Leverage Trading, If you’re armed with the required skills and knowledge to succeed in the online trading arena, and you have a higher appetite for risk – did you know that most platforms now allow you to trade on leverage?

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

In its most basic form, leverage allows you to trade with more money than you have in your account.

On the one hand, this allows you to amplify your gains in the event of a profitable trade. However, trading on leverage is also fraught with risk. In fact, you could have your entire margin liquidated.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

-

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

-

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

As such, we would suggest reading our comprehensive guide on What is Leverage in Trading? Within it, we’ll uncover the ins and outs of how to leverage trading works, who is eligible, how much you’ll be able to apply, the underlying risks, and more.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Note: Leverage limits in the UK are determined by EMSA – a European body created to protect retail investors. You’ll only be able to surpass these limits if you’re a professional trader.

What is Leverage Trading? Leverage Meaning and Definition

In a nutshell, trading on leverage allows you to invest more than you have in your brokerage account. In doing so, you are effectively borrowing funds from the broker in question.

In return, the broker will charge you interest on the borrowed funds, which is known as ‘overnight financing’. As the name suggests, this is charged on a daily basis for as long as your leveraged trades remain open.

However, by applying leverage of 3:1, you can trade to an amount three times larger. This means that a £300 balance would permit the trade of £900 on gold. On the flip side, leverage is a high risk, as you could have your entire ‘margin’ liquidated if the trade goes against you.

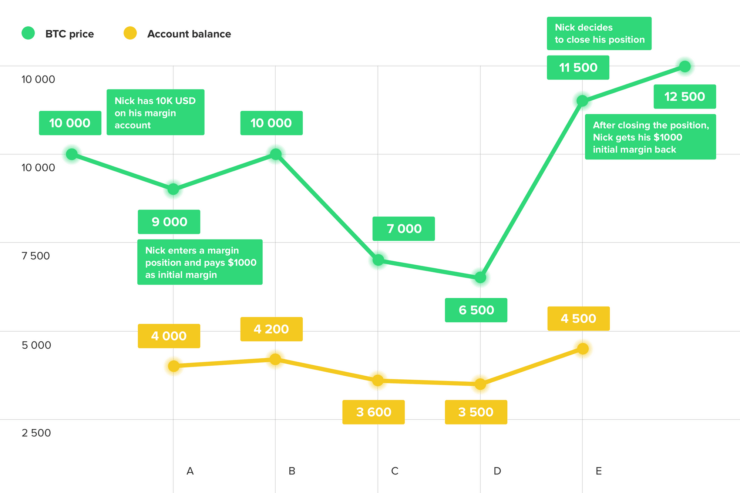

Let’s look at an example of how a leveraged trade would work in practice.

Leverage Trading Example

Let’s say that you want to trade the FTSE 100. Upon analyzing the charts, you’re confident that the FTSE 100 is likely to increase in price over the next 24 hours. As such, you decide to add leverage of 5:1 on your trade.

- You have £500 in your trading account.

- You apply the leverage of 10:1, meaning that your trade is worth £5,000.

- Later that day, the price of the FTSE 100 increases by 3%.

- Ordinally, your £500 order would have yielded £15 in profit (£500 x 3%).

- However, as you applied leverage of 10:1, your profit stands at £150 (£15 x 10).

As you can see from the above example, applying leverage can amplify your gains when the trade goes in your favor. However – and as we cover in the next section, leverage can also amplify your losses.

What are the Pros and Cons of Leverage Trading?

The Pros The Cons

Risks of Leverage Trading – The Margin

If applying leverage was risk-free, we would all be doing it. In other words, why trade with just £500 when we can boost our trades by up to 30:1? The simple answer to this is the margin.

You see, in order to obtain leverage from an online broker, the platform will ask you to put up a margin, which essentially operates as a security deposit.

Note: Your chosen broker will always state the trigger price in which your trade will be liquidated. This is the price that your trade will be closed automatically.

The amount of margin that you will be required to put up as security correlates to the size of your trade, and the amount of margin you wish to apply.

For example, let’s say that you wanted to trade £10,000 at leverage levels of 10:1. This means that your margin would need to be £1,000 (£10,000 / 10). Similarly, a £20,000 trade at 5:1 would require £4,000 in the margin (£20,000 / 5).

Losing Your Margin

Once the margin has been applied to your leveraged trade, you stand the risk of losing it in the event that your position goes against you. This is known as having your order ‘liquidated’, meaning that the broker will close your trade automatically and keep the margin.

Similarly, a trade at leverage levels of 4:1 would be liquidated if the trade lost 25% in value (1/4).

How to Avoid Liquidation?

In order to avoid having your trade liquidated, there are two options available to you. You can either close your trade and take a loss or alternatively, increase the size of your margin.

🥇 Close Your Trade

The easy option is to simply close your trade before it reaches the point of liquidation. Although you will still lose money, you could lose substantially less than leaving your trade open and allowing it liquidate. For example, let’s say that you’re trading at a leverage of 10:1, with a margin of £200.

