Federal Reserve Chair Jerome Powell’s recent comments hinting at a pause in interest rate hikes have impacted the U.S. dollar, causing a dip in its value on Friday.

Powell acknowledged that the Fed’s monetary policy has slowed down the U.S. economy as anticipated, stating that the overnight interest rate is “well into restrictive territory.” However, he reassured us that the Fed stands ready to adjust policies if necessary.

Jeffery J. Roach, Chief Economist at LPL Financial, told Reuters that Powell’s remarks signal a move toward a more dovish stance, contrasting with his previous characterization of policy as restrictive. The U.S. dollar index, measuring the currency against six major counterparts, fell 0.3% to 103.20 after experiencing its weakest monthly performance in a year in November.

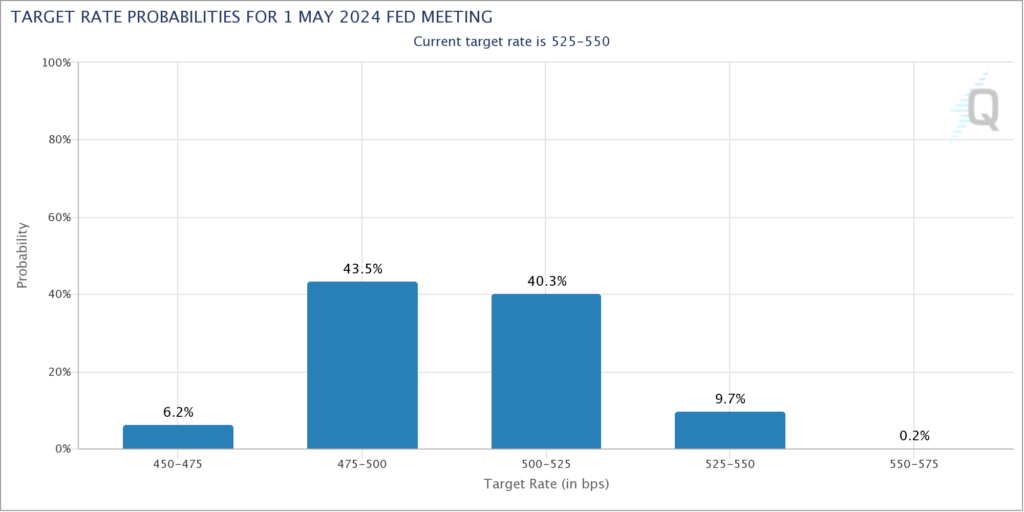

Following Powell’s comments, traders adjusted their expectations, increasing bets on a potential Fed rate cut in the coming year. According to CME’s FedWatch tool, the probability of a rate cut by March rose to 64%, up from 43% on Thursday, while the odds for May surged to 90% from approximately 76%.

Powell’s statements were reinforced by a report indicating continued weakness in the U.S. manufacturing sector for November, with the ISM manufacturing PMI remaining unchanged at 46.7, reflecting a 13th consecutive month of contraction.

Dollar Under Pressure from Inflation Data

The dollar faced additional pressure from softer inflation data in both the U.S. and the eurozone, diminishing expectations of imminent interest rate hikes by their respective central banks. Goldman Sachs adjusted its forecast, now anticipating the ECB to cut rates in the second quarter of 2024 instead of the previously projected third quarter.

While currency movements on Friday were more subdued compared to the previous day’s larger swings driven by month-end trades, analysts suggest that ongoing economic factors continue to influence market dynamics.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.