Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

LUNA is a crypto token that uses multiple fiat-pegged stablecoins to promote payments that can be programmed. The best way to approach a LUNA investment is to use a regulated broker.

Our Crypto Signals

1-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

12-month subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime Subscription

Up to 5 signals daily

Up to 5 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioIn this guide, we instruct on how to buy LUNA from the comfort of your home. We also explain how to create a broker account, and review the best places to buy LUNA online.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

How to Buy LUNA in 10 Minutes or Less – Fast Track Guide

If you want to understand the ins and outs of how to buy LUNA, you will need to have a broker lined up. This is because a reputable platform is a sensible way to access this unpredictable marketplace.

You will see a quick guide below, instructing you on how to sign up and buy LUNA in 10 minutes or less.

- Step 1: Create an account with a trustworthy cryptocurrency broker – The best place to buy LUNA will ideally be licensed by a tier-1 regulatory body. Give the broker your home address, full name, date of birth, and a safe password and username that you will remember moving forward. Confirm everything to proceed to step 2.

- Step 2: Complete the KYC Process – The client identification procedure is commonplace at reputable trading platforms. To finish the KYC process and buy LUNA, you will upload a copy of a bank statement to prove your address. Next, add a photo ID, so the broker can further validate the information you provided in step 1.

- Step 3: Make a Deposit – Investigate what payment types are accepted. The easiest option is a debit/credit card – although some brokers also support e-wallets. Finally, enter an amount to deposit, and confirm all details entered are right.

- Step 4: Buy Luna – The best broker to buy Terra will allow you to place small orders when purchasing cryptocurrencies. Think about how much to risk, place an order, and the LUNA position will appear in your portfolio.

As is clear, it’s never been easier to hit the markets and buy LUNA. The tricky bit can be finding a good broker. Please continue reading to see a review of the best platform to buy LUNA.

78.77% of retail investor accounts lose money when trading CFDs at this provider

Best Broker to Buy LUNA

The best broker to buy LUNA will offer a quality service, and should at least tick a few boxes on things like regulation and low fees.

Next, to shine some light on the subject, you will find a quality-control checklist. You can use this as a guide when carrying out your search to find the best place to buy LUNA:

- To buy LUNA in a safe place, look for licenses from a reputable body like the FCA or ASIC, amongst other tier-1 regulators.

- Do your homework. Ensure the fees you need to pay to enter the cryptocurrency markets and fund your account are competitive.

- You should find the broker’s website simple to use. This will ensure that placing orders to buy LUNA is swift and convenient.

- Consider deposit methods. There should be a good selection of supported payment types to choose from.

- Look for a broker with a varied list of digital markets.

Now that’s the most important metrics out of the way, we can offer a full review of the best platform to buy LUNA.

VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

How to Buy LUNA – Step-by-Step Walkthrough

You will notice that we have opted to use Capital.com for the following walk-through. This makes sense because, in our earlier review, the top-quality CFD trading platform was revealed as the best place to buy LUNA (via CFDs).

Highlights of buying LUNA at this brokerage include:

- Being able to buy LUNA via CFDs, and also trade hundreds of other cryptocurrency pairs. This includes everything from Ethereum to IOTA.

- Capital.com complies with a high standard of regulation. Thanks to the licensing and approval of top-bodies, the FCA, CySEC, and ASIC.

- 0% commission is offered on all crypto CFDs.

- The broker site is straightforward, making Capital.com very user-friendly.

As noted, next you will find a more detailed step-by-step guide on how to buy LUNA in a safe and swift manner.

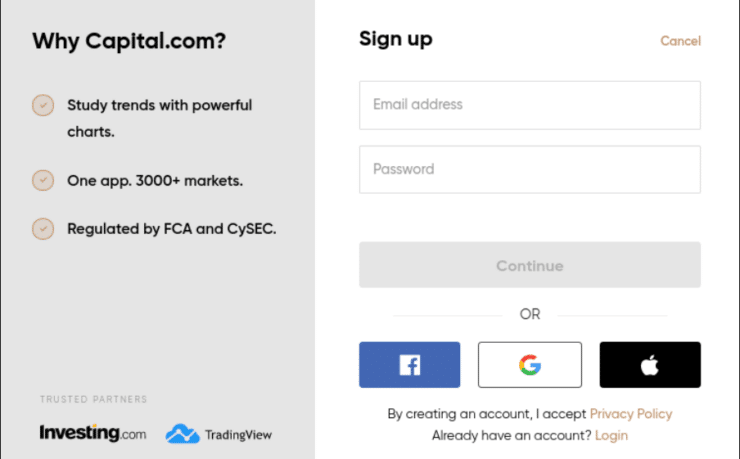

Step 1: Open a Crypto Broker Account

Signing up with Capital.com shouldn’t be a stressful affair. To get started and buy LUNA via CFDs, you can click ‘Sign Up’ on the main page.

