Market Analysis – December 15

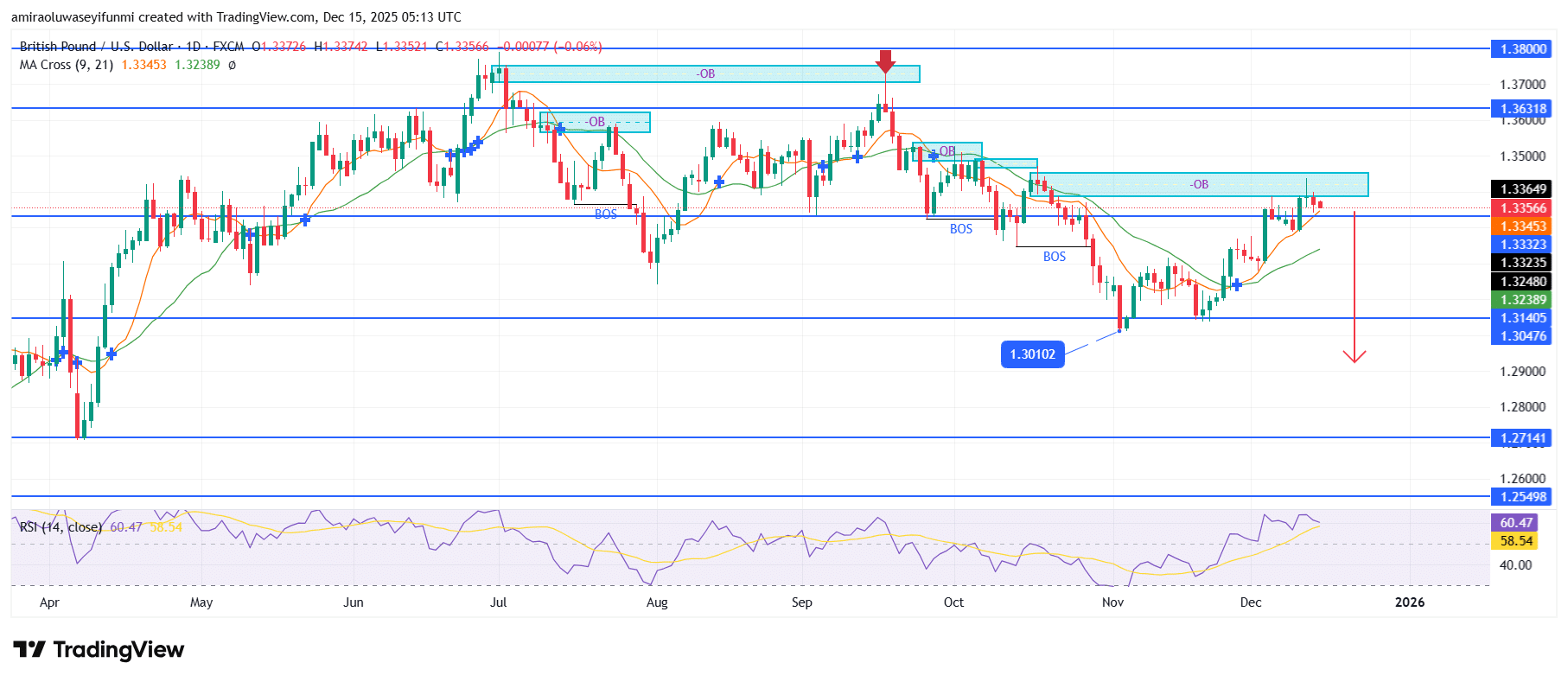

GBPUSD maintains downside bias as technical conditions deteriorate. GBPUSD remains locked in a corrective phase that continues to favour further weakness, as momentum studies fail to support a sustained upside reversal. Short-term moving averages are compressed and largely flat, highlighting near-term indecision, while the broader structure continues to reflect distribution. The RSI is still holding above the neutral threshold near $60 but is gradually turning lower, suggesting that recent advances lack trend strength and are more consistent with corrective rebounds than genuine bullish intent.

GBPUSD Key Levels

Supply Levels: $1.3330, $1.3630, $1.3800

Demand Levels: $1.3050, $1.2710, $1.2550

GBPUSD Long-Term Trend: Bearish

Price action has repeatedly stalled within the $1.33650–$1.33570 supply band, a zone shaped by prior order flow that continues to attract selling pressure. Consecutive bearish breaks in market structure confirm sustained seller control, with price unable to reclaim former support levels that have transitioned into resistance. While demand around $1.32480 and $1.31405 has temporarily slowed declines, rebounds from these areas have been shallow and short-lived, highlighting limited buyer participation and reinforcing the broader bearish tone.

