The U.S. dollar suffered a sudden twist of fate on Tuesday as it turned bearish following a release of fresh data indicating a slowdown in inflation during October. This development has subsequently diminished the likelihood of the Federal Reserve pursuing further interest rate hikes.

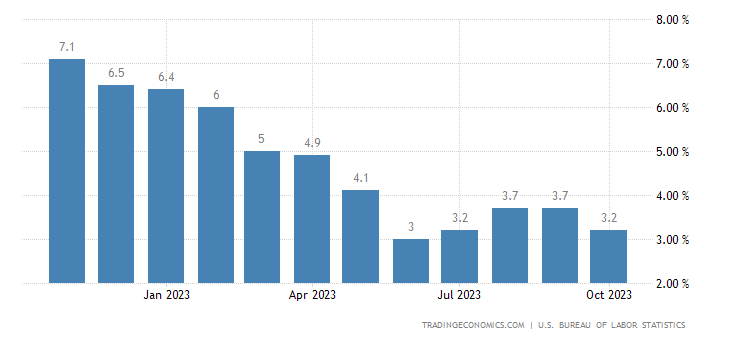

According to the latest report from the Labor Department, the Consumer Price Index (CPI), a key metric gauging changes in the prices of goods and services, remained unchanged in October, in stark contrast to a 0.4% uptick recorded in September. Furthermore, the annual inflation rate witnessed a dip from 3.7% in September to 3.2% in October.

This decline in inflationary figures suggests a potential pause in the Federal Reserve’s aggressive rate-hiking cycle, which has been operational since 2018. Having increased short-term interest rates eleven times since March of the previous year, the Federal Reserve’s benchmark rate has ascended from near zero to its highest point in over two decades.

Matthew Miskin, Co-Chief Investment Strategist at John Hancock Investment Management, anticipates the Federal Reserve adopting a holding pattern as inflation moderates and the labor market weakens. Miskin remarked, “Another rate hike from here looks less likely given this softer inflation data,” according to a Reuters report.

Dollar Index Falls By 1.4%

In the aftermath of this news, the dollar index, tracking the greenback against six major currencies, experienced a 1.71% drop, settling at 104.18.

The euro seized the opportunity, gaining 1.5% to $1.0860, while the Japanese yen rose by 0.67% to 150.70 per dollar.

It is noteworthy that the yen briefly surged against the dollar on Monday, reaching a one-year high attributed to a surge in options trading. However, this strength was not linked to any intervention by Japanese authorities, who last intervened in the currency market in October 2018 to weaken the yen.

As the market digests this shift in economic indicators, the dollar’s trajectory remains uncertain, with global investors keenly observing how the Federal Reserve navigates the delicate balance between economic growth and inflation moderation.

Find Out More About Learn2Trade With Our FAQ. Click Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.