Market Analysis – December 8

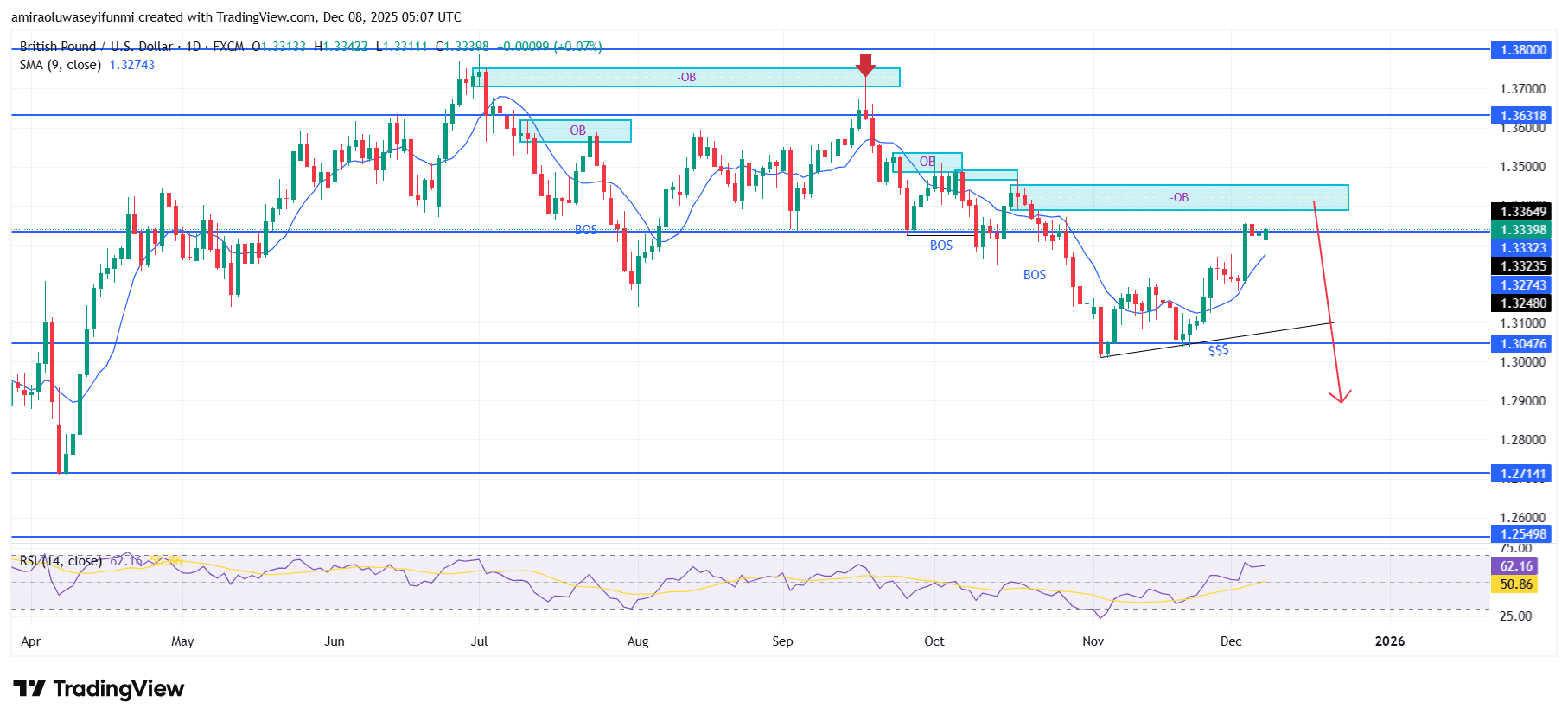

GBPUSD reflects emerging downside bias as momentum conditions soften. The pair is beginning to show signs of a weakening technical posture, struggling to maintain movement above the short-term average near $1.3270. Momentum readings continue to fade as the RSI drops from recent recovery highs, indicating reduced upside participation and a broader loss of bullish strength. This combination of declining momentum and moderating price behaviour places the market in a vulnerable position that supports a renewed bearish tilt.

GBPUSD Key Levels

Supply Levels: $1.3330, $1.3630, $1.3800

Demand Levels: $1.3050, $1.2710, $1.2550

GBPUSD Long-Term Trend: Bearish

Structurally, price has once again reacted negatively to the supply zone between $1.3330 and $1.3370, failing to secure a decisive break above this upper liquidity pocket. The latest rejection is consistent with prior sell-side order-flow tendencies, while repeated structure breaks along the descending leg reinforce the prevailing downward bias. The market remains below a significant dynamic barrier, and the lack of higher highs continues to underscore the influence of sellers.

