The dollar has recorded a notable dip, marking its lowest level in three days on Thursday. This move puzzled some as investors appeared to cast aside the risk aversion that had boosted the U.S. currency in the previous session.

Eyes are now turned toward Friday’s release of U.S. inflation data, seen as a crucial guide to the future direction of Federal Reserve policy.

Recent data showcased the resilience of the U.S. economy, revealing a slight uptick in the number of Americans filing for unemployment benefits last week—a signal of a robust labor market.

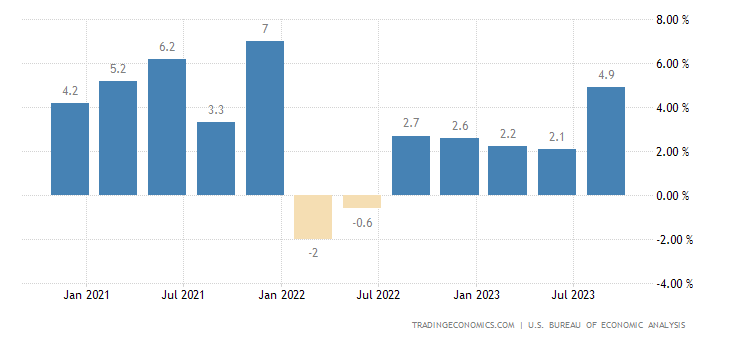

Another report disclosed that the U.S. economy grew at a 4.9% annual rate in the third quarter, slightly below the initial estimate of 5.2%.

Despite these positive indicators, all attention seems focused on the upcoming release of the U.S. core personal consumption expenditure (PCE) index, the Federal Reserve’s preferred gauge of inflation.

Set to be unveiled on Friday, analysts anticipate a modest 0.1% rise in November. If realized, this would bring the annualized inflation rate to 2.1%, aligning closely with the Fed’s target of 2%.

Last week, the Federal Reserve opted to maintain interest rates at their current levels, signaling a shift in its monetary strategy. The central bank conveyed plans to conclude its tightening cycle and initiate rate cuts in 2024, revising its inflation and growth projections for the upcoming year.

Market sentiment suggests a belief that the Fed may need to adopt a swifter and more aggressive approach to policy easing as inflation decelerates and real interest rates climb.

According to reports from Reuters, some traders are even contemplating the possibility of a rate cut as early as March, particularly following the U.K.’s release of a softer-than-expected inflation figure this week.

Dollar Struggling with the 102.00 Support

The dollar index, measuring the U.S. currency against a basket of six major rivals, mirrored this sentiment by falling 0.46% to 101.93 on Thursday—a resumption of its retest of the 102.00 support level.

Analysts caution that the dollar could encounter near-term pressure due to month-end portfolio rebalancing and the potential for thin liquidity to amplify currency movements.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.