Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Core Scientific, a prominent cryptocurrency mining company, recently announced its expected emergence from bankruptcy by January 2024, according to Reuters. This announcement comes after the company successfully reached a comprehensive global settlement with its creditors and stakeholders.

The Texas-based company, which sought Chapter 11 protection in December 2022, had been adversely affected by the crypto market crash that erased over a trillion dollars in value the previous year. Factors contributing to the crash included surging interest rates, regulatory crackdowns, and the collapse of major crypto players like FTX, Celsius, and Three Arrows Capital.

Core Scientific attributed its bankruptcy to the confluence of falling bitcoin prices, escalating energy costs, and outstanding debts from Celsius, one of its major clients. The company asserts that these issues have now been effectively resolved, paving the way for a prompt resumption of operations.

“The global settlement removes key hurdles to our anticipated emergence from Chapter 11 in January,” stated CEO Adam Sullivan.

Known as one of the largest Bitcoin miners in North America, Core Scientific employs powerful computers to process transactions and generate new tokens on the blockchain network.

Core Scientific Went from $4.3 Billion in Value to Bankruptcy

The company, initially valued at $4.3 billion following its public debut in mid-2021 through a merger with a blank-check company, faced delisting as bankruptcy proceedings unfolded.

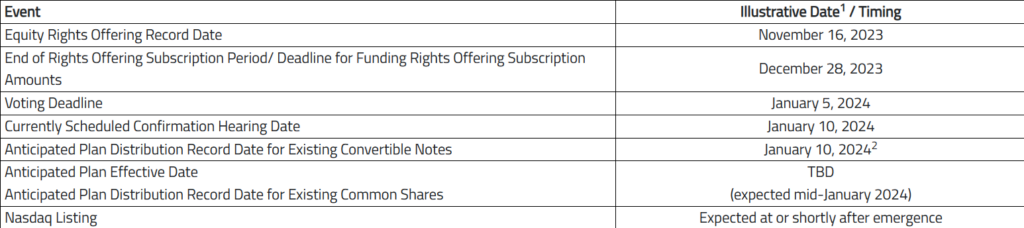

With a rescheduled confirmation hearing on January 10, Core Scientific plans to file a motion seeking modifications to certain dates, including an extension of voting and objection deadlines.

Optimistic about capitalizing on the crypto market’s recovery—with Bitcoin prices surpassing $44,000 in recent days—the company also eyes expansion into areas such as artificial intelligence, cloud computing, and blockchain technology.

The company also published its projected timeline for recovery in its press release, as seen in the table below.

Core Scientific’s potential emergence from bankruptcy signals a noteworthy turning point, emphasizing the resilience and adaptability of the cryptocurrency industry amid challenging market conditions.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.