The U.S. dollar is gearing up for a critical week, where two major events could be game-changers: the release of the November inflation report on Tuesday and the highly anticipated Federal Reserve meeting on Wednesday.

Market sentiment has been riding on the expectation that the Fed might slash interest rates by a whopping 100 basis points over the next year, despite robust economic indicators suggesting a lack of immediate stimulus urgency. However, this dovish outlook faces a potential challenge from the upcoming inflation data, which could reveal either a higher or stable pace of price growth.

For years, the Fed has grappled with the elusive 2.0% inflation target, but recent surges in energy and food prices might just push the headline Consumer Price Index (CPI) higher.

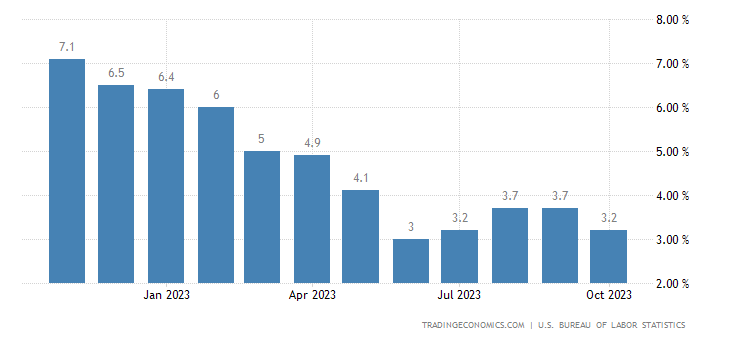

Projections indicate a slight easing to 3.1% year-on-year from October’s 3.2%, while the core CPI (excluding volatile items) is expected to remain at 4.0% year-on-year, comfortably above the Fed’s comfort zone.

Wednesday’s Fed policy decision holds immense significance as investors eagerly await insights into the central bank’s stance on inflation and the ongoing economic recovery. While the consensus points towards unchanged rates in the year’s final meeting, pressure mounts for the Fed to signal a more hawkish approach, countering the market’s dovish expectations.

What Could the Week Bring for the Dollar?

A resolute Fed, reaffirming its commitment to higher rates, could propel the dollar upwards, especially if U.S. Treasury yields rebound from recent dips. A hawkish Fed might also rekindle the dollar’s appeal as a safe-haven currency.

Having faced pressure for most of the year due to the Fed’s cautious monetary policy, the dollar now stands at a potential turning point. With inflation concerns looming and the economy displaying resilience, the dollar could stage a comeback in the closing weeks of 2023. The upcoming week’s events are poised to be decisive in determining the sustainability of the dollar’s rally.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.