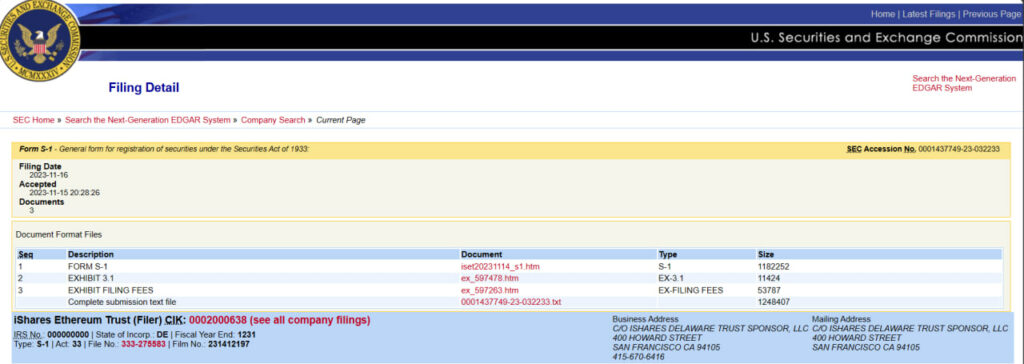

BlackRock, the world’s largest asset manager, has recently submitted a filing for an Ethereum Exchange-Traded Fund (ETF) with the US Securities and Exchange Commission (SEC). This marks the company’s second foray into the crypto ETF space, following its Bitcoin ETF application in June.

The proposed iShares Ethereum Trust is designed to mirror the performance of Ethereum, the second-largest cryptocurrency by market capitalization. It’s worth mentioning that BlackRock has chosen Coinbase as the custodian for the underlying ETH, emphasizing the trust’s commitment to secure and reliable management.

Meanwhile, the S-1 prospectus doesn’t explicitly detail whether the trust will stake ETH and distribute dividends from yields.

BlackRock’s strategic move unfolds against a backdrop of escalating demand for crypto exposure among institutional and retail investors. Competitors like VanEck, WisdomTree, and Grayscale have also thrown their hats into the ring, filing applications for spot or futures-based crypto ETFs in the US.

Despite the surge in interest, the SEC remains cautious, citing concerns over market manipulation, volatility, and investor protection as primary hurdles. Nevertheless, optimistic analysts anticipate regulatory approval for a crypto ETF, speculating it could materialize by the end of this year or early next year.

Initial Ethereum ETF Move By BlackRock Triggered Price Spike

The initial announcement of BlackRock’s Ethereum ETF plans had an immediate impact on ETH’s price on November 9, catapulting it over $200 to a seven-month peak of $2,131. However, the cryptocurrency has since experienced a correction, currently trading at $2,000 at the time of writing.

Addressing speculations, BlackRock has refuted rumors about plans for a Ripple (XRP) ETF, following reports of an XRP Trust registration in Delaware. The case has been referred to local authorities for further investigation.

As BlackRock boldly navigates the evolving crypto landscape, industry watchers eagerly await regulatory developments that could pave the way for broader institutional participation in the burgeoning digital asset space.

Find Out More About Learn2Trade With Our FAQ. Click Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.