We have two stock tips for the week ahead, both in the booming warehouse real estate segment.

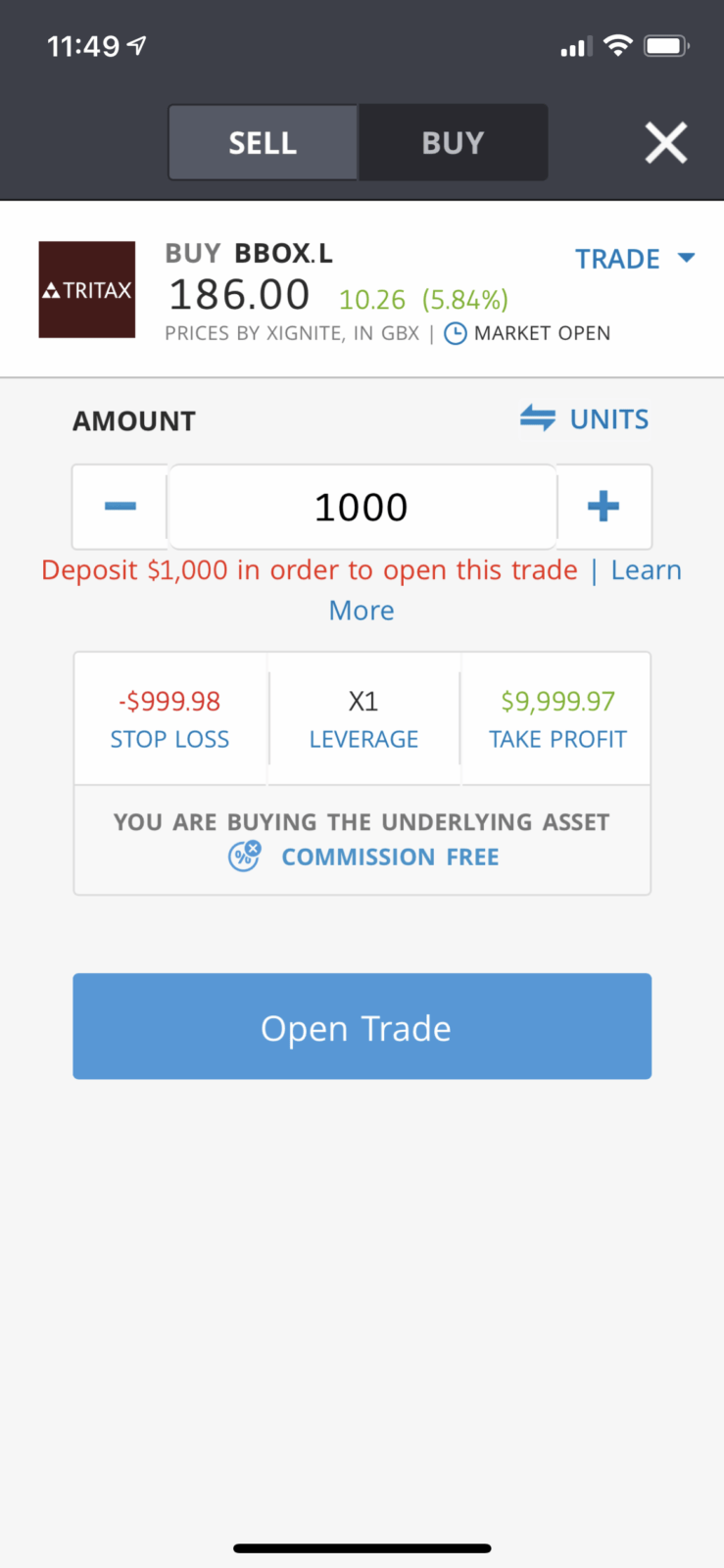

Top of our list is Tritax Big Box REIT (BBOX), which has risen 5% today, followed by Segro (SGRO), the UK’s largest owner of warehouses with a substantial portfolio in continental Europe also.

Why warehouses? Well, among the biggest winners from the pandemic have been the e-commerce platforms that depend on warehouses and last-mile delivery services.

The market is taking notice. BBOX has jumped 5% this morning to 185p, and the bulls will likely have further to run over the coming months as the shift to online firms.

Last Thursday (14 January) it provided the market with a valuation update on its portfolio of logistics real estate assets.

The company says constrained supply and occupier demand for large premises, combined with what it describes as “a buoyant investment market” is increasing valuation for its prime assets.

As at 31 December the like-for-like increase in valuation rose 8% in the second half from 30 June.

It expects its European Public Real Estate Association net tangible assets (an industry metric that crystallises deferred tax liability on the assumption that REIT entities are buying and selling assets) to beat current analyst estimates, ranging from 152p to 166p by nine sell-side analysts, for an average of 159p.

BBOX focuses on ‘Big Box’ logistics assets greater than 500,000 square feet on long-term leases, which can be around 12 years. Rent’s can be reviewed, but on an upward-only basis, making its portfolio doubly attractive for investors.

PE multiple indicates BBOX is a good company at a bargain price

The stock is trading on a PE multiple of just 17 but its trailing twelve month (TTM) EPS growth is 25%.

For investors looking for the opportunity to secure some capital growth plus income, this could be a safe yet profitable place to park your cash in a balanced portfolio. Dividend growth was expected at 8% in 2020 and 6% for 2021 (ex date 22 October, paid on 13 November), on a current TTM of 5.58p per share.

This is a high-quality stock, with an operating margin of 141%, placing it ninth out of 57 companies in the residential and commercial REIT sub-sector, with a return on equity of 6.9%.

