Market Analysis – December 22

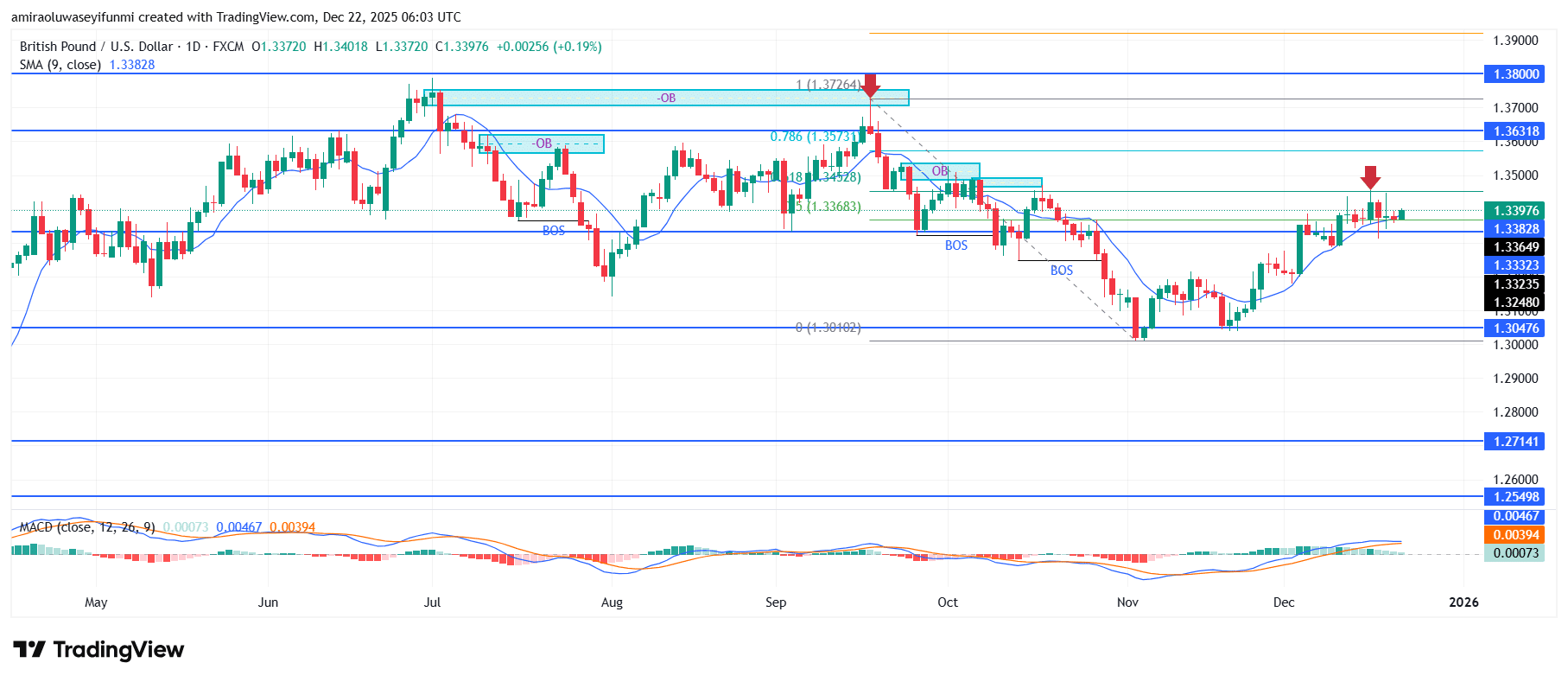

GBPUSD encounters renewed downside bias under a weakening structure. The GBPUSD market is displaying a softening technical profile, as price behavior increasingly aligns with a bearish directional bias across multiple trend-based indicators. The pair continues to trade below key dynamic references, including the short-term moving average near $1.3380, reflecting fading upside sustainability. Momentum conditions remain muted, with the MACD hovering near neutral and failing to show expansion, reinforcing an environment where selling interest remains tactically dominant.

GBPUSD Key Levels

Supply Levels: $1.3330, $1.3630, $1.3800

Demand Levels: $1.3050, $1.2710, $1.2550

GBPUSD Long-Term Trend: Bearish

Upside attempts have repeatedly stalled beneath established supply zones between $1.3500 and $1.3630, preserving a structure of descending highs. Consecutive bearish shifts in market structure indicate that prior demand areas are no longer attracting sustained buying interest. The rejection from the $1.3450–$1.3500 corridor, followed by consolidation below $1.3400, highlights ongoing redistribution, while nearby supports at $1.3330 and $1.3250 continue to erode under persistent pressure.

