our most trusted IOTA broker. As such, we are going to use the platform for this sign-up walkthrough.

Step 1: Sign Up With IOTA Broker

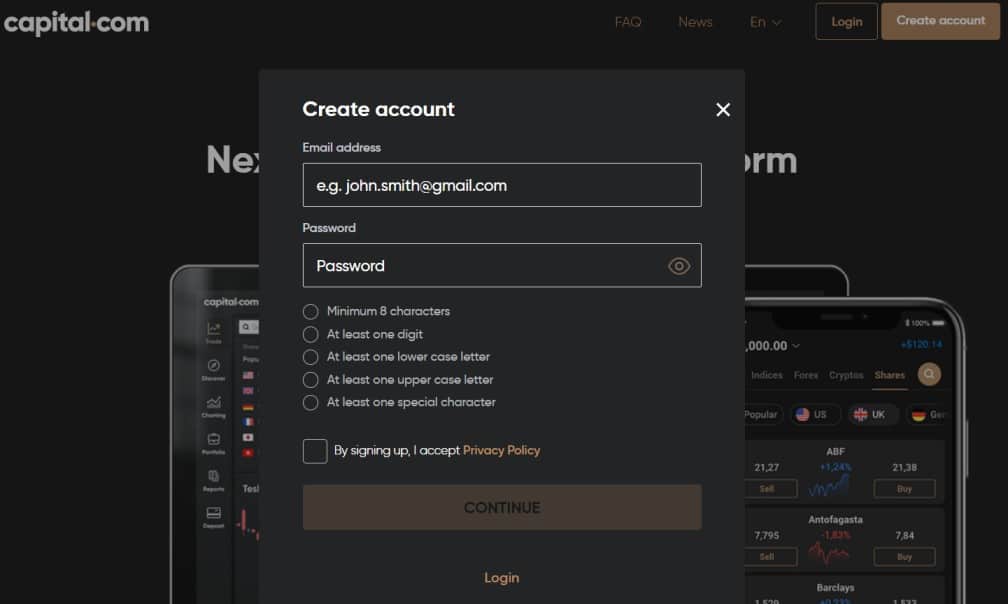

Go to the Capital.com website and click ‘Create account’ to reveal the below sign-up box.

Next, fill in your details as prompted and click ‘Create Account’ to finish.

Step 2: Upload Some Identification

You will need to upload some identification to prove to the brokerage that you are who you say you are – a passport is fine. This is all part of KYC to keep the space free from crime. Capital.com also requires you to prove your address. You can use a bank statement or utility bill for this bit, but it should be dated within the last 3 months.

If you don’t have your passport handy, you can upload your ID at a later date. However, please note that you cannot request a withdrawal or deposit an amount beyond $2,250 until this is complete.

Step 3: Deposit Funds Into Your Account

Before you can buy IOTA, you need to see what payment methods are available to you and add some funds to your account. You can choose from a debit/credit card, e-wallet, or bank wire. When you have double-checked that everything is correct you can click ‘Deposit’.

Step 4: Buy IOTA

Now, all that’s left to do is find IOTA at Capital.com, click ‘Trade’, and fill in your order.

As we mentioned, you can invest in IOTA from just $25 at Capital.com and will not pay any commission for doing so.

To complete the investment – click on ‘Set Order’.

Conclusion

More people than ever are taking an interest in buying digital currencies and with so many online brokers around, it’s never been easier. A word to the wise though – choose your IOTA trading platform with caution as not all are trustworthy.

When looking to buy IOTA from home, you should strongly consider adding strategies to your investment plan, like diversifying. By investing in other markets like commodities, for example, you can protect yourself against cryptocurrency volatility.

Ultimately – Capital.com is strictly regulated and offers some great asset options for diversification. Additionally, you can invest in IOTA from $25 without being charged any commission fees!

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated