The Japanese yen experienced a sharp decline against the US dollar on Wednesday, nearing its January 5 low. This decline comes on the heels of the latest data revealing persistently stagnant wage growth in Japan throughout November, dashing hopes of some investors anticipating a tightening of monetary policy by the Bank of Japan (BoJ).

Official figures indicate that Japan’s real wages, adjusted for inflation, plummeted by 3% year-on-year in November, marking the 13th consecutive month of decline. The nominal wage, not adjusted for inflation, saw a marginal increase of only 0.2%, falling far below the projected 1.5%.

These statistics hold significance for the foreign exchange market as they serve as crucial indicators of Japan’s domestic demand and inflation—the linchpins influencing the BoJ’s policy decisions.

The central bank has clung to an ultra-loose monetary policy, featuring negative interest rates and substantial asset purchases, aiming to stimulate the economy and meet its 2% inflation target.

Despite recent speculation among investors that the BoJ might follow other major central banks in tapering its stimulus, the bank has emphasized that any policy changes hinge on sustainable evidence of demand and inflation in Japan.

The latest wage data paints a picture of weak inflationary pressures, signaling that the BoJ is unlikely to tighten its policy in the near future and may even need to consider further easing if the situation worsens.

Consequently, some investors have shifted their bets against the BoJ’s policy shift, opting to sell the yen in favor of the dollar. The dollar breached the psychologically significant 145-yen mark for the second time this year on Wednesday.

Meanwhile, the US dollar faces downward pressure amid expectations of a Federal Reserve interest rate cut this year, possibly in the first half, to address a slowing US economy.

However, the dollar found support this week from rising Treasury yields, reflective of higher inflation and growth prospects in the US. Even if the Fed lowers rates, the dollar’s returns will still outpace the yen’s, which maintains a negative interest rate of -0.1%.

Upcoming US Inflation Figures Could Favor Japanese Yen

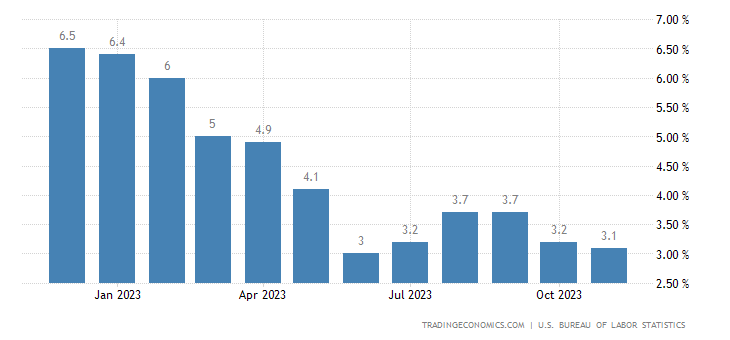

The upcoming US inflation report, set to be released later today, looms as a potential game-changer for the dollar-yen exchange rate. Market expectations point to a climb to 3.2% in December from 3.1% in November. Should core inflation exceed predictions, it may bolster the dollar and exert downward pressure on the yen, increasing the likelihood of a Fed rate hike.

Conversely, lower-than-expected core inflation could weaken the dollar, offering support to the yen and alleviating pressure on the Fed to take immediate action. Investors eagerly await the unfolding dynamics in the coming days.

Interested In Getting The “Learn2Trade Experience?”Join Us Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.