To clarify, if your trade goes down by more than 10%, you’ll lose your £200 margin. With that said, later in the day, your trade has decreased by 5% in value. If you closed the trade, you would lose £100, which is 50% of your margin (5% x 10:1).

Although you still lost £100, a few hours later the asset decreased by a further 5%, meaning that the 10% liquidation point was triggered. Had you held on and hoped for the best, you would have lost your entire margin – which is £200.

🥇 Add More Margin

The second option available to you is to add more margin. Some brokers will send you a notification when you are approaching the liquidation point, asking you whether or not you would like to increase your margin size. If you do, this will keep the trade open and effectively give you more breathing space.

This option is slightly more complex than simply closing your trade automatically, so we’ve outlined a quick example below.

Example of Increasing Your Margin Position

Let’s say that you are trading Apple stocks on margin, at leverage levels of 4:1. Your margin is £500, so you’re trading at £2,000 in the open marketplace. You purchased your Apple stocks at a price of £180 per share. This means that you will be liquidated if the price of Apple goes down to £135 (£180 – 25%).

- Apple released its quarterly results, which are less favorable than the markets had hoped for.

- As such, the price of Apple goes down by 24% over the course of the next few weeks.

- If the price goes down by an additional 1%, you will be liquidated.

- As such, you decide to add a further £500 in the margin.

- This means that at the current price of £136.8, you will afford yourself an additional 25% safety net.

- As such, the only way that you would be liquidated is if the price of Apple goes down to £102.6.

The above example of increasing your margin position will leave us with two possibilities. If the price of Apple eventually recovers beyond your original trade size of £180 per share, you’ll not only be in profit, but your gains will be amplified by the leverage of 4:1.

On the other hand, if the price of Apple continued to tank, and it breached the £102.6 liquidation point, you would lose all of your margins and both trades would be closed. This would amount to £1,000, as you put up two margin securities of £500 each.

How Much Leverage can I Trade With?

The amount of leverage that you are able to get when trading online will depend on a number of variables. This includes the type of asset you are looking to trade, whether you’re a retail or institutional client, your location, and the broker itself.

Below we have listed the leverage limits as per ESMA.

✔️ 30:1 for major forex trading pairs.

✔️ 20:1 for non-major forex pairs, gold, and major indices.

✔️ 10:1 for commodity trading markets other than gold and non-major equity indices.

✔️ 5:1 for individual stock trading markets.

✔️ 2:1 for cryptocurrencies.

With that being said, the above limits will not apply if you are a professional trader.

Higher Leverage Limits for Professional Trader Accounts

In order to open a professional trading account with your chosen broker, you will need to meet at least two of the following three criteria.

✔️ You have opened and closed at least 10 trades in each of the previous four quarters. Each trade must have been worth at least €150.

✔️ Your financial portfolio is worth €500,000 or more.

✔️ You have at least one years’ worth of experience in a relevant financial field (such as working for a stockbroker or investment bank).

As you can see from the above, the requirement is 3 is somewhat subjective. As such, the broker will need to review each and every application when deciding whether or not you approve of you as a professional trader. Moreover, you’ll need to provide supporting documentation.

Nevertheless, if you do meet the above requirements, you will benefit from much higher leverage limits. In fact, this can be as high as 500:1 on major forex pairs, and 100:1 on major indices such as the S&P 500.

How do I get Leverage on my Trades?

In the vast majority of cases, your chosen broker will allow you to apply leverage to your trades as soon as you open the account. However, this will be on the proviso that you demonstrate to the broker that you have a firm grasp of the underlying risks.

In other words, you will be required to answer some basic multiple-choice questions when you go through the registration process. These will center on the risks of applying leverage to your trade. If you answer the questions successfully, your margin capabilities will be activated automatically.

How to Find a High Leverage Broker?

If you’re keen to start trading on margin, you’ll need to find a broker that not only allows you to apply leverage but leverage on your preferred asset class. With that said, most brokers allow you to apply leverage on both forex and CFD trading markets, meaning that you’ll have access to thousands of financial instruments.

Nevertheless, we have listed our top 3 leverage broker picks below. Just make sure that you perform some additional research on the broker prior to signing up.

1. AVATrade – 2 x $200 Forex Welcome Bonuses

The team at AVATrade are now offering a huge 20% forex bonus of up to $10,000. This means that you will need to deposit $50,000 to get the maximum bonus allocation. Take note, you'll need to deposit a minimum of $100 to get the bonus, and your account needs to be verified before the funds are credited. In terms of withdrawing the bonus out, you'll get $1 for every 0.1 lot that you trade.

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

2. VantageFX – Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Conclusion

In summary, applying leverage can be a highly effective trading strategy when utilized correctly. As such, you stand the chance of amplifying your profits when you are confident on a particular trading opportunity.

With that being said, leverage trading is also high risk. If a trade goes in the opposite direction of what you had hoped for, you could lose your entire margin.

Ultimately, if you do decide to trade with leverage, you need to ensure that you have a firm understanding of the underlying risks. Moreover, you need to ensure that you install sensible stop-losses to protect your position from liquidation.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card