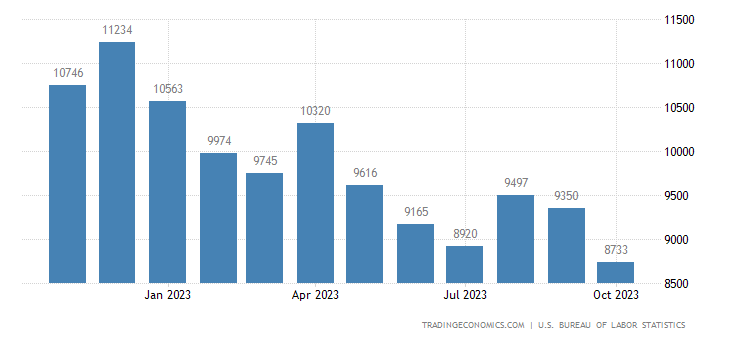

The US dollar strengthened its position, hitting a one-week high against a basket of currencies, propelled by a significant drop in job openings reported by the Labor Department’s JOLTS data. Job openings fell by 617,000 to 8.733 million in October, marking the lowest point in almost two years and missing analysts’ projections.

This decline in labor demand indicated a loss of momentum in the US job market, casting shadows on the prospects of additional interest rate hikes by the Federal Reserve, which has already implemented four increases this year. Some market participants are now speculating on a potential Fed rate cut by mid-2024, citing easing inflation pressures and a slowing economy.

The dollar index, measuring the greenback against major currencies, rebounded with a 0.31% rise to 104.00. This recovery came after a challenging November when the index experienced a 3% drop, marking its worst monthly performance in a year.

Yuan Holds Its Grounds Against the Dollar

Despite a downgrade in China’s credit rating outlook by Moody’s, the Chinese yuan held its ground against the dollar. Moody’s cited risks associated with China’s high debt levels and slowing growth. State-owned banks intervened, selling dollars to stabilize the yuan and prevent abrupt depreciation.

Other major currencies traded cautiously as investors awaited insights into the monetary policy outlooks of both the Federal Reserve and the European Central Bank (ECB). The euro slipped by 0.36% to $1.0795, influenced by lower-than-expected inflation in the eurozone, potentially increasing the likelihood of an ECB rate cut by March.

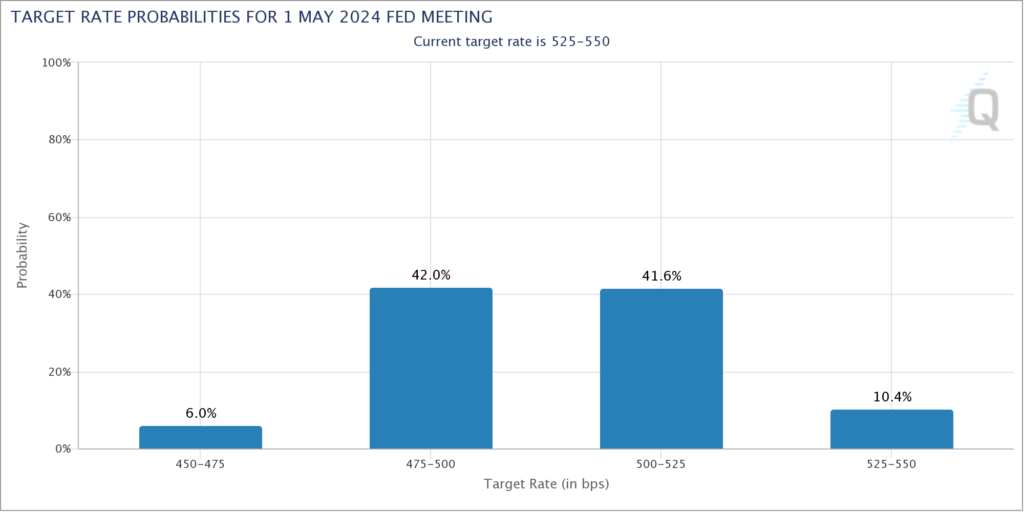

Traders have already factored in expectations of 125 basis points of rate cuts from the Fed in the coming year, along with an anticipated 50 basis points from the ECB, according to CME’s FedWatch tool. The evolving economic landscape continues to shape the currency markets, keeping investors on high alert for future policy signals from central banks.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.