Market Analysis – May 26

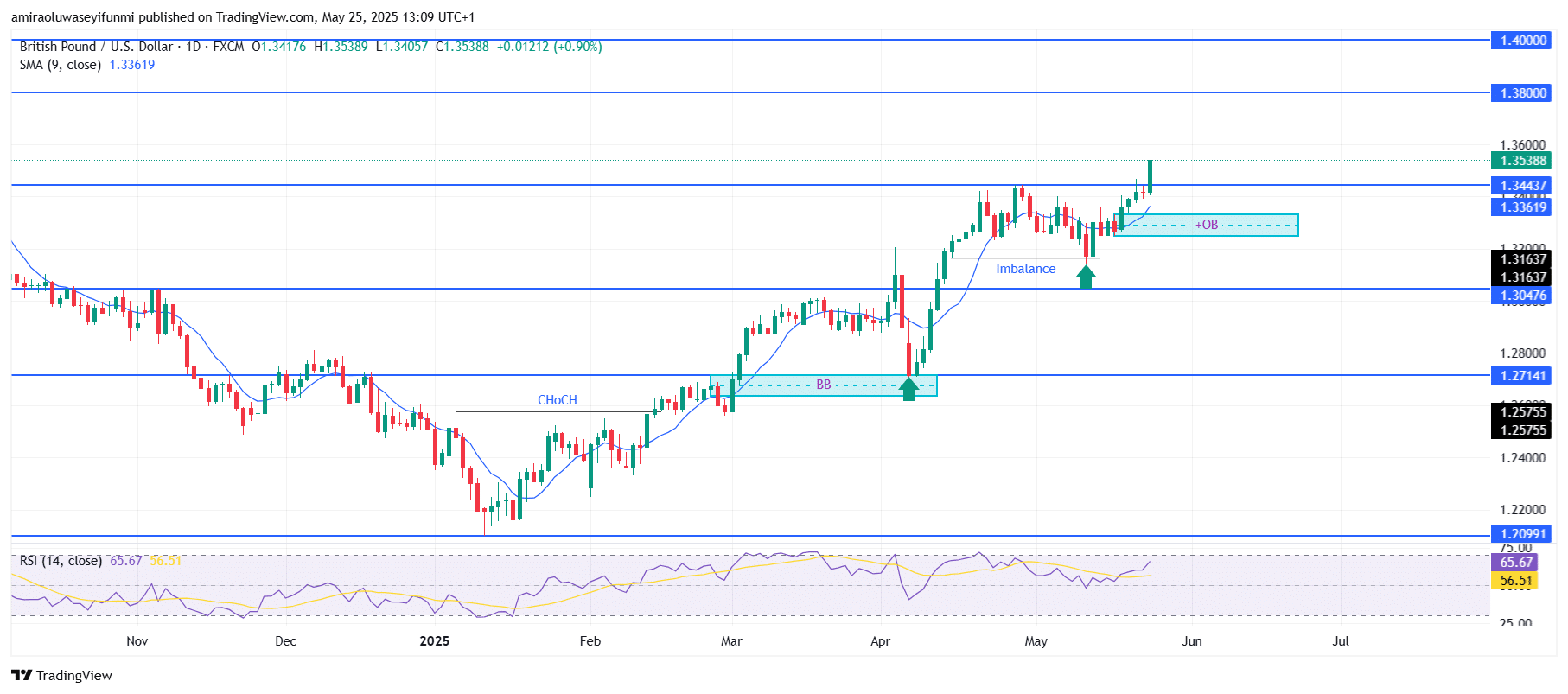

GBPUSD is primed for a rally as technical indicators signal upside potential. On the daily chart, momentum indicators favor bullish activity. The chart reveals a robust bullish setup supported by reliable technical signals. The 9-day Simple Moving Average, positioned at $1.3360, is trending upward, providing dynamic support as the price climbs. This moving average has consistently remained beneath recent price action, affirming the strength of the ongoing trend. Additionally, the Relative Strength Index is hovering around 65.67, comfortably below the overbought threshold of 70. This suggests bullish momentum is present without being overstretched, leaving room for further gains.

GBPUSD Key Levels

Supply Levels: $1.3440, $1.3800, $1.4000

Demand Levels: $1.3050, $1.2710, $1.2100

GBPUSD Long-Term Trend: Bullish

Price action highlights sustained buying pressure, with a decisive break above the $1.3440 resistance zone. The pair has formed a bullish order block between $1.3160 and $1.3050, where price previously consolidated, indicating strong institutional interest. The imbalance from prior price movement has been addressed, allowing the market to resume its upward trajectory. Subsequent higher highs, capped by a bullish engulfing candle surpassing the previous swing high, reinforce the continuation of the uptrend.

