S&P 500 May continue falling

S&P 500 Price Analysis – 16 December

The S&P 500 may hit the resistance levels of $6906, $6950, and $7020. This is based on the $6757 position staying the same. If the price breaks through the $6757 support level, it might attack the $6589 and $6473 possibilities.

Key Levels:

Resistance levels: $6906, $6950, $7020

Support levels: $6757, $6589, $6473

S&P 500 Long-term trend: Bearish

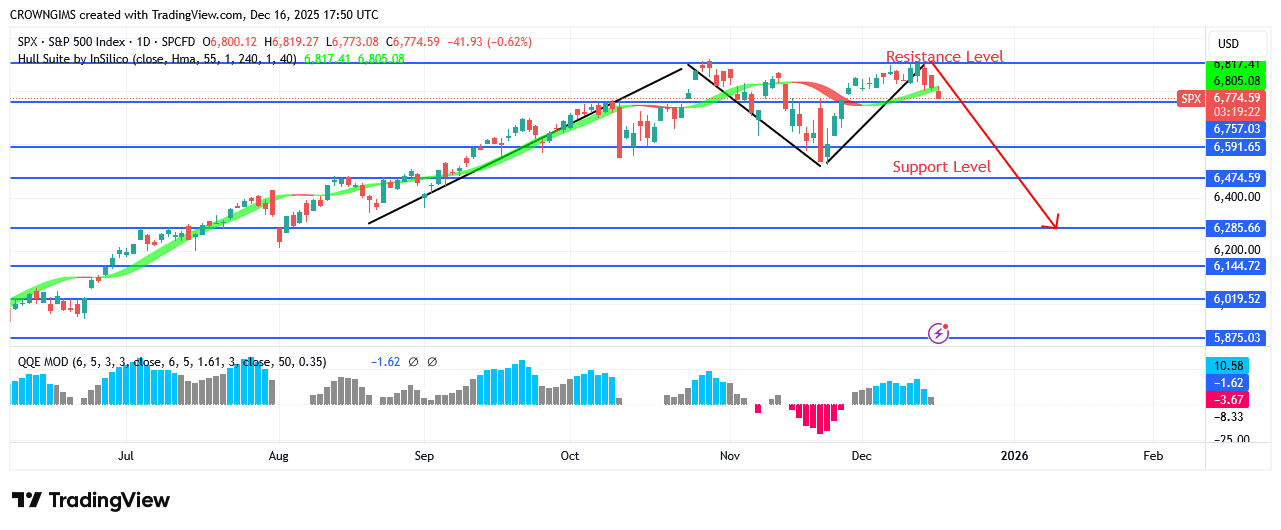

The S&P 500 Index is trending downward on its daily chart. For nearly three months, bulls have dominated the market. Since February 19, the indicator’s primary driver has been subtractions. On September 6, a second attempt was made to reach the $6757 milestone; further visits were made, and the request was granted this time. By maintaining the fixed price at the first recommended position, the purchasers were able to momentarily halt further price rise, and the double-top bearish reversal map pattern held steady at $6950. The S&P 500 increased from $6155 to the barrier level of $6906. Pricing is currently having difficulty rising above the predetermined threshold.

The S&P 500 may hit the resistance levels of $6906, $6950, and $7020. This is based on the $6757 position staying the same. If the price breaks through the $6757 support level, it might attack the $6589 and $6473 possibilities. Both the QQE MOD histogram and the Hull Suite cryptocurrency signals point to selling. Everything may go down.

S&P 500 Medium-term Trend: Bearish

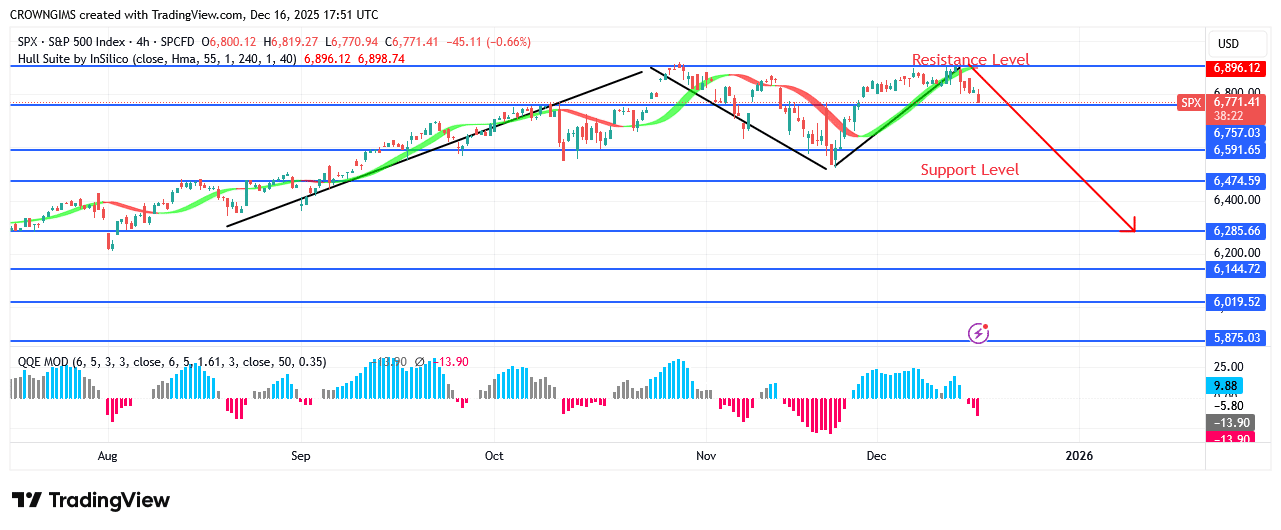

The S&P 500’s 4-hour graph is decreasing. Because of the bears’ strong support, the price hasn’t increased above the $6906 hedge position for the first week. The bulls have remained stable at their designated levels while the price has been climbing. Due to an engulfing candle pattern, the price is currently decreasing quickly toward $6757. Since the S&P 500 rebounded from $6906, its valuation has been decreasing.

Start using a world-class auto trading solution

You can purchase Lucky Block here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.