Crypto options exchange Deribit is experiencing a surge in trading activity, reaching a historic high of $23.6 billion in notional open interest on Friday, as reported by CoinDesk. Bitcoin options constitute 67% of the total, with the remaining portion being Ether options.

Options, serving as derivatives, grant investors the right to buy or sell an underlying asset at a predetermined price and time. This surge in open interest signifies the increasing demand and sophistication among crypto traders, showcasing their adeptness at navigating market dynamics and managing risks.

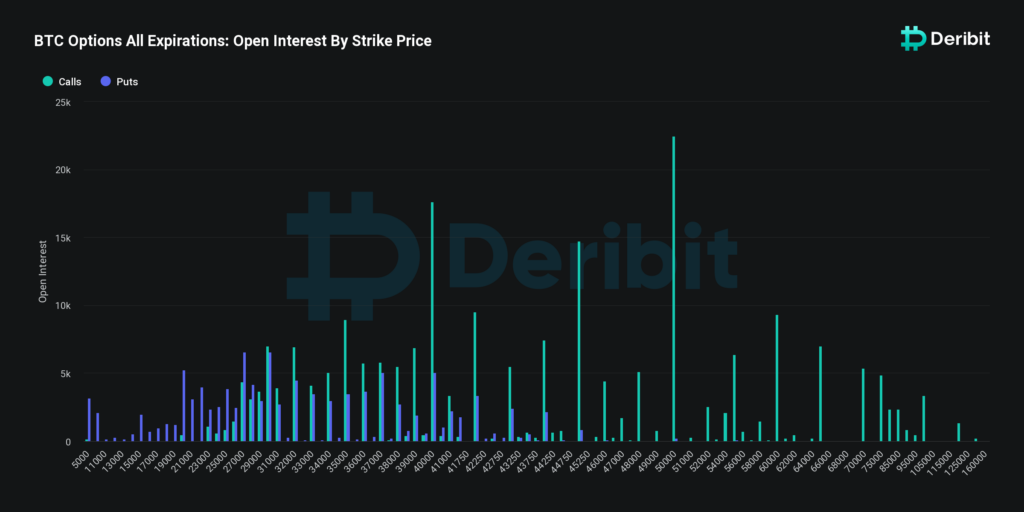

The bulk of the open interest on Deribit leans towards call options, indicative of bullish sentiments toward the underlying assets. For Bitcoin, popular strikes include $50,000, $40,000, and $45,000, while Ether options gravitate towards $2,300, $2,400, $2,500, and $3,000.

This trend aligns with the robust upward trajectory of both Bitcoin and Ethereum. Bitcoin recently tapped $44,500, its highest since April 2022, driven by expectations surrounding a Bitcoin ETF approval, an imminent Bitcoin halving, and a decline in U.S. Treasury yields, marking a remarkable 160% gain this year.

Ether, the native token of Ethereum, is hovering at $2,350, its highest since May 2022, with a nearly 100% gain year-to-date. The cryptocurrency benefits from the flourishing decentralized finance (DeFi) ecosystem, along with the growth of decentralized applications and non-fungible tokens.

Deribit Sees Record Open Interest Volume

Deribit achieves another milestone by surpassing $25 billion in total open interest, covering perpetual and futures contracts. The exchange’s Chief Commercial Officer, Luuk Strijers, attributes this success to the growing sophistication of crypto traders and enhanced market price discovery.

As Bitcoin and Ethereum continue their bullish strides, Deribit remains a focal point for traders seeking to capitalize on the evolving crypto landscape.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.