In a rollercoaster response to a mixed US jobs report, the dollar experienced fluctuations on Thursday, culminating in a modest change after revealing a lower unemployment rate but a sluggish pace of job creation in November.

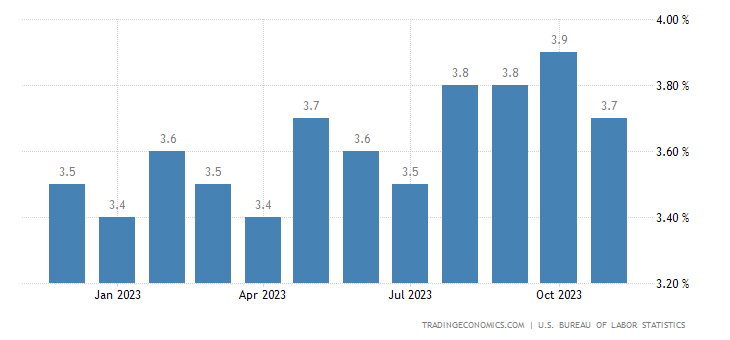

The Bureau of Labor Statistics reported that the US economy added 199,000 jobs last month, falling short of the average monthly gain of 240,000 over the past year. Despite this, the unemployment rate edged down to 3.7 percent, reaching its lowest level since August.

A noteworthy highlight was the uptick in average hourly earnings, showing a 0.4 percent increase to $34.10 for all employees on private nonfarm payrolls. This signals a boost in wage growth, with average hourly earnings up by 4.0 percent over the past 12 months.

The jobs data precedes the upcoming Federal Reserve policy meeting, where a fourth interest rate hike this year is widely anticipated. However, market expectations for a slower rate hike pace in 2024 remain unchanged due to prevailing challenges such as trade tensions, global economic deceleration, and diminishing fiscal stimulus.

Dollar Recuperates Some Losses

The dollar index, gauging the greenback against a basket of six major currencies, initially spiked to 104.26 but settled at 104.04, reflecting a 0.39% increase. This week has seen a 0.9 percent gain in the index as investors recalibrate their expectations for further Fed tightening.

Stephen Miran, co-founder of Amberwave Partners, noted, “In the short term, the US rates market has just gotten, I think, way too dovish on the Fed.” He emphasized that the substantial ease in financial conditions since November suggests the Fed may not need to cut rates to stimulate economic activity.

As the market navigates uncertainties, the dollar’s trajectory hinges on the upcoming Fed decision, maintaining a cautious stance amid economic headwinds.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.