The British pound exhibited robust strength on Friday, nearing its highest levels since early September, fueled by a weakened dollar and rising UK bond yields. The currency climbed to $1.2602, marking a 0.53% increase, while against the euro, it rose 0.23% to 86.77 pence.

The surge in bond yields was propelled by an upward revision of government borrowing forecasts in the latest budget update, influencing investor sentiment positively. The low trading activity during the U.S. Thanksgiving holiday allowed sterling to reach $1.2572 on Thursday.

Analysts suggest that currency markets are currently navigating expectations of imminent rate cuts by central banks. Money markets indicate a potential rate cut by the Federal Reserve as early as May, while the Bank of England is anticipated to follow suit, albeit later and with a smaller reduction. These expectations, combined with a positive consumer confidence report, contributed to the pound’s upward momentum.

Tax Plans Boost UK Economy, Pound

On the fiscal front, Finance Minister Jeremy Hunt unveiled tax increases to bolster the UK economy. However, the projections for growth and inflation were more pessimistic than previously estimated, injecting an element of caution into the market.

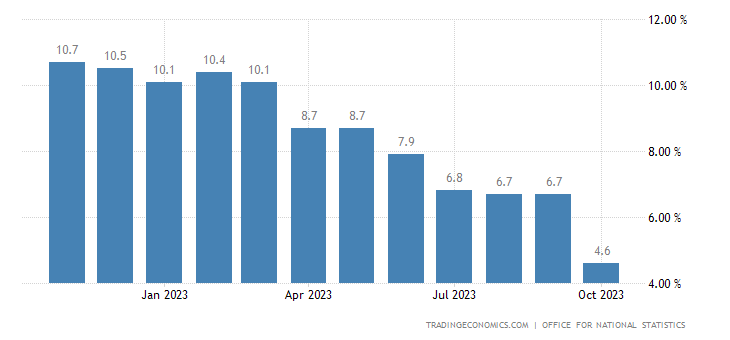

October’s headline inflation dropped to 4.6%, down from 11% a year ago, though still exceeding the Bank of England’s 2% target. The Office for Budget Responsibility anticipates inflation to reach 2.8% in 2024, compared to 0.9% in March.

The Debt Management Office’s slight reduction in the gilt issuance plan for 2023/24, from £237.8 billion to £237.3 billion, had a notable impact on the market, pushing 10-year gilt yields up by 20 basis points.

In another positive development, the consumer confidence index, as reported by market research firm GfK, exceeded expectations by improving from -30 in October to -24 in November. The reading was above the -28 forecast in a Reuters poll and followed a sharp decline the month before.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.