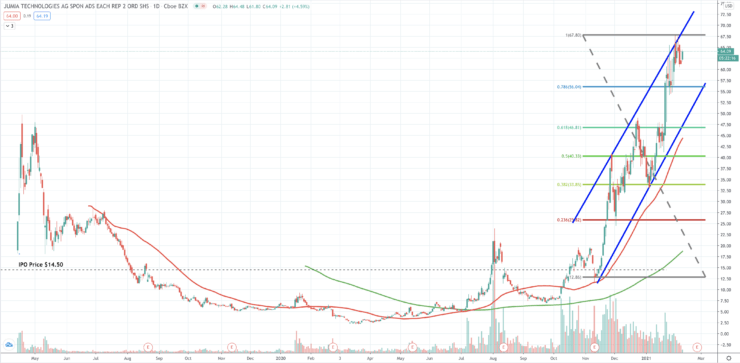

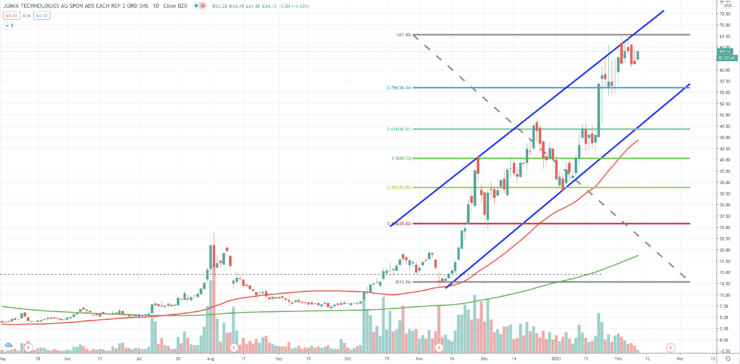

After a rocky debut as a public company in April 2019, when the price jumped at IPO only to fall back below the IPO price of $14.50 in July 2019 and only reclaiming that level in August last year.

The 3Q results followed a poor outing in the previous quarter’s results, leading to a fall in the share price, although the surprise positive earnings per share results for Q1 reported in May had set the share price on an upward trajectory before then.

In its Q2 statement, it also reduced its EBITDA loss, for the second quarter in a row and its active users grew by 14%. However, on that occasion – August 2020 – the stock dropped 30%

Jumia has benefited from the impact of the pandemic but nowhere near not as dramatically as seen in developed markets because of the lack of widespread lockdowns on the continent.

This helps explain the Q3 revenue slippage but cost-cutting led to an improvement on the bottom line and the associated EBITDA loss narrowing from €49 million to €32.4 million ($38.3 million).

Jumia’s results were impacted on the revenue side by its shift to selling a higher proportion of less expensive but more frequently bought items.

Jumia making ‘Good progress’ to a profitable future

Shortly after going public, Jumia was hit by rumours of fraud at its Nigerian operations, which, as you can imagine, made investors jittery, but those rumours proved to be unfounded.

Despite that, gross revenues are showing “good progress”, according to chief executive and co-founder (with Jeremy Hodara) Sasha Poignonnec.

The company’s path to profits rests on the solid growth prospects for the continent, where inward direct investment has been growing at a steady pace and the ranks of the middle class are swelling.

According to consultancy McKinsey, e-commerce will account for as much as 10% of all retails sales ($75 billion) by 2025, as internet penetration via mobile accelerates.

Founded in 2012, the German company now operates in 23 African countries.

Some analysts have encouraged Jumia to partner with big players such as Amazon or Alibaba, but instead it is looking to expand on the deals it is making with local brands as it grows its business.

For example, restaurants is a particular focus for expansion, with food delivery apparently booming but it does have marketing partnerships with US Big Tech in the shape of marketing relationships with Facebook and Google.

Jumia Pay and logistics operation to propel share price higher

Jumia also has tie-ups in place with payments partners such as Mastercard – with an investment of $50 million made two years ago – and local banks, as it positions its Jumia Pay offering.

Jumia Pay is a nimble product, with a wide range of payment options and a swish user-friendly digital wallet interface that helps it stand out from the crowd.

At the centre of its growth strategy is the strengthening of its logistics operation, which the company seeks to build out as a market leader on a continent where postal services and addressing can be unreliable at best. Poignonnec says it is “taking early steps to open up the logistics platform to third parties”.

Jumia began the rollout of its third-party delivery service in November last year and has stolen a march on the likes of Amazon because of its hyper local relationships, which in turn makes it arguably the most trusted e-commerce platform in Africa.

