The U.S. dollar grappled with uncertainties on Tuesday following the release of data revealing a more significant slowdown in November’s inflation than anticipated. This development has heightened expectations that the Federal Reserve may consider lowering interest rates in 2024, aligning with its recent dovish stance.

The yen, in contrast, maintained its position near a five-month peak at 142.50, spurred by speculations surrounding the Bank of Japan (BOJ) potentially concluding its ultra-easy policy. The BOJ, known for its accommodative approach among major central banks, has exerted continuous pressure on the yen throughout 2022 and 2023.

Amidst subdued trading activity post-Christmas, the New Zealand dollar and the Australian dollar soared to fresh five-month highs against the greenback. This surge was attributed to increased commodity prices and robust economic outlooks. Meanwhile, the euro saw a modest gain, and the pound remained unchanged.

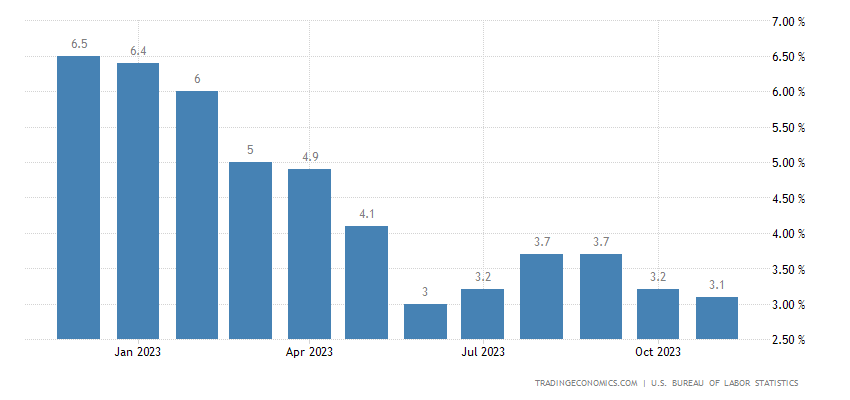

Released last Friday, U.S. inflation data disclosed a 0.1% decline in consumer prices for November. The latest inflation numbers bring US prices close to the Fed’s 2% target.

Analysts assert that these statistics reinforce the perception of easing inflation pressures in the U.S., attributed to the alleviation of supply chain disruptions and labor shortages. This scenario has afforded the Federal Reserve greater flexibility in considering interest rate cuts, especially after signaling a potential reduction in bond purchases starting in January and concluding in March.

U.S. Dollar Index Descends to 5-Month Low

Reflecting market sentiment, the dollar index, gauging the greenback against a basket of six major currencies, descended to a five-month low of 101.42 on Friday and lingered at 101.54 on Tuesday.

Meanwhile, the index has witnessed a 1.88% decline this year (YTD), positioning the Fed behind other central banks in the race to tighten monetary policy.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.