In continuation of yesterday’s sharp decline, oil prices witnessed another dip today, responding to the latest data on US crude inventories and the prevailing uncertainty in the Red Sea region. As of the time of this report, USOil (WTI) has experienced a 2.03% plunge, settling at $72.26.

The American Petroleum Institute (API) released figures indicating a significant uptick in US crude stockpiles by 1.837 million barrels last week, compared to the previous week’s 0.939 million barrel increase. This points towards a potential slowdown in the demand for oil in the United States, the globe’s leading consumer, particularly with the winter season on the horizon.

Tensions in the Red Sea: A Crucial Shipping Channel for Oil

Simultaneously, tensions persist in the Red Sea, a crucial shipping route for oil and other commodities. The US-led Red Sea task force, established to safeguard maritime traffic from Houthi rebel attacks in Yemen, faces resistance and skepticism from supposed allies such as Spain, Italy, Saudi Arabia, and the United Arab Emirates.

Although the Pentagon asserts that the task force comprises a defensive coalition of over 20 nations, some nations have denied or downplayed their involvement.

Citing concerns over the humanitarian crisis in the Gaza Strip and public opinion in their respective countries, these nations pose a challenge to the task force’s efficacy. President Biden’s attempt to separate the Red Sea issue from the Israel-Palestine conflict encounters mounting international pressure on both fronts.

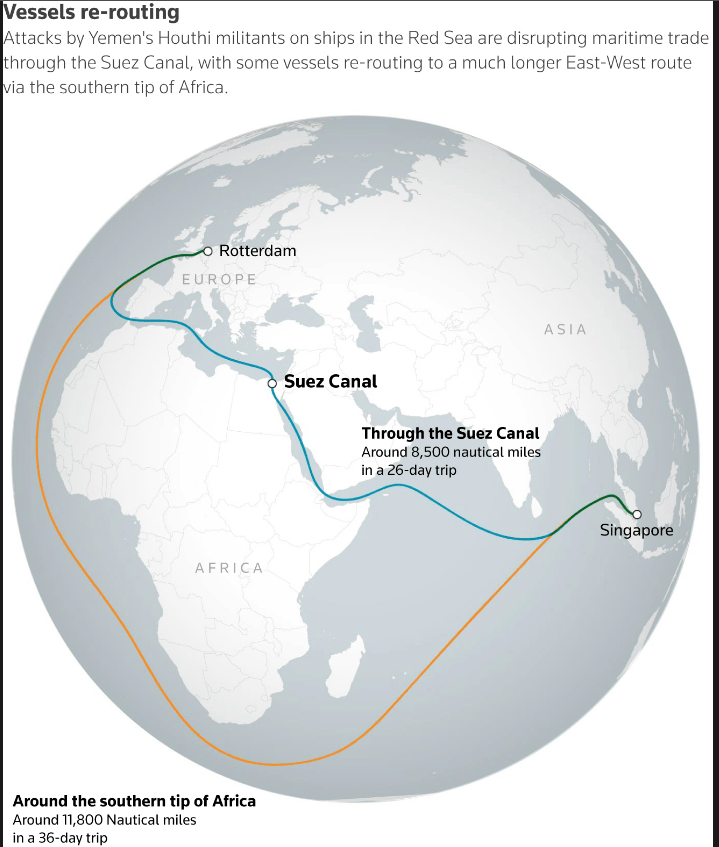

In response to the Red Sea uncertainties, some shipping companies, including Denmark’s Maersk, have chosen to reroute vessels around Africa, circumventing the Suez Canal and the Red Sea.

Despite being a longer and more expensive route, the majority of ships continue to use the canal, which handles approximately 10% of global trade.

As geopolitical developments unfold, the oil market is expected to remain volatile and responsive to uncertainties in the Red Sea region. The delicate equilibrium between supply and demand factors is further complicated by geopolitical risks, making the coming days crucial for market observers.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.