Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Hong Kong regulators have expressed openness to approving spot cryptocurrency exchange-traded funds (ETFs), potentially ushering in a new era for digital assets in the region.

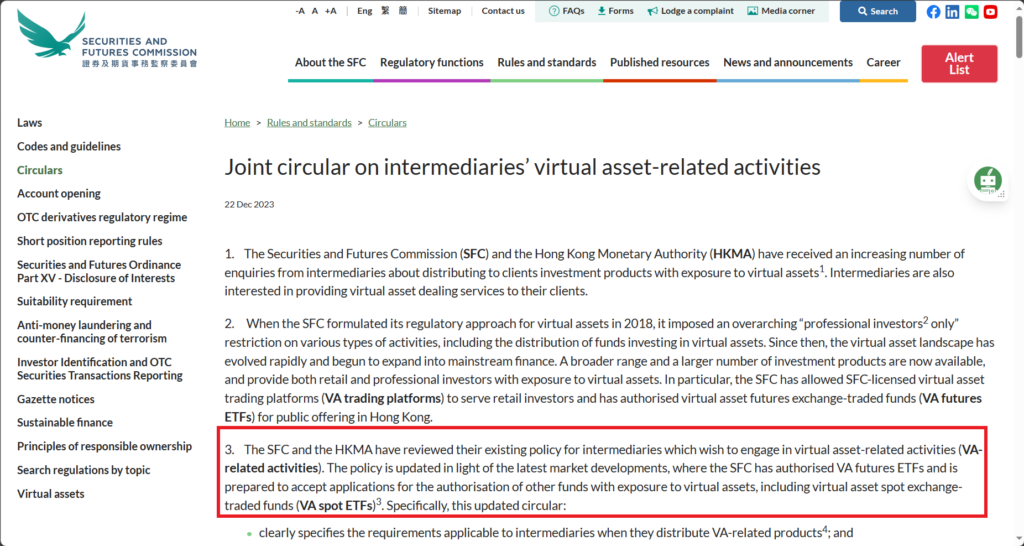

The Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA) jointly declared on Friday a willingness to consider authorizing spot crypto ETFs.

This marks a pivotal shift in Hong Kong’s regulatory stance, evolving from a “professional-investors only” approach adopted by the SFC in 2018.

Spot crypto ETFs are investment funds that mirror the price movements of cryptocurrencies like Bitcoin and Ethereum.

The regulators emphasized their commitment to monitoring virtual asset market developments and risks, pledging collaboration with the global regulatory community to establish a robust and consistent framework.

Hong Kong Has Become Increasingly Crypto-Friendly

Hong Kong’s progressive move aligns with its broader trend of relaxing crypto regulations throughout the year.

In October, the SFC revised its rule book, granting licensed corporations the ability to offer virtual asset services to professional investors. SFC Chief Executive Officer Julia Leung subsequently hinted at extending this accessibility to retail investors in November, expressing openness to innovative technology proposals for enhanced efficiency and customer experience.

The announcement coincides with heightened speculation that the U.S. Securities and Exchange Commission is poised to approve a spot bitcoin ETF, a departure from previous rejections.

If greenlit, a spot Bitcoin ETF would simplify investors’ access to Bitcoin without the technical complexities of cryptocurrency storage and security.

A potential green light for spot crypto ETFs in Hong Kong could redefine the crypto landscape. Offering a regulated and convenient entry point, such ETFs could bolster market legitimacy, attract institutional and retail investors, and significantly enhance liquidity.

The crypto industry awaits further developments as Hong Kong positions itself at the forefront of embracing digital assets.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.