Market Analysis – August 4th

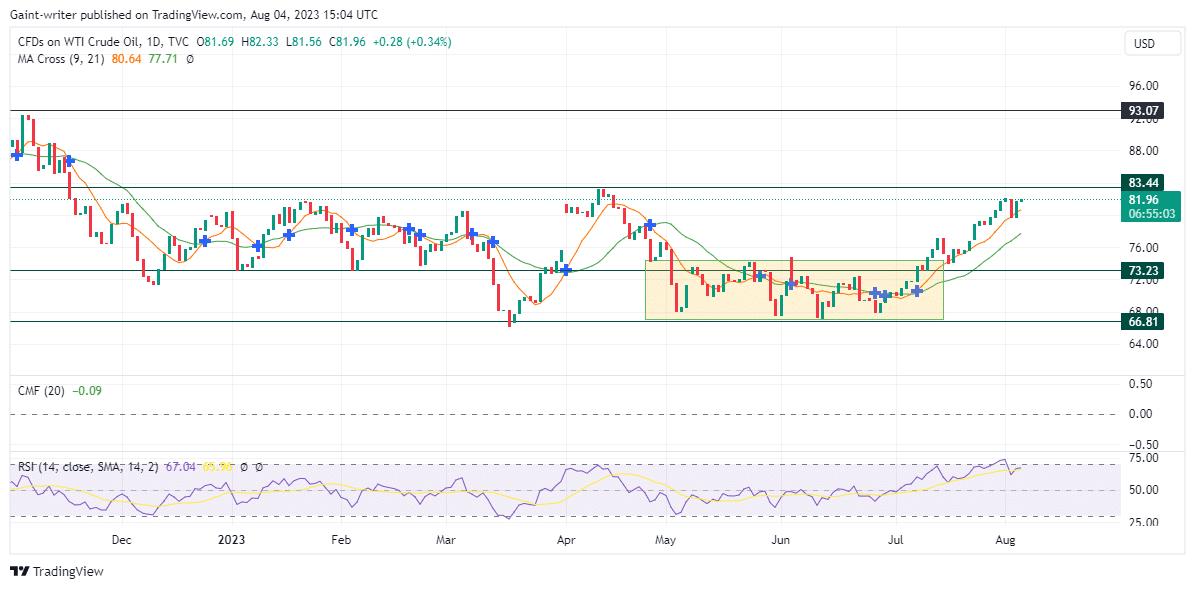

US Oil (WTI) buyers aim for a breakout above the 83.440 key zone. The buyers are focused on achieving a breakout above the significant zone at 83.440. Their determination to push for a breakthrough remains strong. While there has been progress in price, an additional effort is required to surpass the resistance at 83.440. The bullish sentiment has persisted for several weeks, and buyers are demonstrating their commitment.

US Oil (WTI) Market Levels

Resistance Levels: 93.070, 83.440

Support Levels: 73.230, 66.810

US (WTI) Long-Term Trend: Bullish

In July, buyers successfully broke out of a period of price consolidation that had persisted since May. Above the market zone at 73.230, buyers managed to create an upward trajectory. This bullish momentum has been sustained since then. As buyers approach the 83.440 market zone, the potential for easy penetration or a reversal exists. However, it is evident that buyers are not ready to relinquish their fight in the market.

The Moving Average crossing indicator offers support, indicating the acceleration of buyer momentum. This suggests that a breakthrough may be within reach for buyers as their momentum increases. As traders analyze the US Oil (WTI) market, it is crucial to closely monitor price movements and market dynamics. The determination of buyers to achieve a breakout above the 83.440 key zone creates potential opportunities.

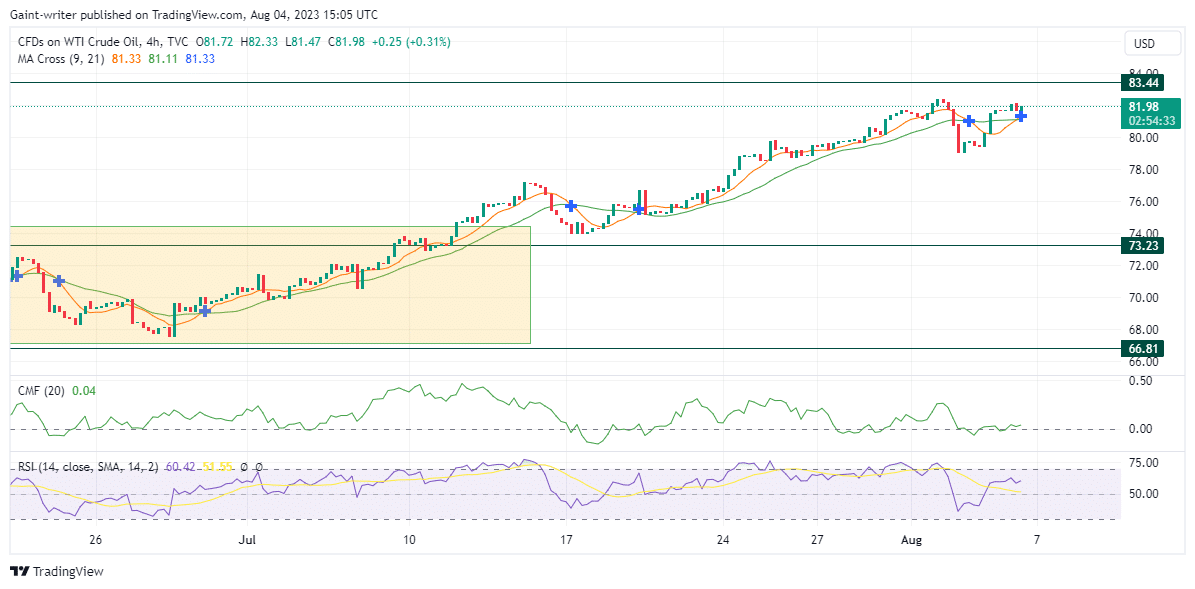

US Oil (WTI) Short-Term Trend: Bullish

On the 4-hour chart timeframe, buyers still require significant strength to continue their push further. Sellers are currently providing resistance as they impede buyer progress. Nevertheless, the bulls remain focused on surpassing the 83.440 market level. The Relative Strength Index (RSI) has not presented a clear direction as sellers continue to exert pressure on prices. As buyers intensify their efforts, monitoring key price levels can provide valuable insights into market direction.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.