“It is not so important to be right, but how to make money when you are right.” – Ivan Hoff

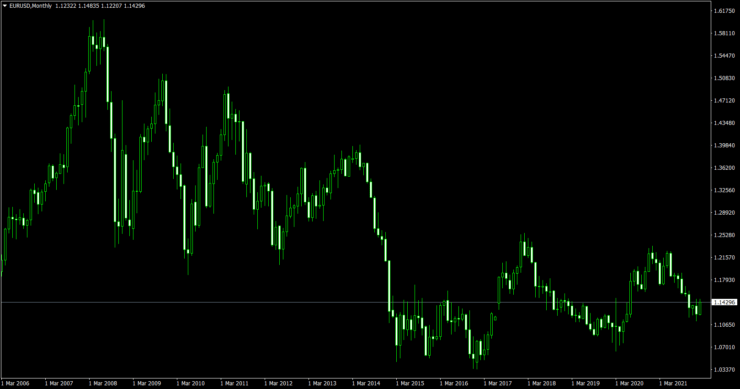

I remember what happened at one interesting trading conference I attended about five months ago. It was an interesting conference indeed. At one stage, the moderator showed us a EURUSD chart (whose dominant trend was bullish, but the short-term trend was bearish) and asked us this question:

Where do you think the price will go next?

One man quickly got up to announce that I was wrong. He said that the price MUST turn upwards since the dominant trend was bullish. I kept quiet. Can you see how traders showcase the mindset that can endanger their career?

This was a bone of contention; some seriously thought the pullback would end up blending with the overall trend. But the reality was that it could be the beginning of another long term reverse trend.

Being opinionated is a not a good thing in trading. Those who have enjoyed lasting success in the markets know how to admit their errors, get out of losing trades and look for the next signals which may be profitable. However, opinionated traders never admit their mistakes and often take the decision to run their loss for as long as the market goes contrary to them. An opinionated trader may even be confident enough to open a very large position (like 20% or 40% risk), believing that the price MUST go in their favour. The person may even refuse to put a stop for disaster prevention.

Was I also right? Yes. I gave two possibilities of the price direction – either up or down. In order to benefit from this expectation or ensure that an adverse movement doesn’t affect my portfolio, I truncate my loss when I’m wrong and give my gain some leeway when I’m right. I’m not opinionated: I know what to do whenever I’m proven right or wrong.

Being Bearish or Bullish Makes No Difference

It’s common for many a trader to say “I’m bearish/bullish on this market.” That doesn’t make any difference. What would happen when a swing trader goes short in a market because they hear a scalper announcing being bearish? When a position trader says they are bullish, do you think an intraday trader can make a ‘fool-proof’ long trade?

I look at a EURUSD chart and I say I’m bearish, but you look at it and say you’re bullish. A chart is a chart, plus both the bear and the bull can make money in the same market. When a dominantly bearish market rallies by over 600 pips, the bull can make some gains. In the same market, the bear can also make some gain when the price pulls back in the direction of the dominant bias in which the buying or selling is prevalent – what makes the difference are the timing methods and trading styles.

Conclusion

The FX markets are among the most liquid trading markets in the world, and therefore, when a strongly trending instrument assumes an established bias, it may go on longer than anticipated. In the face of this fact, a reversal in the context of the established bias may either be transitory or be a start of a protracted movement in the opposite direction. Rather than being opinionated about a direction, you’ll help yourself by aborting your losers and riding your winners – the only way to face the vagaries of the markets victoriously.

This fact is summed up in the quote below:

“I spend my day trying to make myself as happy and relaxed as I can be. If I have positions going against me, I get right out. If they are going for me, I keep them.” – Paul Tudor Jones

This article was taken from the book “Unlock Your Potential with the Realities of Trading.”

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.