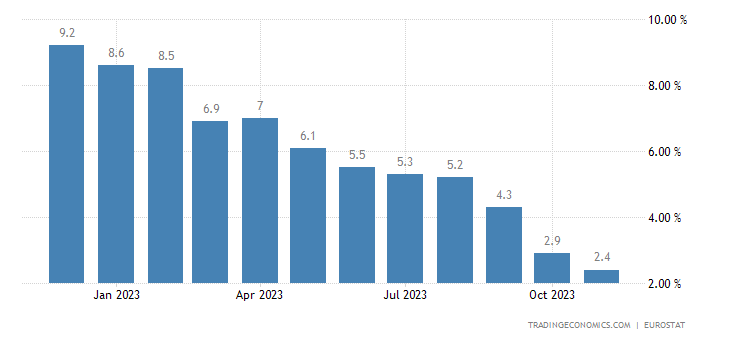

The euro stumbled against the dollar on Thursday, reacting to a surprising drop in eurozone inflation data for November. Official statistics revealed a year-on-year rise of 2.4%, falling below market expectations and marking the lowest inflation rate since February 2020.

Matthew Landon, Global Market Strategist at J.P. Morgan Private Bank, pointed out to Reuters that the data indicates a swift continuation of disinflation in Europe. Landon suggested that the European Central Bank (ECB) might consider early rate cuts, possibly as soon as the first quarter of 2024.

Euro Bulls Lose Grip

The euro, which had recently touched $1.1017, its highest point since August 10, experienced a dip to $1.0909, its lowest since September. This drop, however, saw a partial recovery to $1.0935. Reuters reports market expectations of a potential ECB rate cut by April soaring to 100%, with approximately 115 basis points of easing anticipated by the end of 2024.

Simultaneously, the dollar index, measuring the greenback against major currencies, rebounded from a three-month low to an intraday high of 103.37 on Thursday. Despite this recovery, the index is on track for its most significant monthly decline in a year, with investors anticipating a potential Federal Reserve interest rate cut in the first half of 2024.

Investor attention now turns to Fed Chair Jerome Powell’s upcoming speech on Friday, following hints from Fed Governor Christopher Waller regarding a possible rate cut. Powell’s speech will be a crucial communication opportunity for Fed officials before the December policy meeting.

Prior to Powell’s address, the market will eagerly await the release of the personal consumption expenditure (PCE) price index, the Fed’s preferred measure of inflation. This data release is expected later today and could offer further insights into the trajectory of monetary policy.

Interested In Becoming A Learn2Trade Affiliate? Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.