The British pound weakened against the dollar and euro on Wednesday, spurred by a sharper-than-expected slowdown in UK inflation during November. Official data from the Office for National Statistics revealed a notable drop, with the annual consumer price inflation rate plummeting to 3.9%, down from October’s 4.6%.

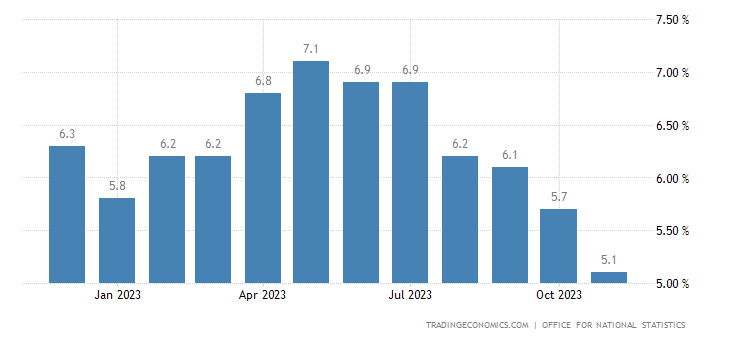

This downturn, the lowest since September 2021, fell below economists’ average forecast of 4.4%. Additionally, the core inflation rate, excluding volatile items, decreased to 5.1% from 5.7%.

The diminishing inflation figures have raised concerns about the UK economy’s resilience amid the ongoing pandemic and Brexit uncertainty. Analysts now project increased pressure on the Bank of England (BoE) to consider interest rate cuts to bolster growth and employment.

Market participants swiftly responded, revising expectations for BoE’s actions in 2024. They are now anticipating a 25 basis point reduction by May, with a 50% probability of another cut by March. This marks a notable departure from earlier expectations, where the BoE was perceived to be more hawkish compared to other major central banks, like the Federal Reserve and the European Central Bank, which have already signaled their openness to rate adjustments if required.

Pound Falls Across Board as British Stock Market Soars

The pound responded by sliding 0.58% to $1.2658 against the dollar and 0.25% to 86.42 pence against the euro.

Concurrently, the prospect of lower interest rates amplified demand for British assets, causing the FTSE100 index to surge 1.2% to its highest level since May. The FTSE250 index, reflecting the domestic UK economy, also gained 1.1%. The 10-year British government bond yield dropped 10 basis points to 3.55%, with the two-year yield falling 17 basis points.

The inflation data is the latest addition to a mosaic of economic indicators presenting a mixed picture of the UK economy.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.