According to Nick Preston at Tritax, manager’s of the trust, “virtually every investor” was eyeing the sector. “Far-eastern investors, European institutions [and] private equity players wanting exposure to the sector,” Preston adds.

Investors should be aware that chairman of the board Sir Richard Jewson is retiring at the company’s next AGM in May 2021. Jewson led the company through its IPO in 2012.

Also, in December Aberdeen Standard Investments acquired a 60% interest in manager Tritax, but the Big Box team is “retaining autonomy and control over investment decisions”, said Sir Richard at the time.

The company’s portfolio continues to grow, with its most recent major acquisition taking place in November 2020, with the purchase of a prime temperature-controlled distribution unit on the south coast of England in a “core” location.

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

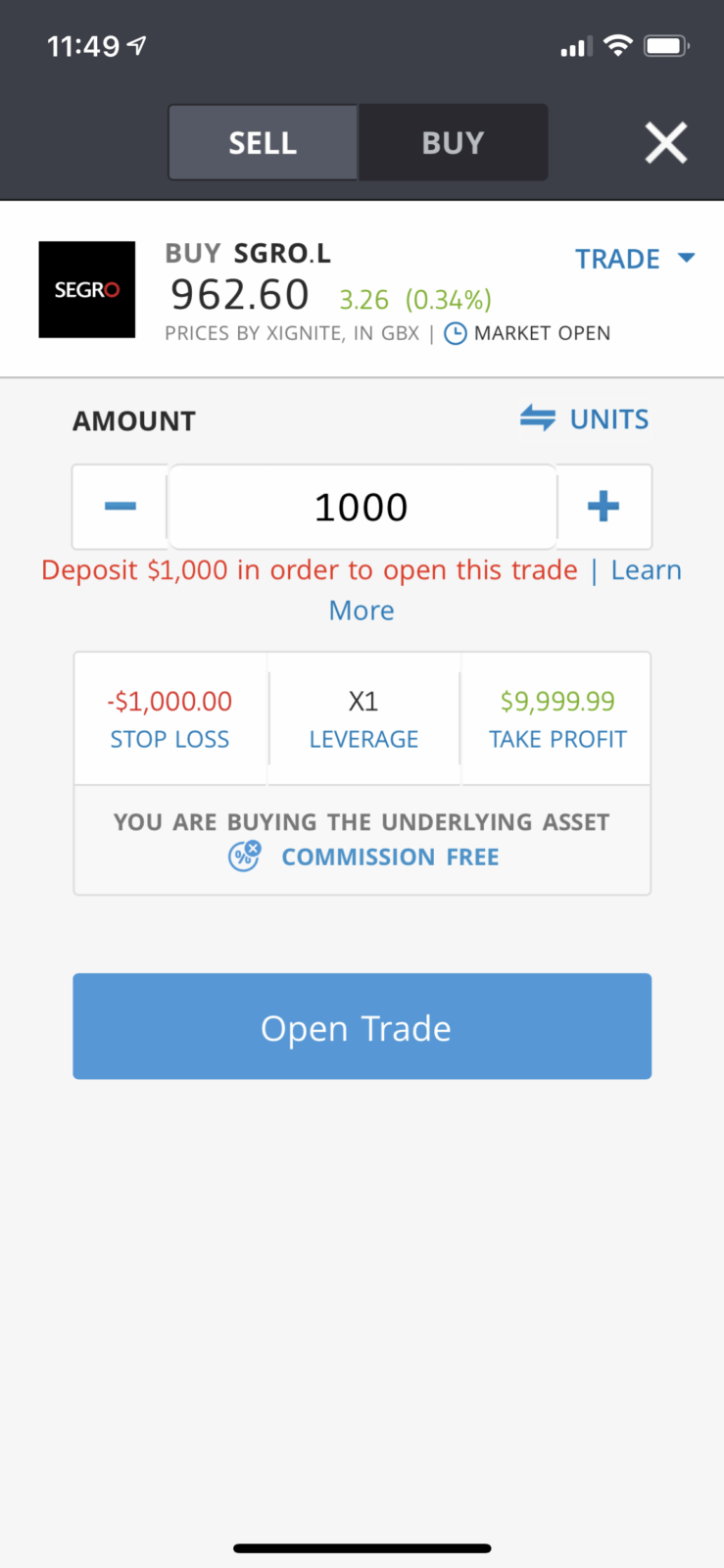

Segro price momentum set for pick up

Investors who prefer not to buy into a stock that has seen a significant one-day appreciation and has already beaten its analyst consensus price target (176p), might prefer Segro, which also concentrates its portfolio around warehouses. It reported last week that it has collected 98% of rent in fiscal year 2020, ended 31 December.

In the first quarter it received 88% of the £63 million that was payable in advance by tenants. That was a higher collection level than seen in the corresponding time in each of the three previous quarters.

Segro’s share price is up just 0.23% today to 963p. It also has an impressive operating margin, that is in fact higher than BBOX, coming in at 187%, placing it third in the commercial real estate sector.

EPS growth has been declining though since 2018, but it is forecast to pick up this year with a 10% increase.

Segro is a contrarian pick in that its price momentum has been poor of late, so taking a position depends on an assumption that the market starts to take notice of its valuable position in the e-commerce space in the Uk and across Europe.

It owns logistics warehousing properties in the valuable Greater London and Thames Valley regions and major footprints also in Germany, France and Poland. Segro owns other warehousing and light industrial units – in Spain, the Netherlands and the Czech Republic.

The company’s properties are used by a broad spectrum of clients in sectors including retail, parcel delivery, transport, technology, services and utilities. Interestingly, it’s warehouses include a number that are used as data centres, bringing another layer of diversification to its portfolio.

The analyst consensus price target is 1006p, a 4.34% premium on the current price.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.