Forward projections favour additional downside movement, with the intermediate support zone near $1.3050 serving as the next logical target for liquidity draw. A confirmed break beneath this level could open the door for a broader decline toward $1.2710, especially if external market flows remain unfavourable to sterling. Unless buyers reclaim and hold price above $1.3370, the broader outlook stays bearish, hinting at further revaluation toward lower price regions.

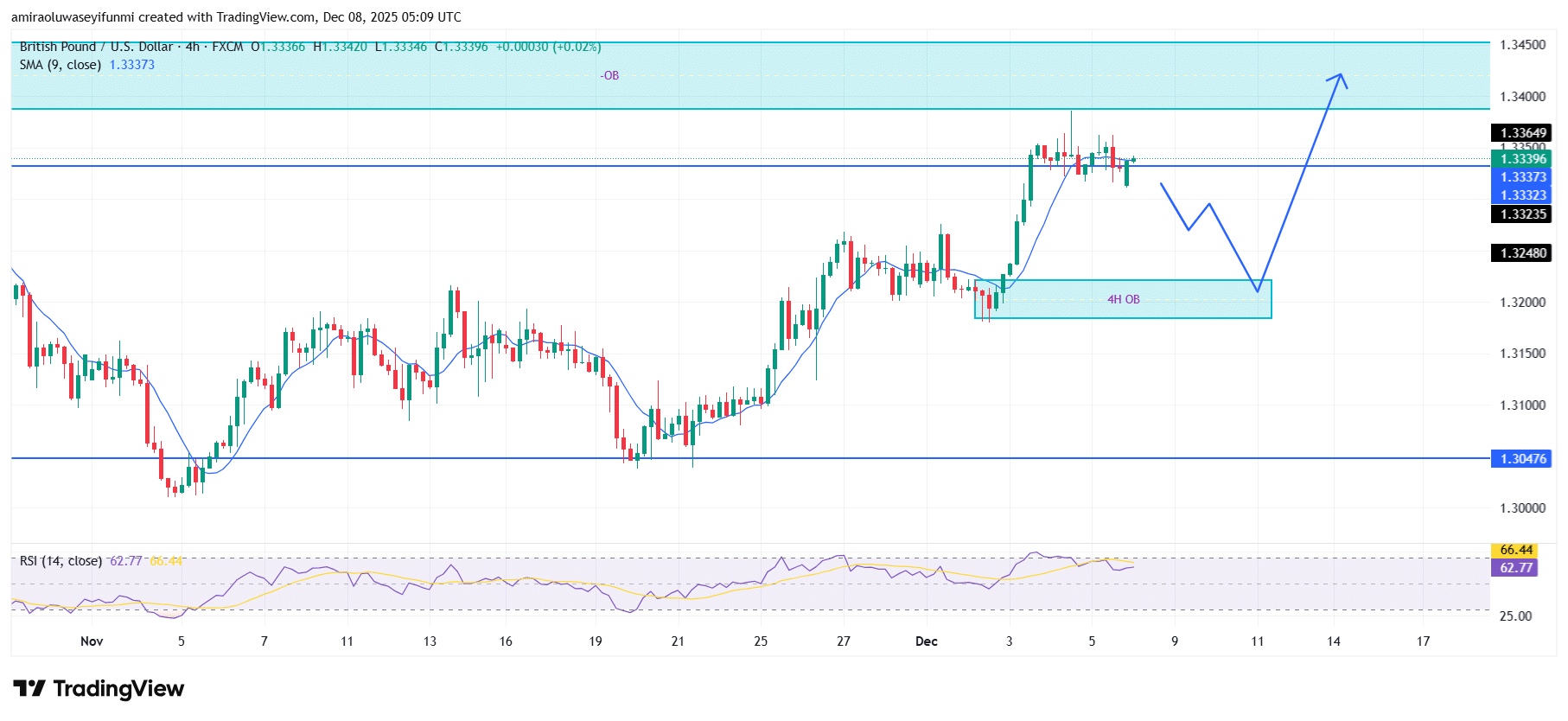

GBPUSD Short-Term Trend: Bullish

GBPUSD continues to maintain a constructive bullish tone on the four-hour chart as price trades steadily above the short-term SMA near $1.3340. The pair is consolidating just below minor resistance, with RSI readings above 60 indicating persistent upward momentum. A corrective move into the $1.3200–$1.3240 four-hour order block would likely attract renewed buy-side interest, supporting a continuation toward the $1.3400–$1.3450 supply region once a higher-low formation is confirmed. This short-term structure provides useful insight for traders monitoring forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.