Key markets include Nigeria – where the company is headquartered, Egypt, South Africa and Ghana.

Jumia listed South African telecoms company MTN Group among its backers, but it sold its stake in October last year for $142 million as part of a divestment strategy to streamline its portfolio.

More familiar institutional investment names from a western investors perspective include Baillie Gifford, the Edinburgh-based investment management group that boasts the UK’s largest investment trust, Scottish Mortgage, among its vehicles.

Jumia’s share price has risen 800% since a low of $7 on 23 September last year and has improved an impressive 57% year to date.

The price is trading within an ascending channel but the safest entry point occurs at the intersection of the 0.786 Fib and the 22 January high of around $56 seen at the top of the 1-day candle (see chart above).

But with Q4 earnings due on 24 February investors may not want to wait for a lower price point that may not arrive in the short-term.

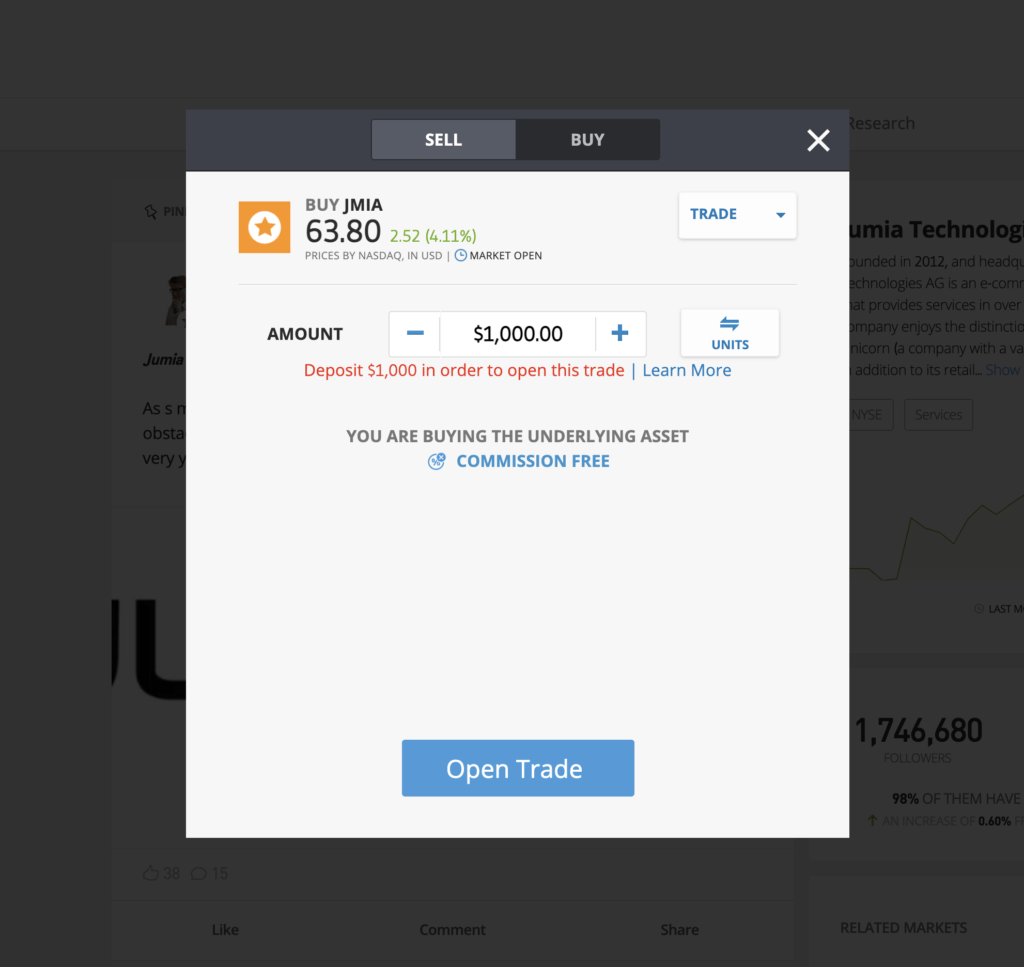

The stock is up 4% in today’s session at $63.80 but on relatively low volume.

Jumia is a long-term buy.

Buy Jumia commission-free on eToro

8cap - Buy and Invest in Assets

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Buy over 2,400 stocks at 0% commission

- Trade thousands of CFDs

- Deposit funds with a debit/credit card, Paypal, or bank transfer

- Perfect for newbie traders and heavily regulated

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.