Market Analysis – Augustus 3rd

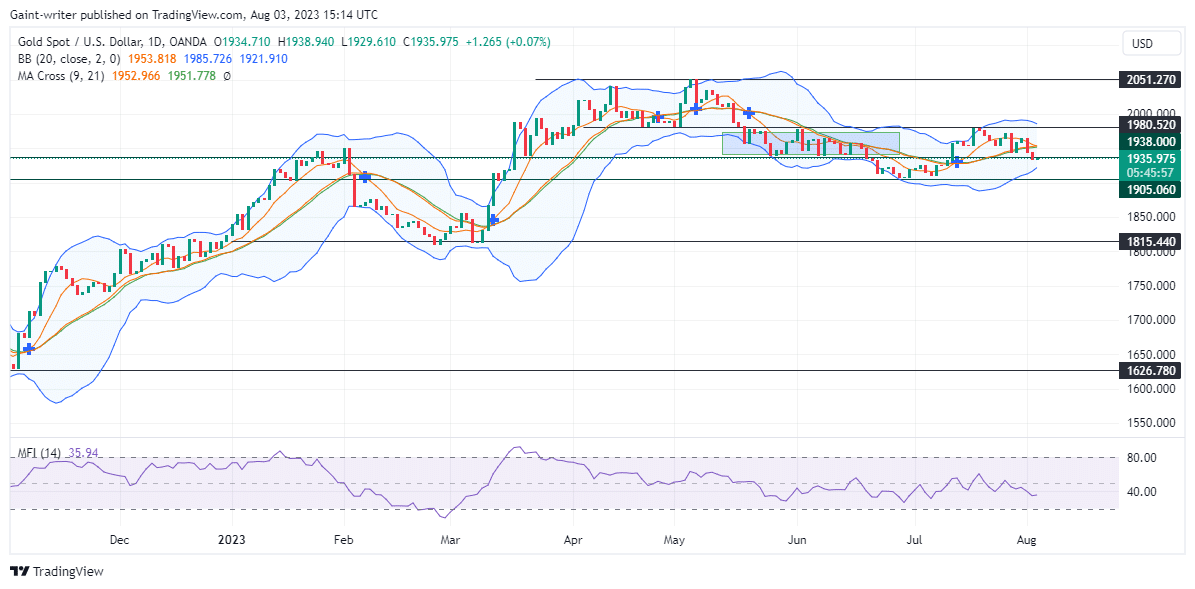

Gold (XAUUSD) faces a potential decline below the 1938.000 market strength as bullish momentum weakens. The yellow metal had been on a bullish trajectory after a period of bearish sentiment from March to July. During this time, the market dropped from the key level of 2051.270 to the price zone of 1905.060.

Gold (XAUUSD) Market Zones

Resistance Zones: 2051.270, 1980.520

Support Zones: 1815.440, 1626.780

Gold XAUUSD Long-Term Trend: Bearish

Buyers managed to regain strength from the 1905.060 level. This is evident on the daily chart. They successfully pushed the price back up toward the key zone at 1980.520. However, this key zone has proven to be a significant barrier that the yellow metal has been unable to breach.

As a result, sellers have regained control of the market. They have successfully breached the 1938.000 significant level. It seems that sellers are currently in control and are likely to continue exerting pressure.

The Money Flow Index (MFI) indicates the direction in which the price is currently heading. It, therefore, highlights that sellers are still assuming control of the market. The sellers are more likely to build stronger momentum in the days to come.

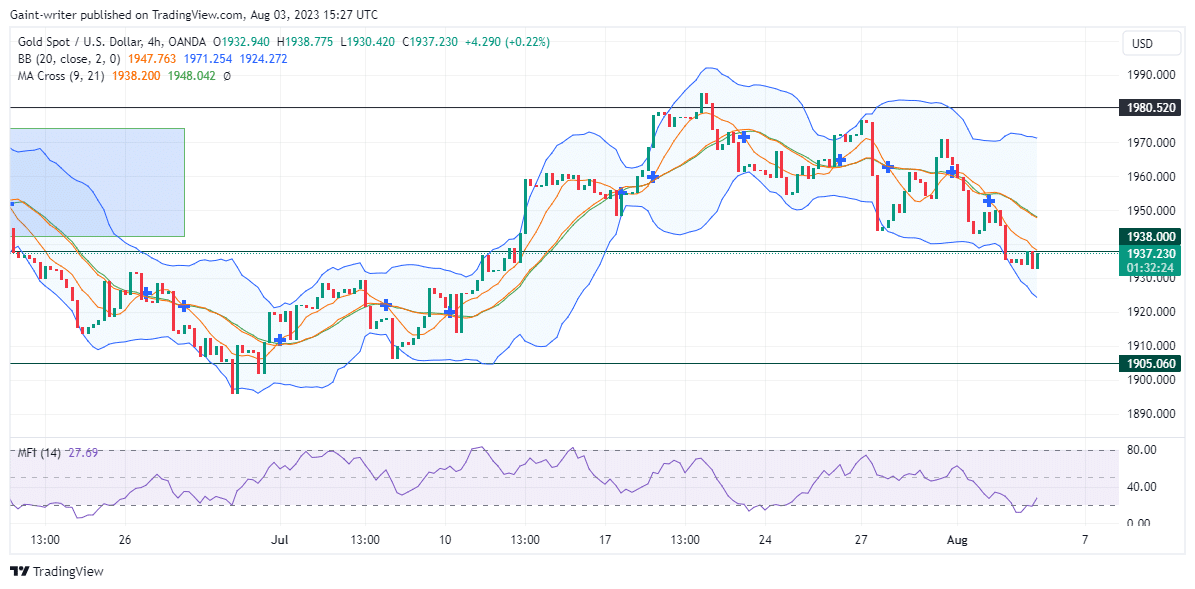

Gold XAUUSD Short-Term Trend: Bearish

On the 4-hour chart, buyers are putting up a fight in an attempt to reclaim ground above the 1938.000 key zone. However, the Moving Average indicator’s crossing still points toward a bearish market direction. The bears are expected to exert further pressure as selling pressure increases. As traders navigate the gold market, caution is advised, and close attention should be given to key levels and market indicators.

There is potential for a further decline below the 1938.000 market strength. This signifies a bearish sentiment that traders should be prepared for.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.