The British pound soared to its loftiest position against the U.S. dollar in 10 weeks on Tuesday, fueled by Bank of England (BoE) Governor Andrew Bailey’s assurance that the central bank stands firm on its interest rate policy.

Addressing a parliamentary committee, Bailey affirmed that inflation is set to retrace its steps to the BoE’s 2% target. However, he cautioned about potential upward risks that could sustain inflation at elevated levels. Echoing sentiments from Monday, Bailey emphatically stated that it is “far too early” to entertain notions of rate cuts.

Pound Rises Against the Dollar and Euro

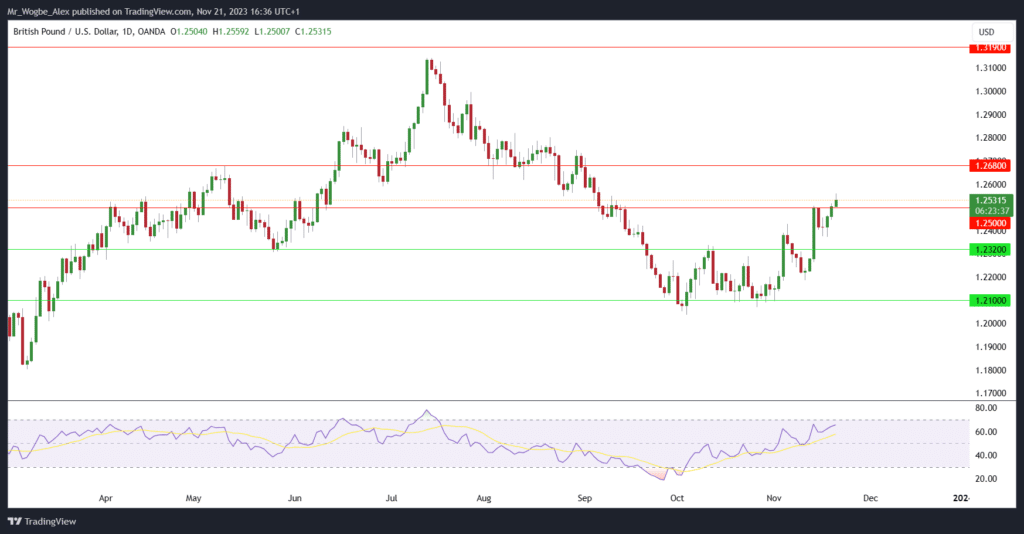

The pound showcased its resilience, posting a 0.22% uptick to $1.2531, reaching $1.2559 earlier in the day—its highest point since early September. Simultaneously, it strengthened by 0.2% against the euro, settling at 87.32 pence as of the time of writing.

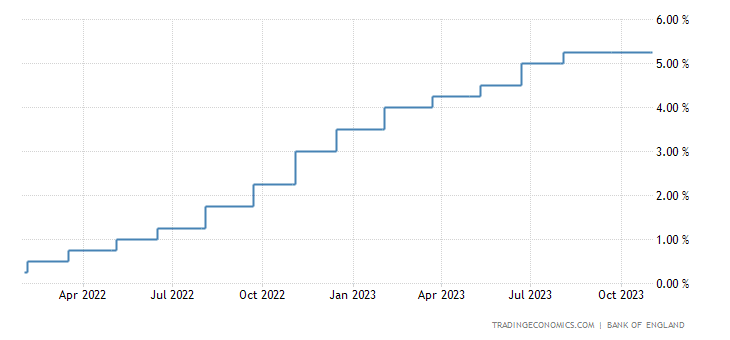

Maintaining its stronghold, the BoE held rates at a 15-year high of 5.25% for the second consecutive month in November. Interestingly, there was a lone dissenting vote from Catherine Mann, an advocate for a 25 basis point hike. Mann, renowned for her hawkish stance, reiterated her support for further tightening to curb inflation.

According to Reuters, market dynamics suggest a consensus that UK interest rates may have peaked, with approximately 70 basis points of cuts anticipated by the close of 2024. This implies nearly three potential rate reductions, a notable shift from the 60 basis points priced in just last week for the end of the next year.

The pound’s surge also finds support in the anticipation of fiscal stimulus from the government, set to be unveiled in the Autumn Statement on Wednesday. Finance Minister Jeremy Hunt is expected to reveal measures aimed at bolstering the economy.

As optimism reverberates through the markets, sterling’s robust performance is a testament to the confidence instilled by the BoE’s commitment to stability and the potential economic boost on the horizon.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.