The U.S. dollar reached its highest point in over two weeks on Wednesday, driven by robust economic indicators and escalating Treasury yields.

The dollar index, gauging the greenback against a basket of major currencies, exhibited a noteworthy surge of 1.24% to 102.60, building on the momentum gained with a 0.9% spike on Tuesday.

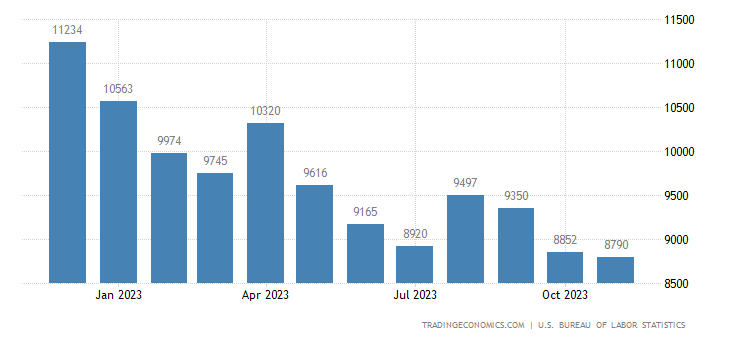

Supporting the dollar’s ascent were compelling U.S. economic metrics, notably the fact that US job openings fell for the third consecutive month to 8,790. A falling US job opening is typically regarded as a sign that the demand for jobs is low, indicating that employment is high or stable.

These reports underscored the resilience of the U.S. economy amidst ongoing trade tensions and a global slowdown, heightening expectations of the Federal Reserve maintaining interest rates throughout the year.

Investors, keen on deciphering the Fed’s policy outlook for 2024, eagerly awaited the release of minutes from the central bank’s December meeting.

The dollar’s strength was further propelled by an upswing in U.S. Treasury yields, reaching a month-high (4.024%) as bond sales surged amid optimism surrounding the U.S.-China trade deal and diminishing geopolitical risks.

These heightened yields made the dollar an attractive option for investors seeking superior returns, particularly compared to weaker major currencies such as the euro and yen, burdened by sluggish economic data and reduced interest rates.

Dollar Gains Across the Board as Analysts Chart the Course for the Year

In currency markets, the euro dipped 0.3% to $1.0906, hitting its lowest level since December 18, while the yen experienced a significant 1.12% decline to 143.56 per dollar, marking its lowest since May 2019.

The dollar’s vigor extended to emerging market currencies, causing declines against the Mexican peso, Brazilian real, and South African rand as investors gravitated toward safer assets amid global growth uncertainties.

Analysts foresee the dollar’s rally persisting in the short term, driven by expectations of the U.S. economy outperforming its counterparts and the Federal Reserve maintaining a cautious monetary policy stance.

However, cautionary notes emerged, warning of potential headwinds later in the year, attributed to factors such as the U.S. presidential election, ongoing trade negotiations with China, and geopolitical tensions in the Middle East that could pose risks for the currency.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.