Looking ahead, the prevailing configuration supports further downside development as long as price remains capped below $1.3500. A decisive break beneath $1.3330 would likely redirect focus toward the $1.3050 level, with scope for deeper extension toward $1.2710 if bearish momentum accelerates. Any recovery into the $1.3500–$1.3630 region is more likely to be corrective in nature, aligning with broader forex signals rather than indicating a structural reversal.

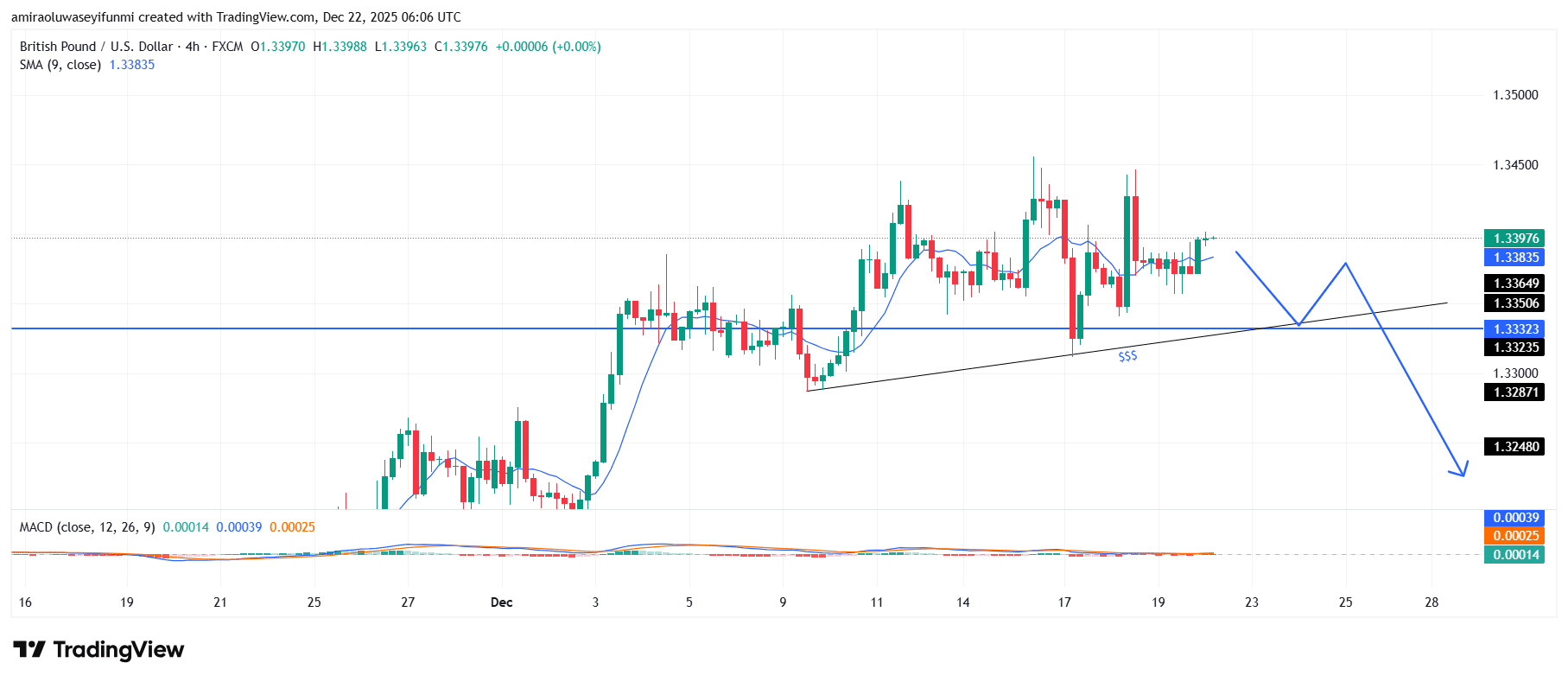

GBPUSD Short-Term Trend: Bearish

On the four-hour timeframe, GBPUSD is losing upside momentum, with price struggling to sustain trade above the short-term moving average near $1.3380. Momentum indicators are flattening, as the MACD remains compressed around the zero line, suggesting weakening bullish participation.

Technically, price is consolidating below the $1.3400 resistance while repeatedly testing rising support near $1.3330, signaling increasing downside pressure. A confirmed break below $1.3330 would likely accelerate declines toward $1.3250, reinforcing the prevailing bearish bias.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.