Fill in the boxes until you have entered all information. This is likely to include a username and password of your choice.

Add your contact details, comprising email and mobile number. Capital.com will also require you to fill in your first and last name, residential address, nationality, and date of birth. Confirm all to proceed.

Step 2: Complete KYC

To begin the KYC process to buy LUNA, you can upload a scan or a photo of your ID. This must include a photograph, such as your passport. When prompted by the broker, you can also upload something with your name and address on it.

The latter could be a recent utility bill or bank statement. All being well, completing the KYC validation process takes minutes at Capital.com. It’s important that if you take photos of your documentation, they are clear.

Step 3: Deposit Funds

Capital.com is compatible with tons of payment methods and supports various currencies. This includes US dollars, euros, British pounds, and others.

To buy LUNA, you can add funds to your account using the following methods:

- E-wallets include Neteller, Android Pay, ApplePay, PayPal, and others.

- If you would prefer to use your debit or credit card to buy LUNA, the broker supports Maestro, Visa, and Mastercard.

- Bank wire transfer is also an option at Capital.com.

The minimum deposit needed to fund your account with most of the above-mentioned payment methods is $20. However, if you were to choose a bank wire transfer instead, the lowest deposit would be $250. Moreover, bear in mind that you may not be able to buy LUNA for 3-7 days should you opt for a bank wire.

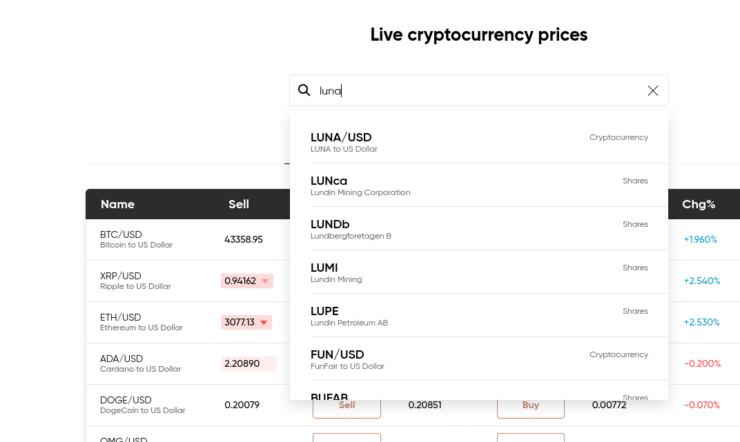

Step 4: Search for LUNA

By now, you should have added trading funds to your account and completed the KYC verification process. This how to buy LUNA guide found the Capital.com search function to be very intuitive.

As such, you can begin to type LUNA in the box provided, and should see the same result as below.

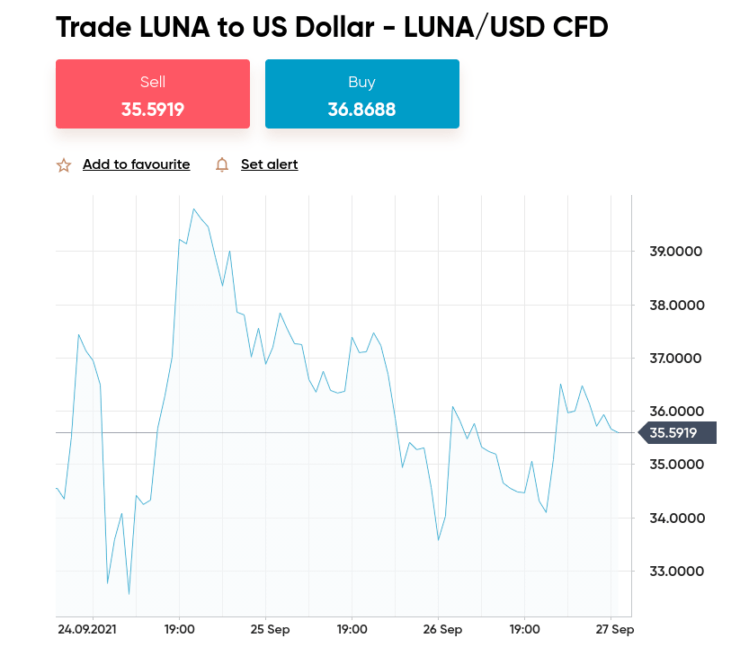

Step 5: Place Buy Order

The chances are, when studying how to buy LUNA, you have considered how much you might want to allocate to tokens. After ensuring the order box is LUNA-specific, press the buy button.