Looking forward, the next resistance lies at $1.3800, with potential for further gains toward the psychological $1.4000 level if buying pressure persists. A dip back to the bullish order block could provide a low-risk entry point, provided bullish momentum remains intact. Overall, GBPUSD is positioned to extend its upward trend, and forex signals may offer valuable guidance for navigating these movements.

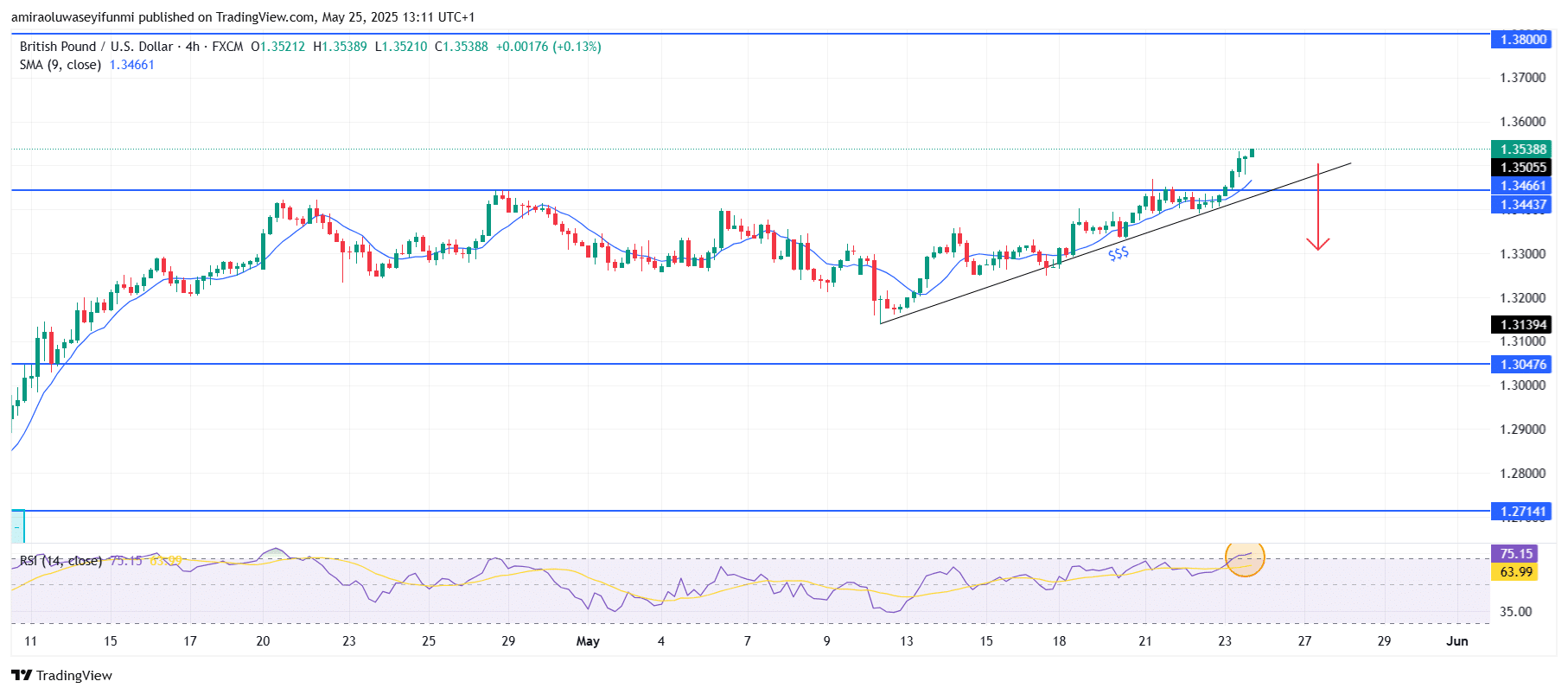

GBPUSD Short-Term Trend: Bearish

On the four-hour chart, GBPUSD appears overbought at $1.3540 following an extended bullish run. Price action indicates weakening momentum above the ascending trendline, with a potential break becoming more likely.

The Relative Strength Index at 75.15 confirms overbought conditions, suggesting a possible bearish reversal. A decline below the diagonal support level may validate a short- to mid-term bearish move.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.