The Canadian dollar, commonly referred to as the loonie, experienced a significant dip, marking its lowest point in nearly a month against the U.S. dollar, trading at 1.3389.

The primary catalyst behind this decline is the mounting apprehension concerning the impact of elevated interest rates on the Canadian economy.

The Bank of Canada (BoC) has steadfastly maintained its key interest rate at 5% since September, ranking among the highest across major economies. The BoC contends that this measure is imperative to curb inflation and stabilize the surging real estate market.

Nevertheless, several analysts argue that the lofty interest rates may be doing more harm than good to the Canadian economy.

Speaking to Reuters, currency expert Aaron Hurd from State Street Global Advisors expressed concern, highlighting Canada’s susceptibility to increased borrowing costs compared to the United States, thereby resulting in the weakened position of the Canadian dollar vis-à-vis the U.S. dollar.

Building Data, Oil Prices, and Bond Yield Exerting Pressure on the Canadian Dollar

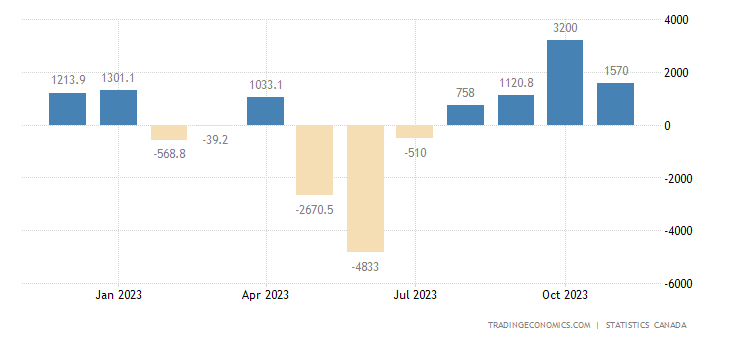

Compounding the loonie’s woes are the discouraging trade and building data from November. According to Statistics Canada, the trade surplus contracted by 50%, standing at C$1.57 billion, with precious metal exports experiencing their first decline in five months.

Concurrently, building permits’ value plummeted by 3.9%, signaling a deceleration in construction activities.

On the flip side, the U.S. dollar surged in anticipation of Thursday’s inflation report, offering insights into the future trajectory of the U.S. Federal Reserve’s monetary policy. The Federal Reserve, adopting a more cautious approach than the BoC, is meticulously monitoring the post-pandemic economic recovery.

While one of Canada’s primary exports, oil, rebounded on Tuesday, rising by 2.1% to $72.24 a barrel, concerns lingered as Monday witnessed a substantial 5% plunge in oil prices. This dip was attributed to supply disruptions in Libya and heightened fears of a broader conflict in the Middle East.

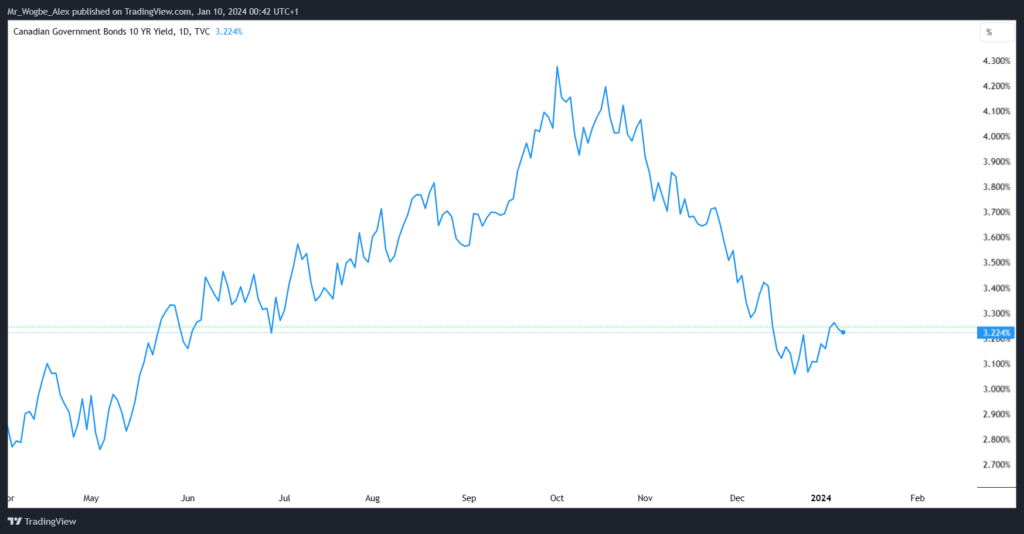

Adding to the economic unease is the decline in the Canadian 10-year bond yield by 2.8 basis points to 3.218%, indicative of investors harboring less confidence in the long-term prospects of the Canadian economy.

This multifaceted scenario underscores the challenges facing the Canadian dollar, with economic indicators and global events playing pivotal roles in its recent downturn.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.