In a subtle retreat, the Indian rupee edged lower against the resurgent U.S. dollar, closing at 83.20 per dollar, down 0.031% from the previous day’s close. The greenback regained strength, bolstered by robust U.S. retail sales data and a surge in Treasury yields.

The dollar index, measuring the U.S. currency against six major rivals, showed resilience at 104.35 after rebounding from a recent low of 103.981. The 10-year U.S. Treasury yield spiked to 4.50%, enhancing the allure of dollar-denominated assets.

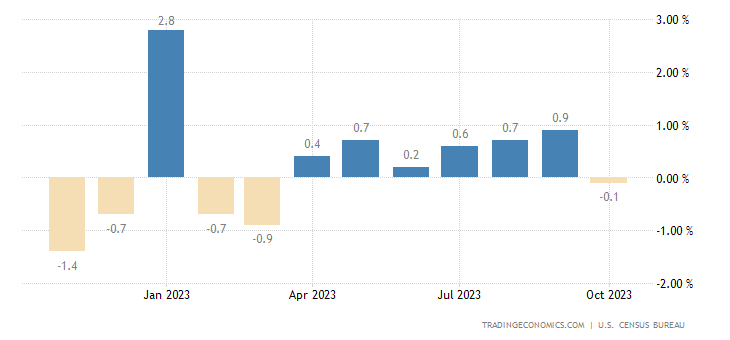

Although U.S. retail sales unexpectedly slipped 0.1% in October, it defied economists’ projections of a 0.3% decline, signaling robust consumer spending amid supply chain disruptions and heightened prices.

Persistent dollar demand from importers and foreign investors, coupled with domestic factors like soaring oil prices, tepid economic growth, and political uncertainty, has kept the rupee under pressure. The currency hit a record low of 83.47 last Friday, amplifying concerns about inflation and the fiscal deficit.

Traders Have Reduced Bearish Bets on the Rupee

Investors, however, have scaled back bearish bets on the rupee, reaching the lowest level in over two months, yet maintaining a cautious outlook on its long-term performance compared to other Asian currencies, according to a Reuters poll.

Market analysts are awaiting cues from the U.S. economy and the Federal Reserve, poised to initiate bond purchase tapering and interest rate hikes next year. Arnob Biswas, Head of Foreign Exchange Research at SMC Global Securities, predicts the rupee to trade cautiously within a narrow band until a decisive move surfaces from the U.S. dollar.

In the face of evolving economic landscapes, the rupee remains at the mercy of global economic developments, emphasizing the need for vigilance in navigating the currency markets.

Find Out More About Learn2Trade With Our FAQ. Click Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.