The Swiss franc has achieved its highest standing against the dollar since January 2015, echoing a broader trend of dollar depreciation. The surge, witnessed on Friday, saw the Swiss franc rise by 0.5% to 0.8513 francs per dollar, surpassing the previous low recorded in July this year.

This rally is part of a larger narrative where the U.S. dollar has been consistently losing ground due to mounting expectations of lower interest rates and a deceleration in inflation.

Recent data reflecting cooling U.S. inflation and speculations on the Federal Reserve’s 2024 interest rate cuts have contributed to a 5.2% drop in the dollar index since the commencement of October, marking its most substantial quarterly decline this year.

SNB Wants to Keep the Swiss Franc Lower

Despite the Swiss National Bank’s (SNB) efforts to maintain a lower value for the franc, its strength persists. The SNB, having abandoned its policy of capping the franc’s value against the euro in 2015, has since kept interest rates at an unprecedented -0.75%, intervening in the foreign exchange market to curb excessive appreciation.

However, the SNB’s measures have been insufficient in countering the broader weakness of the dollar, driven by global economic slowdowns and U.S.-China trade tensions. The SNB has issued warnings regarding the franc’s “highly valued” status and has indicated its readiness to implement further interventions if required.

Dollar Set for More Declines

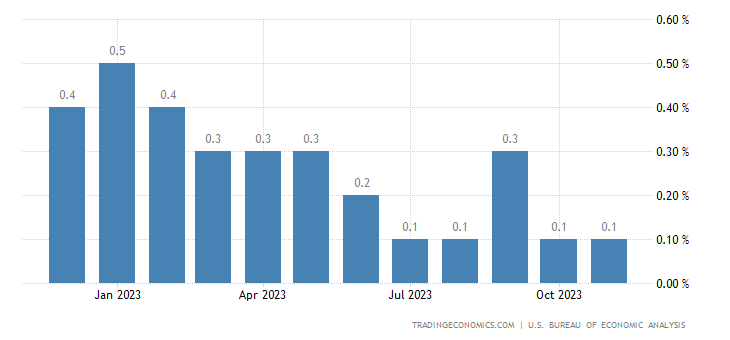

The fate of the dollar may hinge on the U.S. core personal consumption expenditures (PCE) report released hours ago, which revealed a 0.1% decline in November, surpassing expectations. A lower-than-expected PCE figure may intensify pressure on the Federal Reserve to implement additional interest rate cuts, potentially exacerbating the dollar’s decline.

Simultaneously, other currencies have also experienced gains amid the dollar’s downturn. The British pound rose by 0.34% to $1.2744, buoyed by surging retail sales in November, despite a downward revision of third-quarter GDP.

The Japanese yen, marginally stronger at 141.86 per dollar, remains unaffected by the Bank of Japan’s decision to maintain its -0.1% interest rates and offer minimal insights into an exit strategy from its extensive stimulus program earlier this week.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.