In a volatile market, the U.S. dollar plunged to its lowest point in three months against a basket of major currencies on Tuesday. Traders swiftly unwound their long dollar positions, anticipating key data releases on U.S. and Eurozone inflation this week.

Dollar Drops By Over 3% in November

The dollar index, a measure of the greenback’s strength against six major currencies, plummeted to 102.74 during the New York trading session, marking its lowest level since mid-August. Though it managed a slight recovery to 102.85, the currency remains on track for its worst monthly performance since November 2022, with a staggering loss exceeding 3.5% for the month.

Both the euro and the British pound maintained their positions near three-month highs, holding steady at $1.100 and $1.2690, respectively.

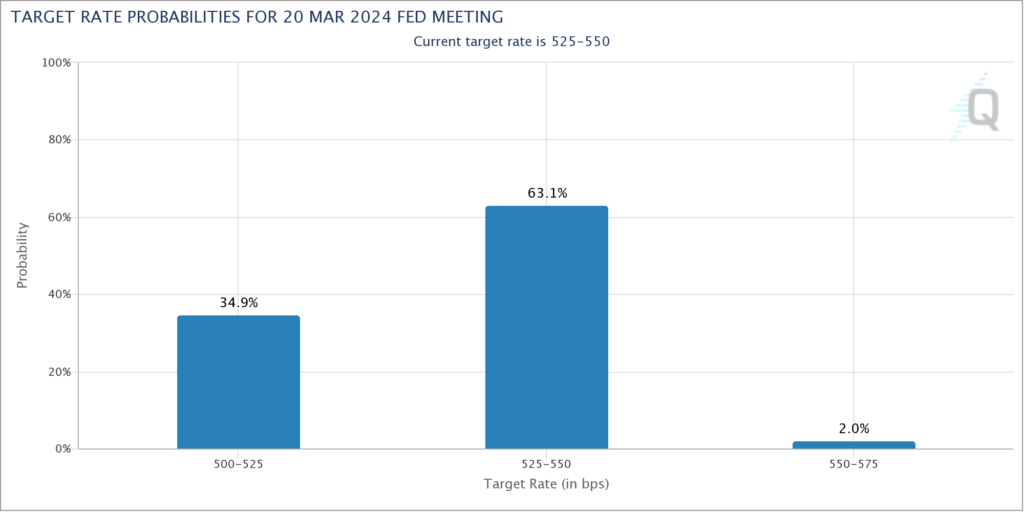

Market sentiment suggests a growing conviction that the Federal Reserve’s rate hike cycle has reached its conclusion, fueled by signs of decelerating inflation in the U.S. The CME FedWatch tool indicates a 32% probability of a rate cut by the Fed as early as March, escalating to a 47% likelihood by May.

Investors Looking Forward to US PCE

Investor focus now turns to crucial economic events later this week, including the release of the U.S. core personal consumption expenditures (PCE) price index, the Fed’s preferred inflation measure. Simultaneously, flash inflation data from the Eurozone, Chinese manufacturing, and services PMI, along with the OPEC+ meeting, will play pivotal roles in shaping global market dynamics.

As the OPEC+ group, comprising the Organization of the Petroleum Exporting Countries and its allies, convenes on Thursday, speculations arise regarding potential extensions or deepening of current oil production cuts set to expire at year-end. A Reuters report, citing an OPEC+ source, indicates considerations for a deeper cut to bolster oil prices.

Amidst this intricate financial landscape, the coming days promise heightened market activity and a closely watched interplay of economic indicators, setting the stage for potential shifts in global currency dynamics.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.