Next, add the amount you wish to allocate to LUNA, confirm the purchase, and you will find the asset in your portfolio

Step 6: How to Sell LUNA

Assuming you learned how to buy LUNA tokens and choose to sign up with a regulated online broker like Capital.com – you will find that cashing out is as simple as making a purchase.

Below you will find a guide on how to sell this digital asset, specifically, at Capital.com:

- Head over to your portfolio to view all open positions.

- Find LUNA amongst the list and click ‘Close’.

- Next, press the ‘Close Position’ button. You will see this to the right of your portfolio.

- Whatever the current market price of your position, the broker will add the proceeds to your trading account.

As is evident, the process of selling cryptocurrencies from the comfort of home couldn’t be easier. Many brokers also offer a free app, so that you can sell and buy LUNA on the go.

Best LUNA Wallets

If you are done learning how to buy LUNA, and now intend on finding a good wallet to store your digital assets – read on. Next, we talk about the best LUNA wallets in the market.

Terra Station – Most Convenient LUNA Wallet

The Terra Station wallet allows you to stake, swap, store, and buy LUNA. This is the official storage solution for all cryptocurrencies within the Terra network. As such, you may find it the most convenient.

- The Terra Station LUNA wallet is available on various platforms. This includes a Chrome extension, desktop edition for windows and macOS, or a mobile app, for Android and iPhone users.

- LUNA holder rewards and extra tokens are regularly awarded via the Terra Station wallet.

- There are heaps of intelligence tools available on the Terra wallet. This includes your activities, live LUNA price data, smart contract information, staking, and governance options.

- You can add various wallets to your Terra Station storage option too.

We mentioned the ability to use Terra Station in unison with other crypto wallets. For people who buy LUNA, one of the most popular wallets to use alongside this option is the Ledger Nano. We offer an explanation of this next.

Ledger Nano – Best LUNA Wallet for Security

The Ledger Nano is one of the more well-known hardware wallets in the cryptocurrency space. This is a physical device that stores your private keys away from thieves. It is absolutely essential that you keep this in a safe place, to avoid it falling into the wrong hands.

If you buy LUNA and consider the Ledger Nano, there are a few things you should be aware of:

- It is widely advised to use Ledger Live to ensure the authenticity of the Ledger Nano hardware wallet.

- Importantly, straight out of the box, the Ledger Nano doesn’t support LUNA tokens.

- As such, you will need to add Terra Station to your crypto wallet via the Ledger Live program/application.

- On Ledger Live, open ‘Manager’ and locate Terra amongst the supported apps. You can then install it on your LUNA wallet.

- Take note, you will need to pay anywhere between $50 and $200 to buy this hardware wallet.

Beginners may find the idea of spending money on a device and looking after private keys intimidating. This is why many newbies look to buy LUNA via CFDs. As we said, this involves trading based on the prediction of its future price – meaning you don’t need to worry about storage.

What is LUNA?

Want to learn how to buy LUNA in full? If so, it’s important to know that Terra is a blockchain payment platform. LUNA powers it, with the help of intertwined stablecoins created by the network.

- The former specialized in software management at Microsoft and Apple. The latter has an entrepreneurial background in the e-commerce sector.

- LUNA was introduced a short time after, in 2019.

Terra has many of its own algorithmic stablecoins. This, in theory, makes it much less volatile than your average blockchain project. It’s important to learn every aspect of how to buy LUNA. We talk about stablecoins next, to clear the mist for newbies.

LUNA – Reasons to Buy

LUNA has grown exponentially this year. If that’s not enough reason to buy this cryptocurrency, see some inspiration below.

Luna: Pegged to Multiple Stablecoins

When you look to buy LUNA, you will see that the digital currency is vital for stabilizing the value of the Terra project’s stablecoins.

As such, when you purchase LUNA, you should be aware of the many stablecoins under the umbrella of this network. Terra offers a range of fiat-pegged cryptocurrencies, which means it is more likely to be widely accepted by businesses.

Below, you will see some of the stablecoins offered by the Terra (LUNA) network:

- US dollars – TerraUST

- Swiss francs – TerraCHT

- Canadian dollars – TerraCAT

- Euros – TerraEUT

- Mongolian tugrik – TerraMNT

- Hong Kong dollars – TerraHKT

- British pounds – TerraGBT

- Australian dollars – TerraAUT

Digital currencies are notorious for their sharp price fluctuations, in either direction.

As such, with so many stablecoin ties, LUNA is all set for a future where the majority of companies may accept digital assets as payment. For instance, businesses that might otherwise be wary of such volatile cryptocurrencies.

