In a tumultuous week for global currencies, the euro struggled against a resurgent US dollar, buffeted by a series of challenges on economic, monetary, and geopolitical fronts. The Federal Reserve’s hawkish stance, led by Chair Jerome Powell, signaled potential interest rate hikes, bolstering the greenback’s strength.

Meanwhile, the European Central Bank, led by Christine Lagarde, maintained a dovish position, grappling with weak economic data and persistently low inflation. The specter of additional rate cuts by the ECB, in contrast to the Fed’s tightening trajectory, rendered the euro less appealing to investors seeking robust returns.

Adding to the euro’s woes, the slowdown in China took a toll on the euro area’s manufacturing sector and trade prospects, amplifying the currency’s vulnerability. Money markets priced in more ECB rate cuts compared to the Fed’s, further diminishing the euro’s attractiveness.

Euro at the Mercy of Inflation Expectations

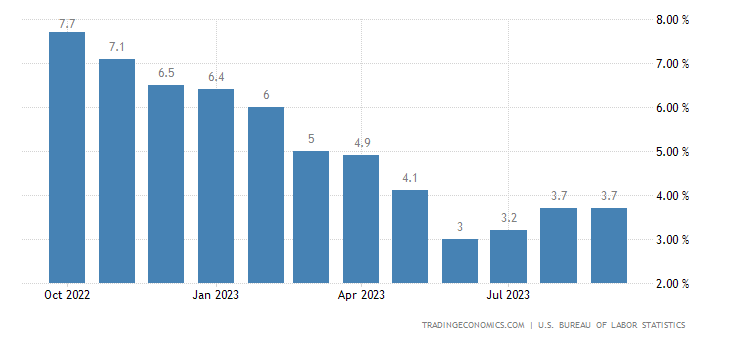

Looking ahead, the focus shifts to crucial inflation figures on both sides of the Atlantic. The Eurozone’s headline inflation is anticipated to plummet to 2.9% from 4.3%, potentially exerting downward pressure on the euro. In the US, inflation is expected to linger at 3.7%, sustaining pressure on the Fed to tighten monetary policy.

Last week, we witnessed the EUR/USD pair halting its descent at 1.0656, a 0.34 dip attributed to the dollar’s robust performance. The euro’s multi-faceted challenges, spanning economic indicators, monetary policies, and global dynamics, suggest a continued struggle against the US dollar in the short term. Unless the ECB surprises markets with a more hawkish stance or the Fed adopts a more dovish approach, the euro may face an uphill battle against the dollar’s supremacy.

As uncertainty looms, traders brace for a dynamic week ahead, closely monitoring data releases and central bank signals that could sway the balance in this currency tussle.

Find Out More About Learn2Trade With Our FAQ. Click Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.