GBPUSD Price Analysis – August 16

The GBPUSD pair has ended a second straight week beneath the 1.3100 price level, unable to stimulate growth potential as Sterling is weakened by Brexit talks. A weak dollar was not enough to drive the pair higher, as Sterling’s demand was constrained by fears about the UK’s potential trading partnership with the EU.

Key Levels

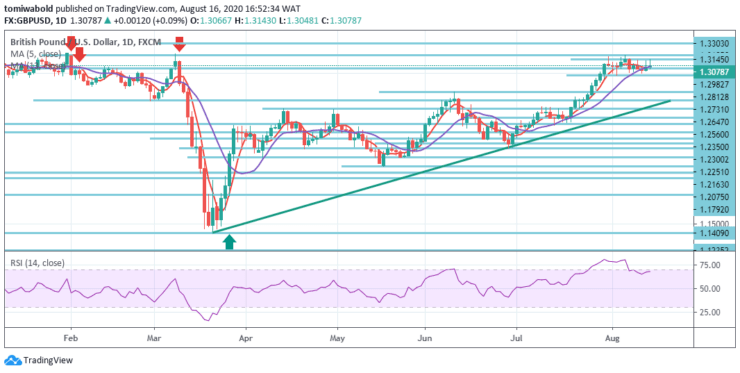

Resistance Levels: 1.3514, 1.3303, 1.3185

Support Levels: 1.2982, 1.2812, 1.2647

The daily chart’s Relative Strength Index also flirts with 70 while mildly overbought. Its trend stays optimistic, and GBPUSD trades beyond the 5 and 13 moving average. Generally, the intensity doesn’t thoroughly reflect bullishness.

Initial levels to consider are 1.3050 levels, which was a temporary limit in August – and just before the global epidemic – and a temporary high of 1.3145 level. More strong resistance is at level 1.3200, a swing high before the crash in March. Even farther up, level 1.3200 was a high point in January, followed by levels 1.3303 and 1.3514.

Last week GBPUSD stayed beneath 1.3185 level in consolidation and trend remains unaltered. First this week the initial bias stays neutral. Further rally with support level 1.2982 intact is anticipated.

On the upwards, a breach of 1.3185 levels may expand the rally from 1.1409 to 1.2647 levels, from 1.2075 to 1.3303 levels. Breakage of 1.2982 support levels may, therefore, validate short-term topping. The intraday bias for 1.2812 resistance turned support level is shifted back to the downside.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.