LUNA Keeps the Terra EcoSystem Stable

Cryptographic versions of fiat currencies are said to be the future of E-Commerce. One of the most well-known is Tether (USDT), pegged to the US dollar. However, as we mentioned, Terra also has many stablecoins of its own.

As you can see from the previous section, this includes everything from US dollars to Mongolian tugrik. All-in-all, LUNA is a staking token and plays an important part in maintaining the balance and stability of its ecosystem.

See below for a theoretical example of how LUNA plays a part in maintaining the Terra ecosystem, and how trading is incentivized for token holders.

- Let’s imagine TerraUST (pegged to the US dollar) is in high demand.

- As a result, instead of the price being $1, it has risen to $1.06.

- To counterbalance this, the network will create more UST tokens.

- If you hold LUNA, Terra will allow you to swap a token for UST, 1 for 1.

- You can then sell the aforementioned UST tokens for a 6% profit.

This is a popular incentive offered to LUNA holders, to reduce the supply of the asset in question. The goal is to stabilize the price.

The Terra network offers this trading incentive on all of its stable coins. In other words, this applies whether the token is pegged to the euro, Swiss francs, or the pound.

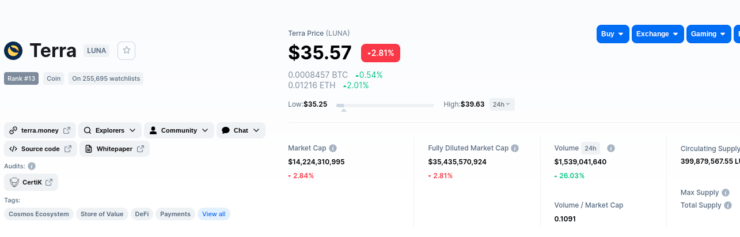

LUNA Growth

As we touched on, LUNA was introduced in 2019. This token, like most other cryptocurrencies, has risen and fallen in value. This volatility is where you can try to make gains.

- On July 27th, 2019, LUNA was priced at $1.31.

- By the same date in 2020, the cryptocurrency had fallen by over 70%. This means you could have bought LUNA for $0.39 per token.

- By March 21st, 2021, the value of LUNA had skyrocketed to $21.98.

- Within 2 months, on May 21st, 2021, you would have been able to buy LUNA tokens for $4.10 each.

So, is this a valid reason to buy LUNA? Well, let’s imagine you had proceeded to buy LUNA on July 27th, 2020. Next, let’s say that you held onto your tokens. If you decided to sell them now, over a year later, you would make a profit of 9,102%.

This is because, at the time of writing, LUNA is valued at $35.89 per unit! As is clear, there could be an opportunity to make some gains from the price spikes of this cryptocurrency.

Investment Risk

The biggest risk to be mindful of when researching how to buy LUNA is that you could lose your capital. This is because digital assets like this are known to rise and fall in value suddenly.

- Like most assets, the price of cryptocurrencies is mainly decided by supply and demand.

- Demand and supply levels can change in a heartbeat, which means if you are incorrect in your speculation of LUNA’s rise or fall, you could lose money.

However, all is not lost. See below some tried and tested ways to lessen the risk involved when you elect to buy LUNA:

- Access LUNA via CFDs, so you don’t have to worry about storage and private keys.

- Only risk small amounts when you buy LUNA. You might try dollar-cost averaging, which will involve purchasing a small quantity of Terra on a regular basis.

- Think about adding other cryptocurrencies, as well as LUNA. This should lessen the risk as you are spreading it across more than one asset.

- Don’t even consider unregulated spaces to buy Terra, as you won’t know whether the platform is legit until it’s too late. Top licensing bodies to look for when choosing a broker include CySEC, FCA, ASIC, and NBRB.

Of course, you must bear in mind that token prices can rise and fall at any time, so it’s important to keep an eye on the markets. Public sentiment, celebrity endorsements, and negative or positive publicity can also affect the price of digital currencies.

How to Buy LUNA – Conclusion

This guide covered the most important aspects of how to buy LUNA safely online. We reviewed a ton of platforms and our research found that the best way to access such a speculative asset class is with the help of a regulated brokerage. On top of regulatory standing, you can also think about alternative market availability, trading fees, usability, and storage.

If you would rather not worry about storing Terra tokens, you might find the best broker to buy LUNA is at Capital.com. You can access tons of cryptocurrencies via commission-free CFDs. Moreover, the FCA, ASIC, CySEC, and NBRB regulate the trading platform. Get started from just $20, by choosing from a list of e-wallets and credit/debit cards to fund your account.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated