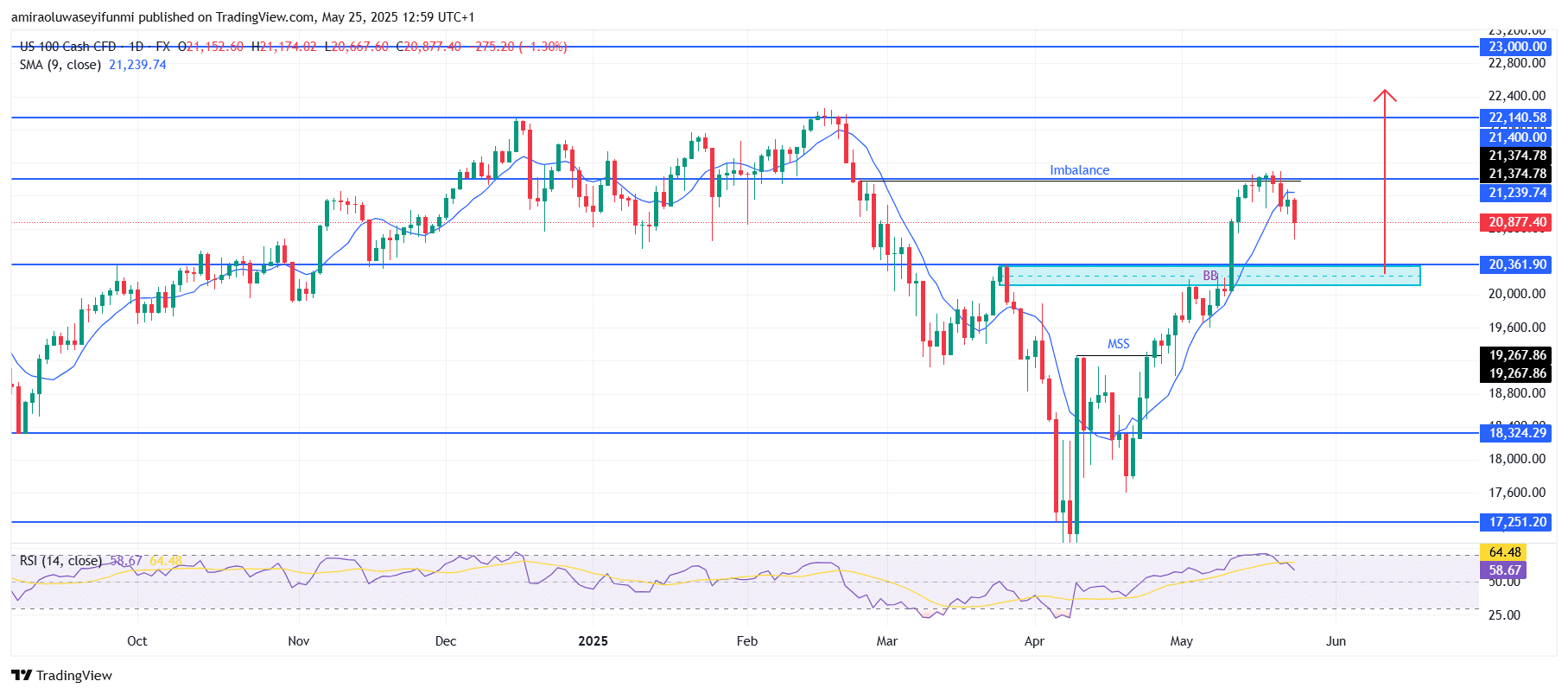

NAS100 Analysis – May 25

NAS100 is undergoing a clear pullback within a broader bullish continuation structure. The index has dipped below its 9-day Simple Moving Average, currently near $21,240, indicating short-term selling pressure. However, the RSI remains comfortably above 50 at 58.7, after recently reaching 64.5, suggesting that underlying bullish momentum remains intact and the retracement may merely represent a temporary pause before further gains.

NAS100 Key Levels

Resistance Levels: $21,400, $22,140, $23,000

Support Levels: $20,360, $18,320, $17,250

NAS100 Long-Term Trend: Bullish

Recent upward momentum stalled at the $21,400–$21,370 supply zone, an area marked by an existing imbalance. The ongoing correction is likely to move toward the critical support zone near $20,360. This level aligns with a bullish breaker block and a previous market structure shift, making it a highly significant confluence zone. If buyers step in to defend this area, it would reaffirm the market’s intention to continue its bullish trajectory.

Additionally, the recent rally left behind a fair value gap that is now being revisited, which enhances the likelihood of a rebound if buyers re-engage the market with conviction. Looking ahead, holding the $20,360 support level is essential for validating the bullish continuation outlook. If sustained, the next resistance levels to watch are $21,400, followed by $22,140 and eventually $23,000. On the other hand, a breakdown below $20,360 could lead to a deeper pullback toward $19,270, with potential further downside extending to $18,320. In this context, forex signals may offer timely insights into market entries and exits.

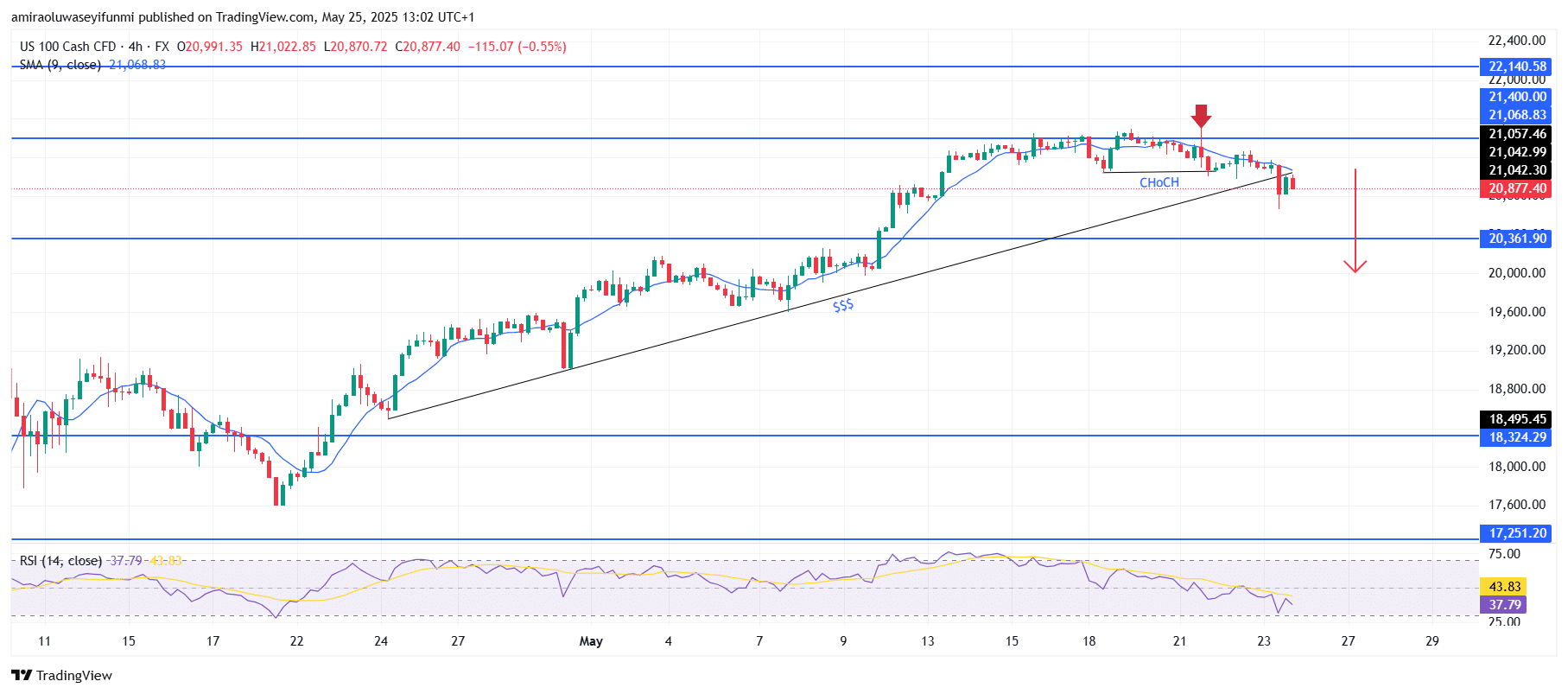

NAS100 Short-Term Trend: Bearish

NAS100 has fallen below its ascending trendline and the 9-period SMA, confirming a short-term bearish shift. A change of character has taken place around the $21,040 level, signaling a reversal in momentum.

With the RSI now below 40, bearish momentum is further supported. The immediate support zone is located near $20,360, and continued selling could push the index lower toward $18,320.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.