Looking ahead, the prevailing technical configuration continues to favour downside continuation. Unless GBPUSD can decisively reclaim and hold above $1.33650, price remains exposed to renewed pressure toward $1.31405, followed by the more strategically significant zone near $1.30100. Should selling momentum intensify, deeper downside objectives may come into focus around $1.27140, with scope for an extended move toward $1.25500, keeping the medium-term outlook aligned with bearish forex signals.

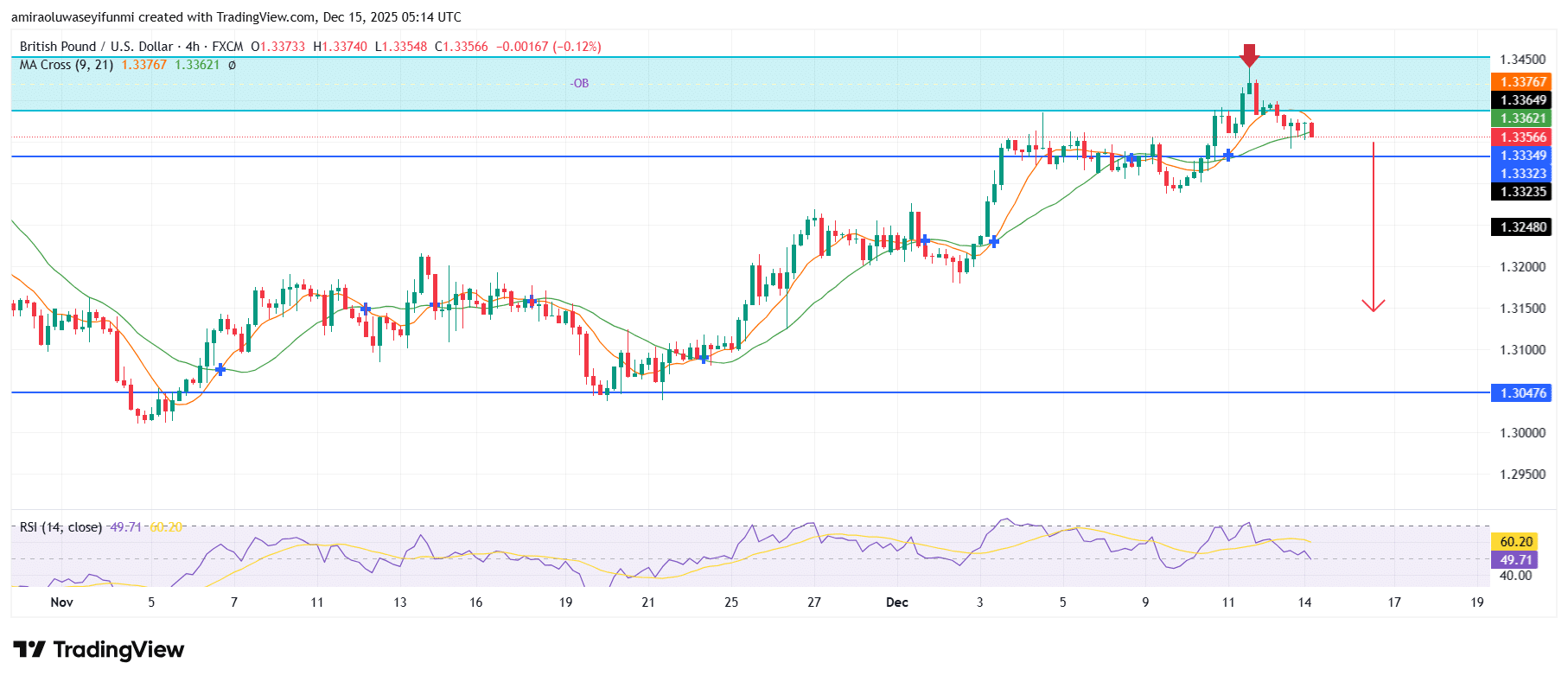

GBPUSD Short-Term Trend: Bearish

GBPUSD is showing early signs of bearish rotation on the four-hour chart, as price struggles to sustain momentum above the $1.33649–$1.33767 supply zone. Short-term moving averages are beginning to flatten, while the RSI is rolling back toward the neutral $50 level, signalling fading bullish strength. Rejection from the upper order block highlights active selling interest and supports the view that the recent rally was corrective. A sustained move below $1.33323 would likely expose downside risk toward $1.32480, in line with the broader bearish structure.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.