Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Introduction:

From its origins marked by speculative fervor, the evolution of crypto is now steering towards a phase where on-chain businesses are emerging, boasting clear business models, cash flows, and long-term economic value creation. This report delves into the ongoing transformation of the crypto landscape, exploring recent developments in on-chain data, crypto fundamentals, and the introduction of new financial products.

Value Investing: Tracing the Roots

Drawing parallels with the evolution of traditional markets, the report reflects on the maturity achieved by global equity markets, rooted in centuries of technological and social progress. The journey commenced in 1602 with the creation of the Dutch East India Company, leading to the birth of the Amsterdam Stock Exchange. The report then navigates through the historical emergence of stock markets in European cities and the US, emphasizing the critical role of regulations and information access in shaping market structures.

Public blockchains, notably addressing the challenge of information access, are identified as a game-changer. The report cites Token Terminal as a firm providing data that informs crypto firms, investors, and regulators. The report accentuates the potential for on-chain data to serve as a regulatory tool by showcasing real-time data, such as leverage buildup within the crypto ecosystem.

Foundations of Fundamental Analysis: A Historical Perspective

In response to the market crash of 1929, regulations and frameworks were introduced, setting the stage for Benjamin Graham’s foundational work on fundamental analysis. The concepts of “economic moats” and “durable competitive advantages” gained prominence, echoing the importance of quality data in driving informed investment decisions.

The report contends that crypto, historically driven by speculation and narratives, is undergoing a paradigm shift. By presenting on-chain data from protocols like Uniswap and Aave, the report highlights the emergence of crypto fundamentals. It argues that similar to traditional markets, investors in crypto can now leverage data for relative comparisons and informed portfolio construction.

Financial Statements in Crypto: A Reality

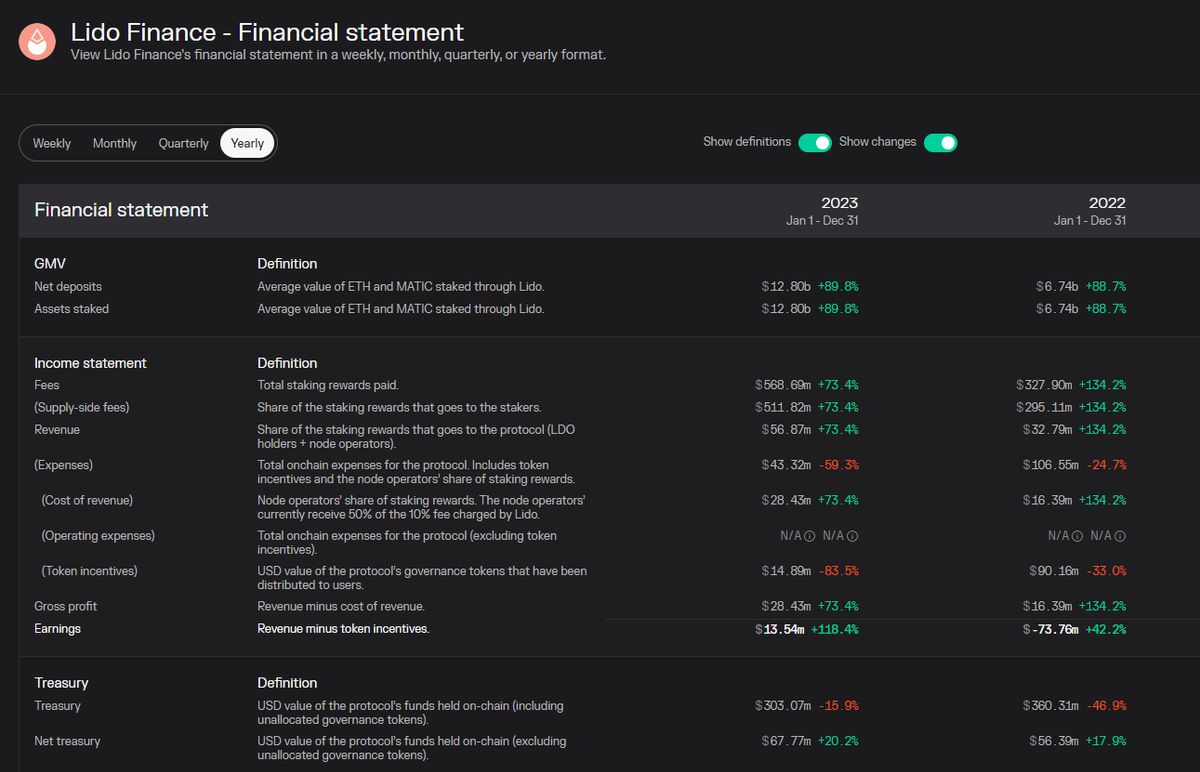

Platforms like Token Terminal bring forth the concept of financial statements in crypto, offering real-time updates through immutable public blockchains. The report illustrates Lido’s financial statements over the years, underscoring the potential for data-driven analysis in crypto investment strategies.

The Emergence of Indices and Financial Products

As the crypto industry matures, the report anticipates a shift from speculative and narrative-based investing to a focus on value and fundamentals. It introduces the MarketVector Token Terminal Fundamental Index, designed to expose the best-performing crypto protocols and networks based on on-chain data. The report envisions a future where indices and financial products proliferate, drawing parallels with traditional financial markets.

Regulatory Role and the Path Forward

The report underscores the importance of on-chain data for regulators, advocating for tools like Token Terminal as catalysts for transparency in crypto markets. It envisions a path towards compliant token launches and listings, where projects adhering to new rules and regulations issue tokens to market makers via exchanges. This evolution is expected to facilitate the integration of crypto projects into indices and new financial products.

Conclusion: Navigating the Crypto Landscape with Data

As crypto embraces fundamentals, the report concludes by emphasizing the pivotal role of on-chain data in shaping the industry’s future. It positions tools like Token Terminal as indispensable for regulators, investors, and crypto projects alike. With a transparent and data-rich environment, the report envisions a landscape where informed decisions drive the next wave of smart money into the highest-quality projects.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, presented product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.